The day within the US session had little to go on. Not solely was it Monday, however the financial calendar was void of any releases. Fed’s Bostic spoke, however he already talked a bunch final week.

What he stated right this moment was (what I assumed) a bit extra hawkish. He did present an optimistic but cautious outlook on the economic system and inflation. He indicated that inflation is on a path to return to the two% goal, nevertheless it’s untimely to declare victory. Bostic expects two quarter-point fee cuts inside the yr, contingent upon additional progress and elevated confidence in disinflationary developments. That will have been rather less optimistic particularly in comparison with different who see 3 because the more than likely variety of cuts in 2024. He added that regardless of the widespread nature of inflation, together with in sectors like housing and actual property the place financial coverage results are evident, the general energy of the economic system and job market affords the Federal Reserve the flexibility to delay fee cuts with out quick concern. Bostic highlighted that companies will not be in misery; they’re poised to take a position and rent, pending favorable circumstances. Nonetheless, he warned of pent-up exuberance within the economic system as a possible inflationary danger. A 3rd-quarter fee minimize is anticipated, more likely to be succeeded by a pause (that’s one thing new from a Fed official), underscoring the shortage of urgency to regulate charges given the present financial energy. Bostic concluded by emphasizing {that a} return to cost stability is achievable however not assured, suggesting a cautious and measured method to financial coverage.

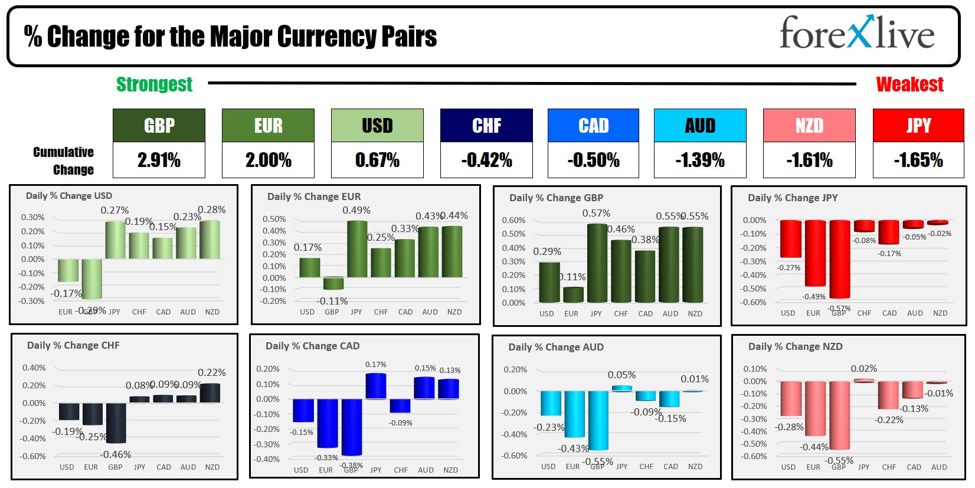

Total for the day, the GBP is ending because the strongest of the most important currencies forward of the finances on Wednesday. The EUR was behind the GBP as the subsequent strongest of the majors. The weakest was the JPY and NZD that are ending the day with comparable declines vs the majors. The USD is ending the day with positive factors vs the JPY, CHF, CAD, AUD and NZD. It fell vs the EUR and GBP.

The strongest to the weakest of the most important currencies

Gold is buying and selling at its highest stage after rising by $32.50 or 1.56% to $2115.20. Silver additionally surged right this moment with a achieve of $0.77 or 3.33% at $23.89. Silver remains to be properly away from its all-time excessive at $30.09.

Crude oil fell right this moment by -$1.24 or -1.55% at $78.33 after buying and selling above $80 for the 2nd consecutive day, however couldn’t maintain upside momentum The excessive value for the day reached $80.41 at session highs.

IN the US inventory market, the most important indices took a breather after closing at report ranges on Friday for the broader S&P and NASDAQ indices. The ultimate numbers are displaying:

- Dow industrial common -97.55 factors or -0.25% at 38989.84

- S&P index -6.13 factors or -0.12% at 5130.94.

- NASDAQ index -67.44 factors or -0.41% at 16207.50

The small-cap Russell 2000 index fell -2.086% or -0.10% at 2074.30.

Within the US debt market:

- 2-year yield 4.610%, +7.7 foundation factors

- 5-year yield 4.209%, +5.0 foundation factors..

- 10-year yield 4.21%, +3.5 foundation factors

- 30-year yield 4.353%, +2.6 foundation factors

Thanks on your help. Luck together with your buying and selling.