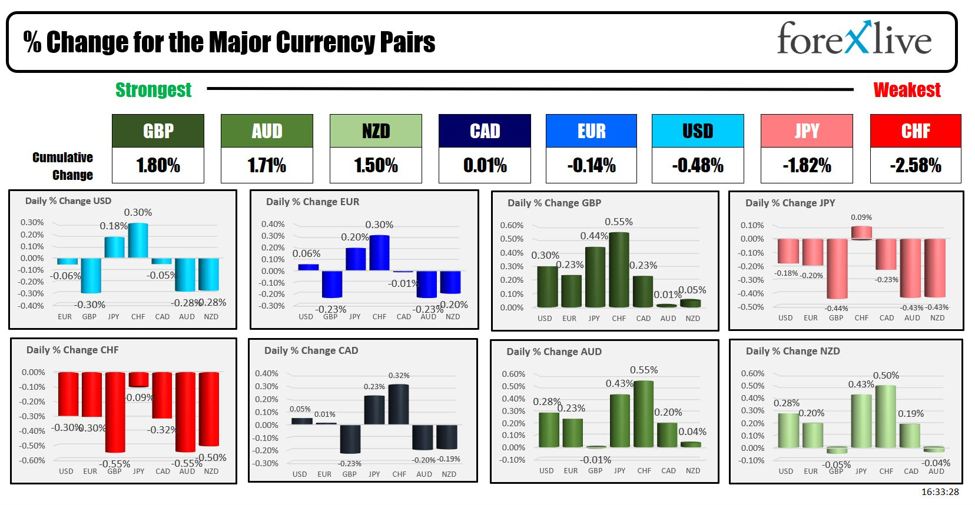

The GBP is ending the US session as the strongest of the major currencies today. The CHF is the weakest. The USD is ending the day mixed with gains versus the JPY and CHF and losses vs the GBP, AUD and NZD. The USD was near unchanged on the day vs the EUR and CAD (-0.05%).

The strongest to the weakest of the major currencies

For the trading week, the trade weighted dollar index (DXY) fell -0.77% with the index moving to the lowest level since April 1 week. That index is also closing below its 100-week MA at 104.83, after 5 weeks of closes above that MA. That shifts the technical bias for the index to the downside (staying below is more bearish for the USD).

Dollar index closes below the 100 week MA

Looking at the main currencies vs the USD, the % changes of the USD vs each major currency this week shows mostly lower USD moves. The exception is the USDs gain of 0.30% gain vs the CAD.

- EUR, -0.93%

- JPY, -0.08%

- GBP, -1.43%

- CHF +0.30%

- CAD, -0.43%

- AUD, -1.40%

- NZD, -1.92%

The move lower in the USD this week got the fundamental shove from the tamer CPI, flat retail sales (lower than expected), and lower NY manufacturing index all released on Wednesday. A PPI number that was stronger but offsel by sharp revisions in the prior month opened the door for the downside when it was released on Tuesday.

Not congruent with the fundamentals is that Fed officials remain focused on higher for longer, whereas other countries are more likely to ease conditions earlier (especially the EU). That may ultimately slow the greenback’s declines at some point. Nevertheless, the EURUSD closed above its 100-day moving average (USD bearish) at 1.0819 for the first time since March 21 after the gains on Wednesday. The GBPUSD also closed above its 100-day moving average for its first time since April 9 on Wednesday (and stayed above).

The NZD and AUD are also moving away from its 100-day MA (dollar bearish). If the USD is to move back higher, the dollar needs to reverse back above the 100 day MAs on each of those currency pairs.

Looking at the US stocks today, the major indices closed mixed with the Dow industrial average leading the way. That index closed above a key milestone today above 40K, and also closed at a new record level. On Wednesday both the NASDAQ and S&P closed at new record levels and although higher on the week, are closing the day below those record closes (marginally).

Today:

- Dow industrial average rose 134.21 points or 40.34% at 40003.60.

- S&P index rose 6.17 points or 0.12% at 5303.26. It closed at a record 5308.14 on Wednesday

- NASDAQ index fell -12.35 points or -0.07% at 16685.97. It closed at a record 16742.39 on Wednesday

The Dow industrial average closed higher for the fifth consecutive week. Both the S&P and NASDAQ indices closed higher for the fourth consecutive week.

US yields are closing the day the highs but are still down on the week after the run lower on the back of the CPI/retail sales on Wednesday. The yield did rebound on Thursday and Friday, however.

For today,

- 2-year yield 4.86%, +3.6 basis points

- 5-year yield 4.446%, +4.8 basis points

- 10 year yield 4.421%, +4.5 basis points

- 30-year yield 4.561%, +4.3 basis points

For the trading week,

- 2-year yield fell -4.3 basis points for the week, but was down -16.6 basis points at the week’s low

- 5-year yield fell -6.8 basis points for the week, but was down -20.0 basis points at the week’s low

- 10 year yield fell -7.8 basis points for the week, but was down -18.7 basis points at week’s low.

- 30-year yield felt -8.0 basis points for the week, but with down -17.3 basis point at week’s low.

Thank you for your support this week. Hoping you and yours have a happy and healthy weekend.