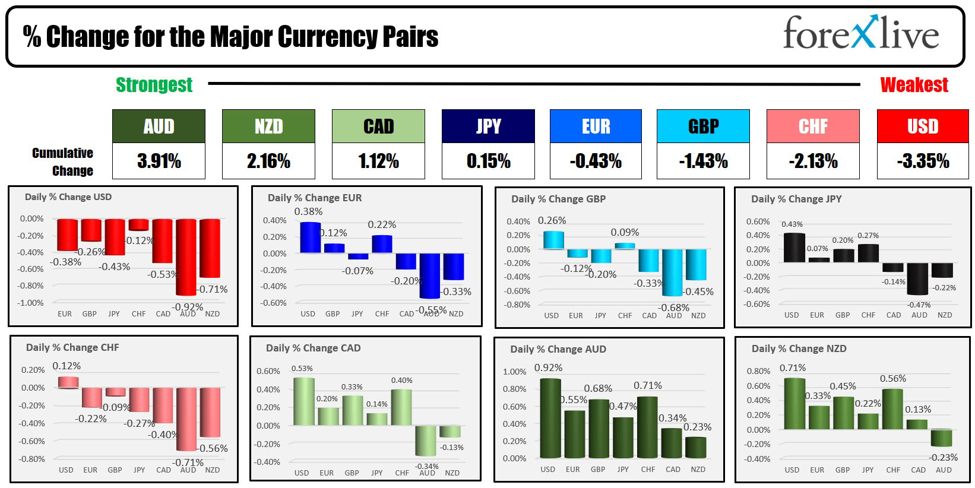

The AUD is ending the day because the strongest of the most important currencies, and the USD is the weakest in buying and selling at the moment.

The USD was the weakest of the most important currencies.

The USD’s weak point was influenced by considerably weaker US knowledge, decrease charges and feedback from Fed Chair Powell who stored easing a bit later within the yr in play. With regard to financial knowledge, the ADP employment report got here in contact weaker at 140K versus 150K. The US JOLTs job openings was additionally weaker, as was wholesale inventories and gross sales .

In his testimony to the Home of Representatives, Federal Reserve Chair Powell outlined the central financial institution’s cautious stance on financial outlook and coverage price changes amid ongoing issues about inflation and financial progress. Powell emphasised that the Fed is unlikely to cut back the coverage price till there’s larger confidence that inflation will sustainably transfer towards the two% goal. However, he indicated a possible easing of coverage restraint later within the yr, with the coverage price anticipated to have reached its peak for this cycle. The Fed’s strategy will likely be guided by cautious evaluation of incoming knowledge, with consciousness of the dangers of adjusting charges too prematurely or too hesitantly.

He added that there’s an expectation for housing companies inflation to lower. On financial progress, Powell reported continued strong efficiency with no vital near-term dangers of recession, highlighting a robust and tight labor market conducive to attaining a delicate touchdown. This optimistic view extends to managing dangers within the industrial actual property sector, with the Fed making certain banks can deal with potential losses, which can stay a problem for years.

Trying forward, Powell steered that if the economic system evolves as anticipated, vital price reductions might happen within the coming years, depending on improved inflation readings. He acknowledged the potential for surprises within the economic system’s subsequent chapter, underscoring the Fed’s readiness to adapt its coverage in response to unexpected developments.

In Canada at the moment, the Financial institution of Canada introduced their price resolution and selected to maintain charges unchanged as anticipated however was much less dovish of their official assertion and people of Governor Macklem.

Macklem’s feedback highlighted a number of key issues influencing the central financial institution’s coverage choices. He famous the numerous impression of shelter value inflation on the Financial institution of Canada’s decision-making course of and tempered expectations concerning the timeline for attaining the two% inflation goal, suggesting it’s unlikely to be met this yr. Regardless of the challenges posed by inflation, Macklem noticed that the labor market has adjusted comparatively easily to larger rates of interest. A notable focal point for Macklem has been the sudden energy of the US economic system over the previous couple of quarters, which has contributed to the Financial institution of Canada’s consolation with present measures of core inflation.

Macklem emphasised a cautious strategy to future price choices, stating that every resolution will likely be taken one by one, with the good thing about essentially the most present knowledge accessible, notably by the point of their April resolution. He additionally warned that if core inflation measures don’t lower, the forecast for complete inflation discount won’t materialize. Nonetheless, there’s optimism throughout the Financial institution of Canada, as progress within the struggle in opposition to inflation has been noticed, with additional progress anticipated. The financial institution continues to view the dangers to the inflation outlook as fairly balanced, and inflation expectations stay well-anchored, aiding within the effort to convey inflation again to focus on ranges in Canada.

The USDCAD did transfer sharply decrease in days of closing the day between its 100 bar transferring common on the 4-hour chart at 1.3528, and it is 200 bar transferring space on the identical chart at 1.34921. The 200-day transferring common is available in at 1.34793, and will probably be a draw back goal to get to and thru if the sellers need to proceed their push to the draw back.

USDCAD trades between its 100 and 200 bar MAs

US yields transfer decrease at the moment and assist to maintain a downward bias within the US greenback:

- two yr yield 4.559%, +0.5 foundation factors

- 5-year yield 4.118%, -2.0 foundation factors

- 10 yr yield 4.107%, -3.0 foundation factors

- 30-year yield 4.242%, -3.2 foundation factors

US shares closed larger on the day however nicely off intraday excessive ranges:

- Dow Industrial Common rose 75.86 factors or 0.20% to 38661.06. At session highs, the index was up 272.93 factors.

- S&P index rose 26.13 factors or 0.54% at 5104.77. At session highs, the index is up 49.33 factors

- NASDAQ index rose 91.94 factors or 0.58% at 16031.53. At session highs the index was up 188.97 factors.

The Fed chair will communicate in entrance of the Senate tomorrow, earlier than the TU jobs report on Friday. The expectations are for the employment price to stay regular at 3.7%. The non-farm payroll is anticipated round 190,000 jobs.

Crude oil costs couldn’t maintain momentum concerning the $80 degree. The excessive value reached $80.67 for rotating decrease. The value presently trades at $79.12

Gold costs proceed its surge to the upside with a achieve of $18.72 or 0.88% to $2146.70.

The value of Bitcoin is buying and selling at $66,500 after coaching is excessive $67,645 and as low six $2843