The week ended with a bang because the US jobs knowledge got here a lot stronger than expectations.

- Non-farm payroll rose by 353K a lot larger than the 180K estimate (and the ADP rise of 107K launched earlier this week). T

- Unemployment fee got here in at 3.7% versus 3.8% anticipated

- Common yearly earnings rose by 0.6% versus 0.3% anticipated MoM

- Common yearly earnings rose by 4.5% versus 4.1% anticipated YoY

- The typical workweek in hours and fall to 34.1 hours from 34.3 hours final month (that was the estimate too).

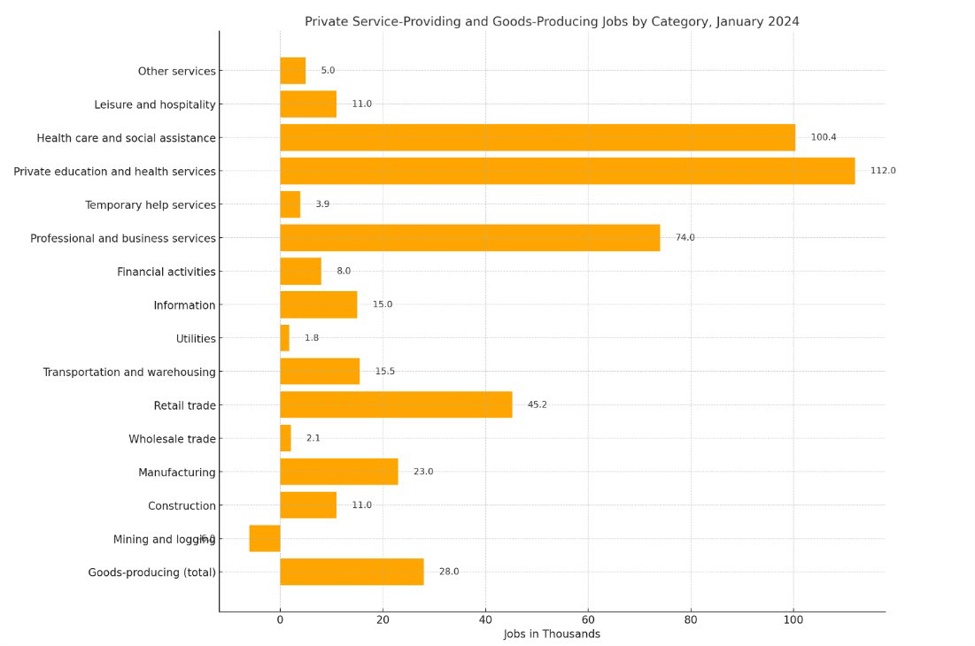

Wanting on the jobs by sectors, Non-public schooling and well being companies led the best way with a achieve of 112K. Skilled and enterprise companies rose by 74K. Each sectors, are comparatively high-paying jobs . Manufacturing superior by a stable 23K (one other excessive paying sector). Leisure and hospitality – a proxy for service economic system – was comparatively subdued at 11.0K

Jobs by sectors

The stronger-than-expected jobs knowledge put the wheels in movement in all markets:

The US bond yields moved larger:

Wanting on the yield curve for the day:

- 2- yr yield 4.372% +17.8 foundation factors.

- 5-year yield 3.985% +18.9 foundation factors.

- 10-year yield 4.023% +16.1 foundation factors

- 30-year yield 4.223% +12.0 foundation factors

These are huge strikes to the upside, however for the week yields had been transferring decrease till at present and other than the 2 yr yield for the opposite a part of the yield curve moved decrease. That included a Fed which mentioned a March lower was not going and an non farm payroll that surges 353K (with massive revisions too). For the week, the:

- 2-year yield rose 1.9 foundation factors

- 5-year yield fell -5.2 foundation factors

- 10-year yield fell -11.5 foundation factors

- 30-year yield fell -14.7 foundation factors

The USD surged to the upside.

Wanting on the strongest to the weakest of the most important currencies, the USD was the runaway winner within the rankings. The JPY was the weakest adopted by the NZD.

The strongest to the weakest of the most important currencies

The US shares moved larger:

Shares had been a special story. Usually, you may anticipate shares to maneuver decrease given the surge in yields and the upper USD. Nonetheless, shares moved sharply to the upside helped by

- A sense {that a} robust economic system is sweet for earnings. Who cares if the Fed holds off on reducing charges, if inflation can stay regular/not transfer larger/transfer marginally decrease, that’s good for shares.

- Meta and Amazon earnings had been gangbuster good. Microsoft earnings earlier this week had been additionally good however the market nonetheless offered off their shares. For Meta, their shares rose over 20% on the day. Amazon shares had been up practically 8% however needed to take a backseat.

For the day,

- Dow industrial common rose 134.58 factors or 0.35% at 38654.43

- S&P index rose 52.44 factors or 1.07% at 4958.62

- NASDAQ index rose 267.30 factors or 1.74% at 15628.94.

For the buying and selling week, the positive factors at present within the index turned a unfavourable weed right into a constructive week. The key indices rose for the fourth consecutive week:

- Dow Industrial Common +1.43%

- S&P index +1.38%

- NASDAQ index +1.12%

among the different markets:

- Crude oil fell $-1.40 % or -1.95% to $72.38. The value decline regardless of the robust economic system, issues concerning the breakdown of the cease-fire rumors within the Center East, and likewise the story of retaliatory bombings by the US in response to the killing of US servicemen.

- Gold costs moved sharply decrease by -$15.01 or -0.73% to $2039.54 because it reacted to larger charges and the upper USD.

- Bitcoin is buying and selling at $42,987.

Over the weekend, an interview with Fed Chair Powell shall be broadcast on the Sunday night information program 60-Minutes. The feedback would be the first from the chair after the FOMC fee determination. It’s uncertain if the interview was earlier than the stronger jobs knowledge was reported.

On Tuesday morning in Australia (night on Monday within the US), the RBA will announce its most up-to-date fee determination. The expectations are for no change in coverage 4.35%. Additionally on Tuesday Cleveland Fed Pres. Mester shall be talking.

On Wednesday, Feds Kugler and Barkin will each be talking. On Wednesday the morning in New Zealand, employment statistics for the quarter shall be launched

China CPI shall be launched on Thursday morning in China (Tuesday night time within the US).

Canada employment statistics shall be launched on Friday.

On the earnings calendar subsequent week:

Monday:

- Caterpillar

- McDonald’s

- Palantie

Tuesday:

- Lilly

- BP

- Toyota

- Ford

- Chipotle

- Fortinet

Wednesday:

- Alibaba

- Uber

- CVS Well being

- Paypal

- Disney

Thursday:

- Conoco Phillips

- Expedia

Friday:

Thanks for all of your help. Have and secure weekend.