- US stocks end a solid week with strong gains. NASDAQ leads the charge.

- EURJPY gets close to 2008 high at 169.96. Break above and trading at 32-year-high

- Crude oil settles at $83.85

- Key event and releases for the trading week starting April 29

- Baker Hughes oil rigs down to 506 vs 511 last week

- European indices close higher for the day/week. UK FTSE 100 closes at a record level.

- Citigroup now sees 100 basis points of cuts this year from July

- Atlanta Fed GDPNow estimate for Q2 growth 3.9%

- University of Michigan April consumer sentiment (final) 77.2 versus 77.9 estimate

- WH Brainard: Work to bring costs down are ongoing

- Kickstart the FX trading day for April 26 w/ a technical look at EURUSD, USDJPY and GBPUSD

- US March PCE core inflation 2.8% YoY versus 2.7% expected

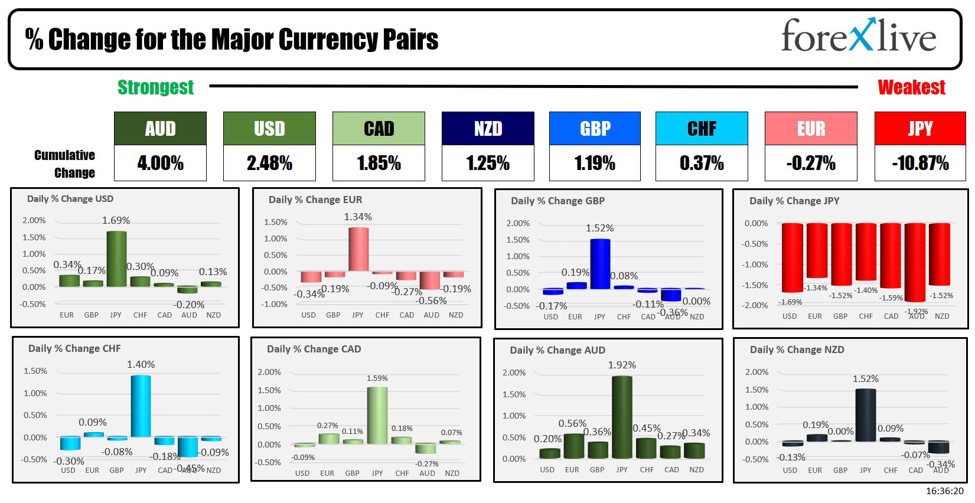

- The AUD is the strongest and the JPY is the weakest as the NA session begins

- ForexLive European FX news wrap: Japanese yen volatility ramps up after Ueda presser

The JPY pairs all rose sharply (JPY decrease) as JPY promoting continued after the BOJ price choice.

The feedback from BOJ Ueda didn’t strike any worry in merchants hearts, after saying that the JPYs fall may result in greater inflation, however expressed no issues about its fall.

After, an preliminary dip quickly after the announcement to close 155.00, consumers rapidly reentered. The USDJPY is extending to a brand new session excessive at 158.292 going into the final minutes of buying and selling as we speak. The excessive value from 1990 at 160.40 is inside attain.

The JPY moved essentially the most vs the AUD with a fall of -1.92%. It fell -1.69% versus a US greenback and -1.59% versus the Canadian greenback.

Wanting on the JPY crosses:

- The AUDJPY traded to it is highest stage since April 2013

- The EURJPY traded at its highest stage since July 2008

- The GBPJPY surpassed its 2015 excessive, and traded to the very best stage since 2008.

- The NZDJPY traded briefly above its 2014 excessive value and to the very best stage since July 2007

- The CHFJPY is buying and selling to its highest stage a minimum of going again to 1973.

- The CADJPY traded to its highest stage since December 2007.

Wanting on the strongest to weakest of the most important currencies, the AUD and the USD have been the strongest as we speak.

At present within the US session, core PCE for the month March was launched and got here in higher than expectations. After the US GDP yesterday confirmed core PCE for the primary quarter greater than expectations, the worry was for an increase of 0.4 – 0.5%. The precise enhance for the month got here in 0.3%. The year-on-year stayed unchanged at 2.8% which was 0.1% greater than the two.7% estimate.

Coming off stronger earnings from Microsoft and Alphabet after the shut on Thursday, shares received one other increase. The good points have been led by the NASDAQ index which rose over 2% on the day and by 4.23% for the buying and selling week. That was the most effective week since October 2023. The S&P index rose 1.02% as we speak, and its week achieve of two.67% is sweet sufficient for its finest efficiency since October as nicely.

Within the US debt market, yields are ending the day decrease however off their lowest ranges. Yields are nonetheless greater for the buying and selling week:

- 2-year yield 4.995%, -0.3 foundation factors

- 5-year yield 4.6%, -2.8 foundation factors

- 10-year yield 4.665%, -4.1 foundation factors

- 30-year yield 4.776%, -4.3 foundation factors

For the buying and selling week:

- 2-year yield up 1.0 foundation factors

- 5-year yield up 1.7 foundation factors

- 10 yr yield up 4.2 foundation factors

- 30-year yield up 6.4 foundation factors

in different markets this week:

- Crude oil rose $1.42 or 1.73%.

- Gold fell $-54.06 or -2.26%

- Silver fell $-1.48 or -5.12%

- Bitcoin fell $-1038 or -1.60%

This text was written by Greg Michalowski at www.forexlive.com.