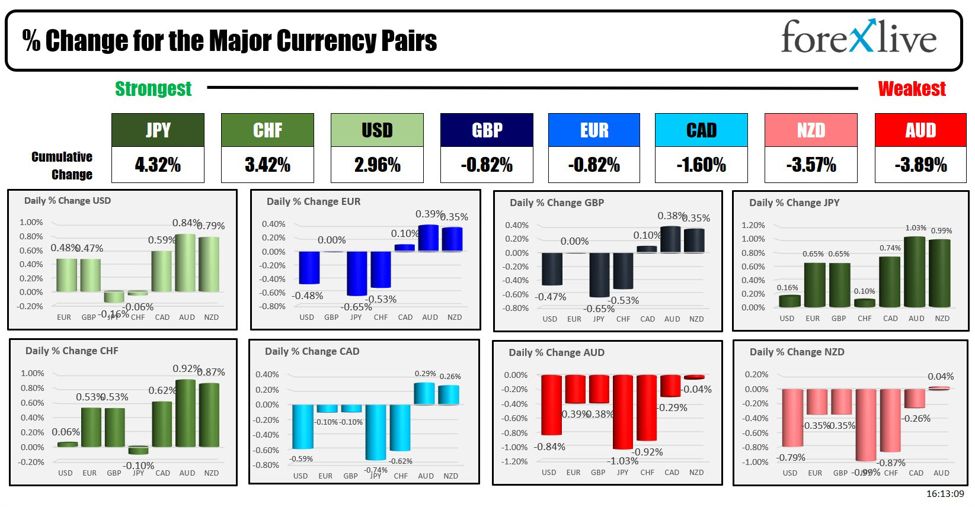

The USD is ending the day principally greater with positive factors vs all the key currencies excluding the JPY and CHF (-0.16% and -0.06 respectively).

The strongest to the weakest of the key currencies

The buck rose essentially the most vs the AUD (+0.84%), NZD (+0.79%) and CAD (+0.59%). Stable positive factors on the day (close to 0.50%) have been made vs the EUR and the GBP as properly.

For the buying and selling week, the USD moved greater vs ALL the key currencies. Under is these positive factors:

- EUR: +0.72%

- JPY: +1.59%

- GBP: +1.03%

- CHF: +1.46%

- CAD: +0.50%

- AUD: +0.71%

- NZD: +1.52%

The positive factors within the buck got here regardless of declines in US yields this week indicative of both an oversold USD, an overbought situation in foreign exchange or just a head-scratching transfer. It could even be a basic feeling that the US economic system is stronger than the others. Essentially, the SNB did lower charges abruptly, however the BOJ raised charges for the primary time in 17 years.

The RBA and BOE stored charges unchanged this week as did the Fed. The Fed did maintain the dot plot at 3 cuts in 2024, BUT it did elevate GDP estimates, and lowered the tip of yr unemployment charge.

- 2-year yield -13.7 foundation factors

- 5-year yield -14.0 foundation factors

- 10-year yield -10.6 foundation factors

- 30-year yield -5.0 foundation factors

For the buying and selling day, yields moved decrease regardless of the greenback rise.

- 2-year yield 4.595%, -3.6 foundation factors

- 5-year yield 4.191%, -6.2 foundation factors

- 10-year yield 4.204%, -6.7 foundation factors

- 30-year yield 4.381%, -6.1 foundation factors

US shares in the present day have been blended with the Dow and the S&P closing decrease for the day, however nonetheless greater for the week. The Nasdaq closed at a brand new document excessive in the present day

- Dow fell -0.77%, however was up 1.97% for the week

- S&P fell -0.14%, however was up 2.29% for the week (largest positive factors since December)

- Nasdaq rose 0.16%, and was up 2.85% (largest achieve since 2nd week in January)

Subsequent week, Friday is a vacation in Australian, New Zealand, and Europe for Good Friday. Core PCE shall be launched on Friday within the US. Fed’s Powell can even communicate on Friday, giving him an opportunity to touch upon the Fed’s favored inflation gauge.

Australia CPI shall be launched on Wednesday (Tuesday evening within the US). Advance US sturdy items shall be launched on Tuesday at 8:30 AM ET.

In different markets at week finish:

- Crude oil is buying and selling down $0.20 on the day. For the week, the value fell -$0.21 or -0.17%

- Gold rose $9.97 or 0.45%

- Silver fell -$0.50 or -2.03%

- Bitcoin fell -$4869 or -7.1% on the week.

Thanks in your help this week. Have an important weekend.