The US PPI came in mixed today. The initial jobless claims came in as expected. The combination initially did not change perceptions that the Fed will likely cut rates by 25 basis points.

Later there were a couple posts by WSJ Timiraos. The first talked to the dilemma that the Fed is facing. Do they go small or do they go big (ie.25 or 50 bps cut).That gave the market more hope that the Fed may still go big with a 50 basis point cut. There was another tweet where the number crunchers of CPI and PPI, project core PCE to be in the 0.13% to 0.17% range. That would keep the bias moving lower for inflation.

The news helped to push the USD lower not only on the data but also due to risk-on sentiment.

The clear focus , nevertheless, remains on the Federal Reserve’s potential rate cut next week, and the market is still pricing in a 25% chance of a 50 basis point cut. Remember as well, the dot plot and the updated GDP, inflation and employment estimates from Fed officials will also be presented as focus moves more into 2025 as well. What will the dot plot project?

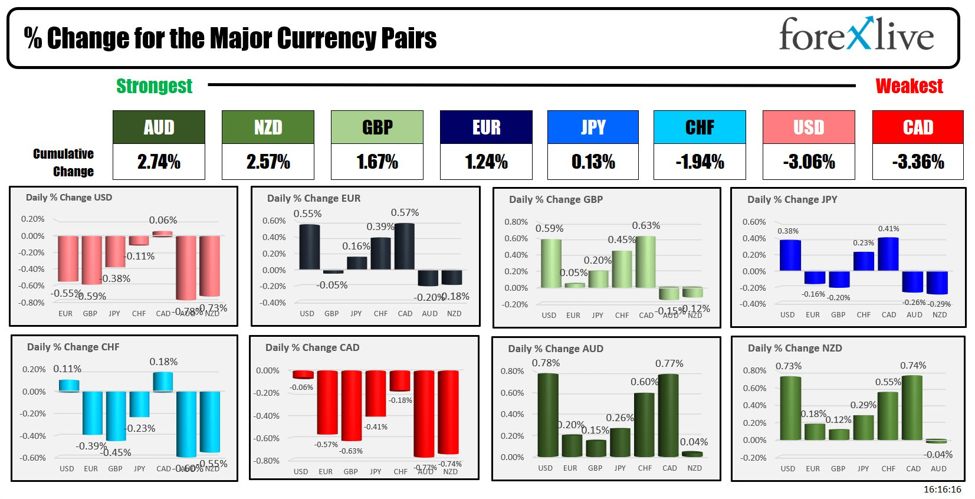

Looking at the strongest to the weakest of the major currencies, the Australian Dollar (AUD), New Zealand Dollar (NZD), and British Pound (GBP) outperformed, benefiting from the risk-on trade and the USD weakness.

The AUDUSD extended above its 200 hour MA at 0.6700 and looks toward the 100 bar MA on the 4-hour chart at 0.6734. The NZDUSD also extended above its 200 hour MA at 0.6175 and looks toward its 100 bar moving average only 4-hour chart and 0.61936. GBPUSD moved above its 200 hour MA at 1.3110.

Conversely, the Canadian Dollar (CAD) underperformed closing near unchanged on the day and is testing its 100-hour MA at 1.35779 after holding support near that MA earlier in the day and moving higher. The new trading day will use that MA as a risk defining level. Move below would be more bearish. Stay above would be more bullish. .

The EURUSD also moved higher- extending above its 200-hour MA at 1.1056 in the process. The European Central Bank (ECB) cut rates as expected, but President Lagarde did not commit to a specific future rate path. Inflation projections were revised slightly higher for 2024 and 2025, while growth forecasts were slightly downgraded. Later in the day, “ECB sources” implied that October cut is likely not on the table and that December needed more weak growth to prompt the ECB to cut rates. That also seemed to give the EURUSD a bid into the close. The price is above its 200 hour MA at 1.1056. Stay above would be more bullish.

The broader Nasdaq and S&P indices closed higher for the 4th consecutive day this week and have reversed most of the -5.77% and -4.25% declines from last week.

US yields rose by two – three basis points. The 30 year bond auction did not go as well as the 3 and 10 year auctions on Tuesday and Wednesday, although there was still fairly strong international demand:

- 2-year yield 3.645%, unchanged

- 5year yield 3.467%, +2.1 basis points

- 10 year yield 3.677%, +2.5 basis points

- 30 year yield 3.990%, +2.8 basis points.

Gold prices soared and closed at a record level. The price of Spot gold rose $47.60 or or .0% had 2558.83. Silver is up $1.21 or 4.22% at $21.85. Bitcoin also rose by $892 or $58,232.