The main focus in the present day was on the big-cap tech shares in the present day. The Nasdaq index bought creamed with a decline of -2.05%. That was the most important decline since January 31 when the index fell -2.23% The transfer decrease was initially off of disappointing ahead steering from Netflix after its incomes announcement after the shut on Thursdays. Its shares tumbled -9.09%.

The kick to the draw back bought one other shove, simply earlier than the open Tremendous Micro Computer systems introduced its earnings date, however did to not pre-announce its earnings for the fiscal third quarter. SMCI has been one of many darlings of the 1Q because it tagged together with Nvidia. In accordance with sources, in seven of the previous eight quarters, the corporate issued a press launch saying preliminary outcomes forward of its routine earnings launch, typically elevating monetary steering. That was to not be in the present day, and the inventory fell sharply in response. That momentum continued within the US session with the inventory plunging 23.16% to $713.65. The excessive value within the 1Q reached $1229.00. The decline. Nvidia as properly. It shares fell $84.31 or -10.0% to $762.

BTW Tremendous Micro Computer systems will announce their earnings on April 30. Nvidia would not announce till Might 22

Different huge movers in the present day included numerous totally different chip shares:

- AMD, – 5.44%.

- Micro -4.61%

- Broadcom -4.31%

- Meta Platforms -4.13%

- CrowdStrike holdings -3.99%

- Taiwan semiconductor -3.46%

- Amazon -2.56%

- Intel -2.40%

- Qualcomm -2.36%

- Tesla, -1.92%.

Subsequent week, the earnings calendar kicks into full gear Under is a sampling of a few of the main earnings releases. :

- Monday: Verizon,SAP

- Tuesday: GM, Tesla,Visa, Texas Devices

- Wednesday: Boeing, AT&T, Normal Dynamics, Meta Platforms, IBM, Ford, Chipotle, ServiceNow

- Thursday: American Airways, Caterpillar,Southwest Airways, Bristol-Myers Squibb,Microsoft, Alphabet,Intel

- Friday: Exxon Mobil, Chevron

Within the US debt market in the present day, yields transfer modestly decrease.

- 2-year yield, 4.99%, unchanged

- 5-year yield 4.671%, -1.6 foundation factors

- 10-year yield 4.622%, -2.4 foundation factors

- 30-year yield 4.715% -2.9 foundation factors

For the buying and selling week yields moved increased as markets reacted to the Fed’s shift towards charges regular for longer:

- 2-year yield +8.7 foundation factors

- 5-year yield +11.4 foundation factors

- 10-year yield +9.7 foundation factors

- 30-year yield +8.3 foundation factors

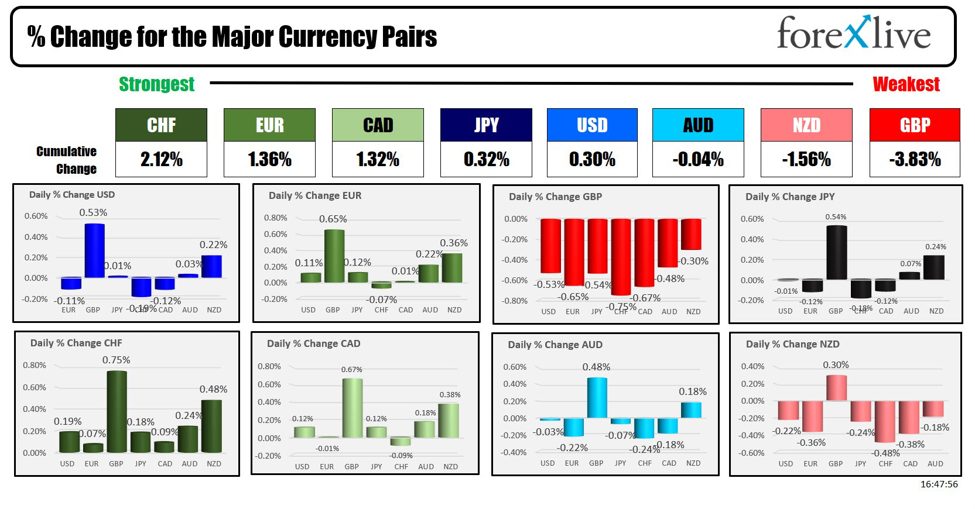

A snapshot of the foreign exchange market on the week’s finish has the CHF because the strongest of the key currencies on the again of a security bid.

The GBP was the weakest. BOEs Ramsden commented that:

- Over the previous couple of months, I’ve turn into extra assured within the proof that dangers to persistence and home inflation pressures are receding.

- Steadiness of home dangers to the outlook for UK inflation is now tilted to the draw back.

That helped to push the GBPUSD to the draw back and the pair moved to the bottom stage for the yr and going again to November 14. The value can also be testing the 61.8% of the transfer increased from the October 2023 low at 1.23635, and the excessive of a swing space going again to first quarter of 2023 at 1.2368. The low value in the present day within the GBPUSD reached 1.2366.

Fed’s Goolsbee closed up the Fedspeak forward of the quiet interval (the Fed is to subsequent announce on Might 1). Goolsbee mentioned the present state of the U.S. financial system, highlighting a stall in progress on inflation and advocating for a cautious method to rates of interest till extra readability is achieved. He affirmed that the Federal Reserve’s present restrictive financial coverage stays applicable however emphasised that future coverage changes will likely be data-driven. Goolsbee identified the persistent problem posed by excessive housing inflation and famous that there’s room for enchancment in providers inflation via will increase in labor provide. He questioned whether or not robust GDP and job numbers may point out an overheating financial system contributing to inflationary pressures, although he additionally acknowledged that not all information counsel labor market overheating. Whereas the Fed has efficiently maintained low unemployment, it has struggled to fulfill its inflation mandate. Goolsbee warned towards sustaining a excessive stage of restrictiveness for too lengthy as a consequence of potential destructive impacts on employment. He described the coverage trade-offs as more and more advanced and famous that the actual Federal Funds fee is traditionally excessive. Optimistically, he projected that inflation would return to the two% goal over an affordable interval, and he didn’t dismiss any coverage choices, together with fee hikes if crucial, to handle financial situations.

In the meantime, ECB officers in the present day together with Lagarge. Muller and Wunsch advocating for a number of fee cuts beginning in June.

The US core PCE information will likely be launched on Friday and will likely be key for the Fed outlook going ahead.