The US session was centered on a variety of Fed officers talking. We’ve already heard from Kashkari because the FOMC determination, however Collins from Boston Fed Pres. Collins and Fed Gov. Adriana Kugler, helped to know their biases. Richard Fed Pres. Barkan additionally spoke.

All appear to be content material with being affected person. There isn’t any rush particularly given sturdy jobs markets, and issues that inflation shifting decrease continues to be depending on some assist from wages and repair costs shifting decrease. There additionally is worried that items disinflation won’t present the stimulus it has over the past 6 to 12 months.

Under are the abstract of every:

- Minneapolis Fed Pres. Kashkari:

Neel Kashkari of the Federal Reserve shared insights suggesting that the present financial coverage may not be exerting as a lot strain on demand discount as beforehand believed. He indicated that if the labor market stays strong, the tempo of coverage fee changes might be moderated. Kashkari talked about that, primarily based on the present financial indicators, 2-3 fee cuts appear applicable, emphasizing that continued constructive inflation information over the following few months would bolster confidence in returning to a 2% inflation goal. He famous the business actual property sector’s power, apart from the workplace section, and highlighted the financial system’s outstanding resilience. Kashkari’s feedback mirrored an optimistic view on the financial system’s efficiency, underlining the necessity to observe shopper and enterprise behaviors intently, particularly concerning spending on items, as these may have longer-term implications.

- Fed Governor Adriana Kugler:

Fed Governor Kugler expressed satisfaction with the numerous progress made on inflation, sustaining an optimistic outlook for its continued enchancment. Regardless of the progress, Kugler emphasised that the Federal Reserve’s work on inflation is ongoing, with a dedication to attaining and sustaining the inflation goal at 2%. The stance on financial coverage stays restrictive, balancing the dangers to the Fed’s twin mandate and acknowledging that future changes, together with potential fee cuts, will probably be contingent on the evolving financial panorama, notably if disinflationary progress slows or stalls.

Kugler highlighted areas of optimism, similar to companies inflation and the expectation of moderating wage development, that are seen as very important contributors to ongoing disinflation efforts. The cooling of labor demand with out resulting in widespread layoffs was famous as a constructive improvement, alongside the expectation that shopper spending will sluggish, aiding disinflation. Regardless of some easing in monetary situations, they’re nonetheless thought of tight, supporting the battle in opposition to inflation.

Kugler pressured the significance of wage development moderation, notably within the companies sector, as essential for sustaining disinflation. Whereas housing inflation stays persistent, it’s anticipated to lower. The Governor additionally talked about the function of immigration in assuaging sector-specific labor shortages, similar to in building.

Acknowledging the unsure surroundings surrounding the impartial rate of interest, Kugler said that coverage choices could be intently tied to inflation’s efficiency. The opportunity of fast shifts within the unemployment fee and the monitoring of potential monetary stress sources, like business actual property and regional financial institution exposures, have been additionally famous. Kugler concluded by underscoring the uncertainty round items costs attributable to world transport dangers, affirming that each upcoming assembly could be pivotal in shaping coverage route.

- Boston Fed President Susan Collins

Boston Fed President Susan Collins outlined a cautious however adaptive stance on financial coverage, indicating the opportunity of fee cuts later this yr if the financial system aligns with expectations. She emphasizes that financial coverage is presently well-suited to the financial outlook, although she anticipates a probably uneven journey again to 2% inflation. Collins advocates for gradual and methodical fee changes once they start, underscoring the necessity for extra information to assist any determination to chop charges. Her perspective is knowledgeable by current sturdy job information and the general financial resilience, suggesting a cautious method to make sure that inflation steadily strikes in the direction of the goal with out precipitating undue financial slowdown. Collins additionally highlighted the significance of moderating wage beneficial properties and famous the blended affect of provide chain enhancements on inflation. Whereas acknowledging the unsure terrain of the impartial rate of interest, she means that future charges may exceed pre-pandemic ranges, reflecting a shift in financial situations and a decrease chance of deflation dangers in comparison with the interval earlier than the pandemic.

- Richmond Fed President Barkin

Richmond Fed President Barkin emphasised the significance of persistence concerning potential fee cuts amid the present financial uncertainty. Highlighting that inflation has proven a promising decline over the previous seven months, Barkin stays cautious, expressing concern that the current lower in items costs may be non permanent and will reverse. With out committing to a selected fee path, his focus stays squarely on the financial system’s efficiency, notably the broadening of disinflation throughout varied classes as a sign for contemplating fee reductions. Regardless of a nonetheless tight labor market, challenges stick with companies and hire inflation remaining elevated, indicating ongoing inflationary pressures. Barkin pressured the necessity for a broad-based disinflation earlier than making coverage changes, noting his shock on the power of the current jobs report and underscoring a non-urgent stance on altering the coverage fee, favoring a cautious method to make sure inflation targets are sustainably met.

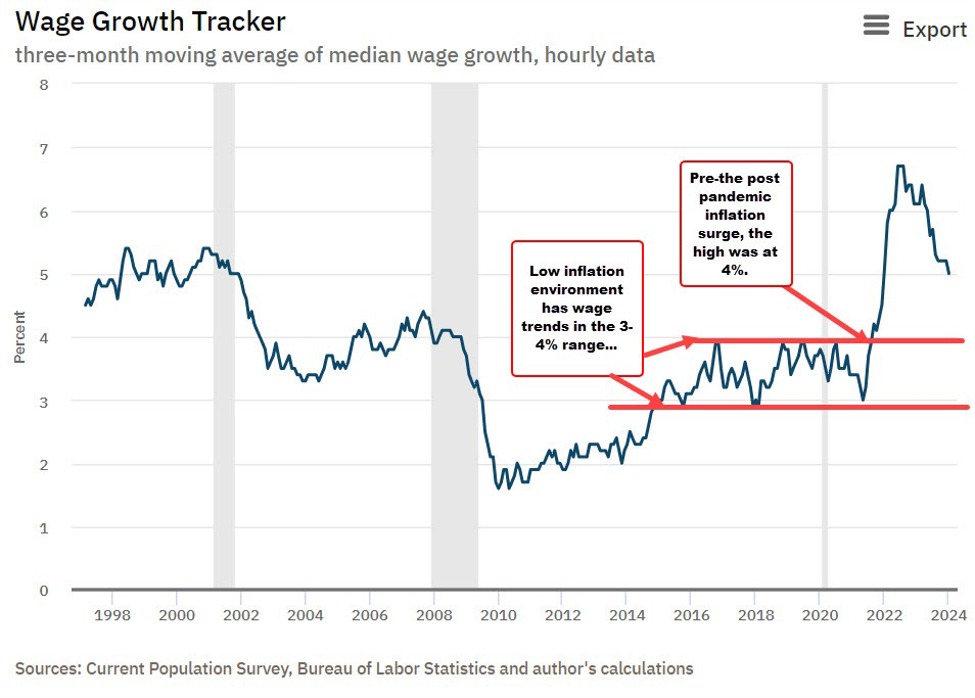

Each Fed Gov. Kugler and Collins highlighted particularly the significance of moderating wage beneficial properties. Later within the day, the Atlanta Fed wage development tracker got here in a 5% which was beneath the 5.2% final month. Nevertheless, in the event you look again to earlier than the pandemic inflation spike, the wage development tracker was extra between 3% and 4%. The 5% stage continues to be properly above that focus on wanted to maintain inflation nearer to the two% goal (see the chart beneath).

Atlanta Fed Wage Tracker

In different information/developements within the US session:

- Israel’s Netanyahu stated that the objectives and technique of the battle in Gaza stay centered on attaining a complete victory, as emphasised by the dedication to not looking for alternate options till the goals are met. This consists of the decisive defeat of Hamas, the return of all abductees, and a transparent indication that the battle, whereas not anticipated to increase for years, is anticipated to final for months. The choice-making course of for the struggle entails a two-tier method, beginning with a mini-ministerial council earlier than shifting to a broader struggle council, underscoring a structured and hierarchical method to strategic choices within the battle. Crude oil is a buying and selling up $0.69 at $74.01.

- US shares continued their run to the upside with each the Dow Industrial Common and the S&P index closing at all-time document excessive ranges. The S&P index reached a excessive of 4999.89 simply 0.11 wanting the magical 5000 stage. The NASDAQ index is closing up 0.95% and the Dow Industrial Common is closing up 0.40%. Nvidia price above the $700 stage for the primary time ever with a acquire of two.75% on the day. Meta surged by 3.27%, and Microsoft rose 2.13%.

- Within the US debt market, yields have been larger regardless of sturdy demand on the 10-year observe public sale (-1.2 foundation level tail led by stellar demand from worldwide patrons. 2-year yield is at 4.428% up 2.1 foundation factors within the 10-year yield is up 2.3 foundation level at 4.115%. The U.S. Treasury will full their coupon auctions for the week with the sale of 30-year bonds tomorrow. It is yield is presently at 4.320% up 2.5 foundation factors.

Within the foreign exchange market at this time, the CAD, GBP, NZD and EUR have been all inside shouting distance of being the strongest of the key currencies.The CHF was the weakest of the key currencies at this time.

For the USD, it was blended/little modified (it was the weakest of the majors yesterday). The USD was stronger by 0.54% vs the CHF, however fell by -0.21% vs each the GBP and the NZD. It was additionally down -0.19% vs the CAD, and -0.17% vs the EUR.

The strongest to the weakest of the key currencies.