The begin to the brand new buying and selling week is off to a gradual begin. Keep in mind, the FOMC is within the quiet interval forward of their rate of interest resolution on January 31. On the financial calendar, the one launch was the Convention Board Main Index which is meant to foreshadow slower/adverse progress. It fell for the twenty first consecutive month and merchants maintain ready for the recession. Evidently, the markets aren’t paying consideration.

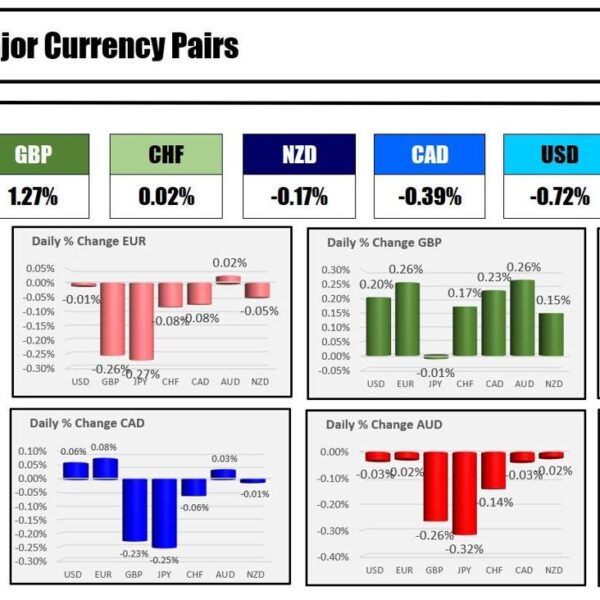

The ranges for the day of the most important currencies vs the 22- day common (about 1 month of buying and selling) reveals:

- EURUSD 32 pips vs 63 pip common

- GBPUSD 55 pips vs 85 pip common

- USDJPY 69 pips vs 129 pip common

- USDCHF 35 pips vs 71 pip common

- AUDUSD 48 pips vs 60 pip common

The USDCAD is an exception to a number of the upsi and downs. That pair did see regular shopping for within the North American session with the worth transferring as much as check its key 200 day MA and 100-hour MA at 1.3480 (see chart under). The extent can also be house to a swing degree on the hourly chart on the similar degree (see purple numbered circles on the chart under). Going into the brand new buying and selling day, that degree will probably be a barometer for consumers and sellers.. Buying and selling above is extra bullish. Keep under retains the sellers in play

The NZDUSD can also be buying and selling close to session lows with the pair testing the cluster of assist outlined by the 50% of the transfer up from the October twenty sixth low at 0.6071, the swing space at 0.6078 and 0.6585 and the 200 day MA at 0.60893 (see video).

At the moment, the GBP is ending the day because the strongest of the most important currencies. The NZD is ending because the weakest . The USD is generally larger due to the USDs power vs the three commody currencies – the CAD, AUD and the NZD. Versus the EUR, GBP, JPY and the CHF, the beneficial properties or losses vs these currencies are minimal (0.04% vs 0.13%).

Taking a look at different markets right this moment:

- Crude oil is buying and selling larger by $1.21 or 1.77% at $74.55

- Gold fell with by -$9.00 or -0.44% at $2020.47

- Silver fell -$0.54 ore -2.37% at $22.07

- Bitcoin traded under $40,000 for the primary time since December 4 to a session low at $39,445. The value is buying and selling again above the extent at $40,027

IN the US debt market, yields are buying and selling close to mid-range and decrease on the day:

- 2 yr yield 4.395%, -1.1 foundation factors

- 5 yr yield 4.0313%, -4.1 foundation factors

- 10 yr yield 4.1089%,-3.7 foundation factors

- 30 yr yield, 4.324%, -3.0 bais factors

Within the US shares right this moment, each the S&P and the Dow industrial common closed a brand new file ranges. The Nasdaw index remains to be 4.14% away from the all-time excessive shut at 16057.44. Every of the most important indices closed larger for the third day in a row.

The ultimate numbers are exhibiting:

- Dow industrial common rose 138.01 factors or 0.36% at 38001.82

- S&P rose 10.62 factors or 0.22% at 4850.44

- Nasdaq rose 49.31 factors or 0.32% at 15360.28

The Russell 2000 index rose 38.98 factors or 2.01% at 1983.38.