The North American session was void of any key financial information though US employment tendencies did dip to 113.05 from 114.16. A brand new Fed survey of your head inflation dipped to three.4% from 3.6% prior. Recall the Michigan client sentiment 1-year inflation expectation gauge fell to three.1% from 4.5% in November on Friday.

Tomorrow the US CPI information will probably be launched at 8:30 AM with expectations for the headline quantity to return in at 0.0% and for the core measure to return in at 0.3%. The CPI information comes earlier than the FOMC price choice on Wednesday at 2 PM ET. The Federal Reserve is predicted to maintain charges unchanged as soon as once more at 5.5%. The Fed has remained regular for 2 consecutive conferences after mountaineering one final time in July from 5.25% to five.5%.

The Federal Reserve is considered one of 4 main central banks who will announce rate of interest selections this week. The Swiss Nationwide Financial institution, Financial institution of England, and ECB will all announce their rate of interest choice on Thursday.

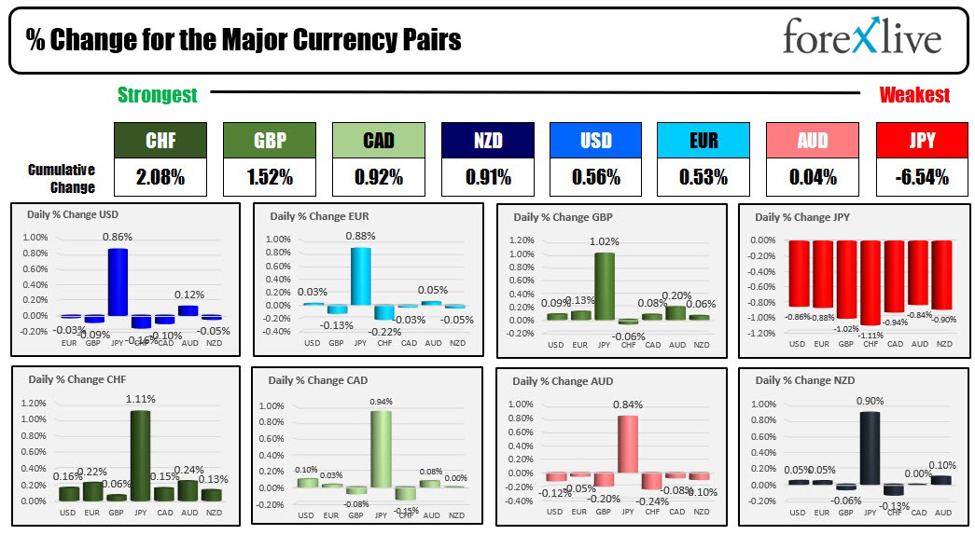

The JPY was the weakest whereas the CHF was the strongest

At this time in Forex, the story revolved across the JPY. There was a report that laid to relaxation the concept the Financial institution of Japan was on the verge of elevating charges. That helped to push the JPY sharply decrease versus all the main currencies. The most important transfer was versus the CHF with a decline of -1.1%. The JPY misplaced -0.86% versus the USD, and -0.88% versus the EUR. It declined by -1.02% vs the GBP.

Aside from the 0.86% transfer in opposition to the JPY, the USD was little change vs the opposite main currencies. Its greatest transfer was a -0.16% decline vs the CHF. Versus the EUR, GBP, CAD and NZD, the buck was inside 0.10% of the closing ranges on Friday. That’s not a number of value motion. The US CPI information on one with the slew of central-bank selections (and feedback from central bankers) appears to be holding the USD in verify.

Wanting on the US debt market right now, yields had been blended regardless of some lukewarm treasury auctions within the three and 10 yr maturity sector:

- 2- yr 4.710%, -1.7 foundation factors

- 5-year 4.246%, -0.9 foundation factors

- 10-year 4.235%, -1.0 foundation factors

- 30-year 4.326% +0.1 foundation factors

Wanting on the US inventory market, the main indices all closed larger. The good points had been led by rotation into the Dow shares. Paradoxically, all the so-called “Magnificent 7” fell on the day:

- Dow Industrial Common Rose 157.06 factors or 0.43% at 36404.94

- S&P index rose 18.07 factors or 0.39% at 4622.43

- Nasdaq index rose 28.52 factors or 0.20% at 14432.50

Shares of Meta fell by -2.24% and Nvidia-1.85% main the Magnificent 7 declines. Microsoft was the very best performer with a decline of -0.78%.

Wanting on the Dow 30, Intel led the best way with a acquire of 4.31%. Honeywell rose 2.97%, Nike rose 2.34%, Cisco rose 2.09% and Residence Depot rose 1.49% rounding out the highest 5 largest gainers. Verizon and Apple had been the worst performers with declines of -1.50% and -1.29% respectively.

Crude oil costs right now had been regular. They’re buying and selling up 9 cents on the day at $71.32.

Bitcoin fell sharply with the digital foreign money buying and selling at $41,143. It traded as little as $40,181 earlier than rebounding. Final Monday, the worth surged above the $40,000 stage for the primary time since April 2022. Its excessive value prolonged to $44,729 on Friday of final week.