Yields and the USD began the day larger on observe via flows after the stronger US ADP jobs report yesterday. Nevertheless, that transfer which noticed the ten 12 months transfer to the very best degree since November 2023, and the USDJPY retest the 30+ 12 months highs close to 151.945, reversed course after the Institute for Provide Administration (ISM) reported the US companies index at 51.4 for March 2024, under the anticipated 52.7 and a lower from the earlier 52.6.

Notably, the employment part confirmed a minor enchancment to 48.5 from 48.0, however nonetheless indicated a slight contraction in employment ranges throughout the service sector. New orders skilled a decline to 54.4 from 56.1, reflecting a slowdown in demand. A big statement was the substantial lower in costs paid, which fell to 53.4 from 58.6, marking the bottom level since March 2020 and suggesting easing inflationary pressures throughout the sector. This decline in costs paid was sudden and served as a major focal point, particularly as market considerations concerning a brand new wave of inflation had been escalating.

Different elements of the report, akin to inventories, provider deliveries, and backlog of orders, additionally confirmed declines, indicating general softening within the companies sector’s exercise. Nevertheless, new export orders and imports remained above the 50 threshold, indicating enlargement, albeit at a slower tempo for imports. This combined bag of indicators suggests a nuanced view of the service sector, with easing costs providing a possible aid in opposition to inflation worries, regardless of softer demand and exercise ranges.

Later Fed Chair Powell was not overly totally different from prior feedback which additional appeased the frightened market. Powell did reiterate the central financial institution’s cautious stance on adjusting rates of interest, indicating there’s ample time for deliberation over potential cuts. He emphasised the Fed’s particular position regarding climate-related monetary dangers, strictly as a financial institution supervisor, distancing the establishment from local weather policymaking to keep up public belief and stop mission creep. Powell acknowledged the coverage fee could be at its peak for the present cycle, amidst an setting the place financial dangers are steadily balancing out. Regardless of uncertainties and the twin mandate of the Fed, the labor market exhibits indicators of rebalancing, supported by varied knowledge together with quits, job openings, and a gradual decline in wage development. The financial system is experiencing stable development, with inflation on a path in direction of the two% goal, albeit with latest sudden inflation and job positive aspects that don’t considerably alter the general financial outlook. Powell harassed the significance of basing selections on incoming knowledge and remained optimistic in regards to the potential for coverage changes later within the 12 months, contingent on financial evolution aligning with expectations. He additionally highlighted the complexity of the inflation state of affairs, acknowledging each demand and provide shocks, and identified the crucial stability in timing fee changes to keep away from derailing progress on inflation or labor market stability. Powell stays hopeful in regards to the position of technological developments like AI in boosting productiveness, albeit acknowledging it is too early for important impacts, and maintains a dedication to steering the financial system in direction of secure inflation and employment via cautious coverage administration.

Within the European session in the present day, inflation got here in weaker than anticipated at 2.4% vs 2.6% final month. The core flash estimate was additionally decrease at 2.9% vs 3.1% final week. Later ECB member de Cos acknowledged, that the decline in each normal and core inflation as robust proof that financial coverage is successfully influencing the financial system. Whereas not offering express forecasts for future financial coverage instructions, he famous that the latest inflation knowledge aligns properly with the ECB’s mandate to keep up inflation objectives. Moreover, de Cos talked about that present central eventualities are pointing in direction of a possible fee minimize as early as June, suggesting a shift within the ECB’s financial coverage stance in response to the inflationary tendencies.

Regardless of the feedback, the EURUSD focus was on the USD weak point. For the day, the EURUSD moved up 0.61%. and within the course of moved again above the 100 and 200-hour MAs at 1.0774 and 1.07987 respectively. The value then prolonged above the 38.2% of the transfer down from the March excessive at 1.08219 and ended the day buying and selling above and under the 200 day MA at 1.08323. That MA would be the barometer within the new buying and selling day.

The USDJPY in the present day moved as much as check the swing highs from 2022 (at 151.94), 2023 (at 151.91) and 2024 (at 151.967 reached final week). The excessive worth in the present day reached 151.94 earlier than rotating decrease on the again of the ISM knowledge and the Fed chair’s feedback . Within the new buying and selling day, the merchants shall be eyeing the 100-hour MA at 151.51 and the 200-hour MA at 151.45.

The AUDUSD moved up 0.71% in the present day and within the run larger, it prolonged above a cluster of MAs together with the 200 day MA at 0.65429, the100 bar MA on the 4-hour chart at 0.6545, and the 200 bar MA on the 4-hour chart at 0.65477. That led to extra momentum to the upside within the pair with the excessive worth stalling simply wanting the 50% midpoint of the vary for the reason that October 26, 2023 low at 0.65704 (the excessive reached 0.6569 and is buying and selling at 0.6560 into the shut.

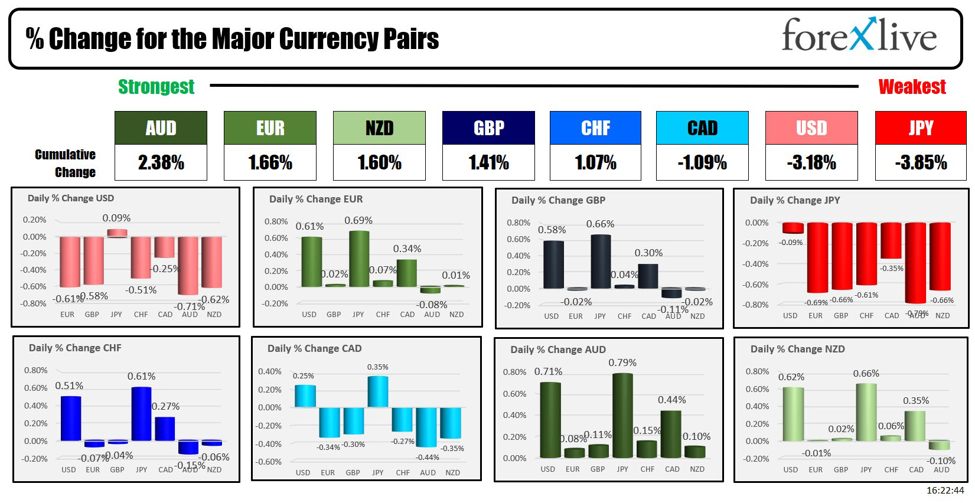

Total, the AUD is ending the day because the strongest of the most important currencies, whereas the JPY is the weakest. The USD is simply behind the JPY because the weakest.

In different market in the present day, yields are closing largely decrease after its preliminary transfer larger:

- 2-year yield 4.672%, -2.9 foundation factors.

- 5-year yield 4.330%, -2.2 foundation factors

- 10 12 months yield 4.351%, -1.4 foundation factors. The ten 12 months yield attain day holy of 4.429% – the primary degree since November 27: 2001.

- 30-year yield 4.512%, +0.3 foundation factors. The 30-year yield just lately I hope 4.570% is his degree since November 28, 2023.

US shares closed combined with the Dow closing decrease with the broader S&P and NASDAQ index larger:

- Dow industrial common fell -43.10 factors or -0.11% at 39127.15.

- S&P index rose 5.68 factors or +0.11% at 5211.48

- NASDAQ index rose 37.01 factors or 0.23% at 16277.46

- Russell 2000 rose 11.16 factors or 0.54% at 2076.20

European shares closed larger after the decrease inflation readings:

- German DAX, +0.51%

- France CAC +0.29%

- UK FTSE 100 +0.03%

- Spain’s Ibex +0.52%

in different markets:

- Crude oil closed larger for the fourth consecutive day. It’s presently buying and selling up $0.28 or 0.33% at $85.43.

- Gold prolonged to one more excessive and traded above the $2300 degree for the primary time ever. It’s presently buying and selling at $2298.80 up $20.10 or 0.80%

- Bitcoin is buying and selling at $65,571

![Celebrities Who Earn the Most on Instagram [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/05/bG9jYWw6Ly8vZGl2ZWltYWdlL2lnX3RvcF9lYXJuZXJzMi5wbmc.webp-600x435.webp)