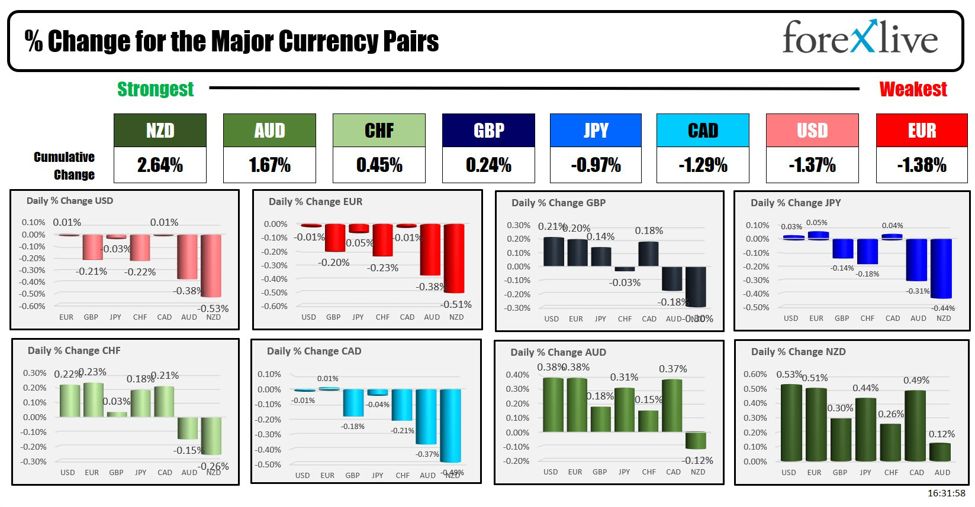

The USD is ending the day in a race for the weakest of the foremost currencies with the EUR (the EUR simply nudged out the USD for the weakest distinction). Nonetheless, the dollar can be effectively off lows after promoting in US shares abated a bit, and dip patrons got here in.

The strongest to the weakest of the foremost currencies

The worth motion was helped within the European and early US session by decrease yields. Yields remained down on the day on the shut, however the foreign exchange market started to disregard and recuperate. The transfer again decrease within the EURUSD (increased USD) was specific topic to up and down volatility. At session highs. The EURUSD reached 1.0884 and traded above the 100-day MA at 1.0871. With one hour to go within the buying and selling day, the pair was down at 1.0847 and buying and selling at new lows for the day.

The USDJPY additionally reacted negatively to the US inventory decline earlier within the day falling to the 200 hour MA at 151.55 after buying and selling as excessive as 151.91 within the European session. The worth is buying and selling at 151.75 close to the center of the vary at present.

Even pairs just like the AUDUSD and NZDUSD that are ending the day because the strongest of the foremost currencies, declined (USD increased) within the US session however nonetheless remained above closing ranges from the earlier days.

A part of the volatility could also be a results of the CPI information which might be launched tomorrow at 8;30 AM ET. The RBNZ might be saying their fee resolution within the new buying and selling day (10 PM ET), and which will have been a catalyst for volatility and motion increased in that pair as merchants place (or sq. up) for the choice.

US shares had been risky and technical ranges (just like the 200-hour MA within the USDJPY) had been additionally in play and an affect in among the USDs strikes at present. For forex pairs just like the EURUSD, they’ll announce their fee resolution Thursday and buying and selling on the highest degree since March 21, could have frightened (and inspired) some merchants into taking some revenue. The pair additionally examined the 61.8% of the March buying and selling vary at session highs which gave merchants a technical motive to loosen up.

Trying on the US treasury market, the yields remained decrease on the day regardless of what was a sloppy three 12 months word public sale (+2.0 foundation level tail and a BTC effectively under the 6-month common). On the finish of the day, a snapshot of the US yield curve reveals:

- 2-year yield 4.744%, -4.4 foundation factors

- 5-year yield 4.377%, -5.7 foundation factors

- 10 12 months yield 4.365% -5.8 piece factors

- 30-year yield 4.498%, -5.5 foundation factors

The U.S. Treasury will public sale off tenure notes tomorrow in 30 12 months bonds on Thursday.

Within the US inventory market, the telephone numbers are exhibiting:

- Dow industrial common minus 9.13.0 or -0.02% at 38883.68

- S&P index +7.54 factors or +0.14% at 5209.92

- NASDAQ +52.68 factors or 0.32% at 16306.64

within the different markets:

- Crude oil is buying and selling decrease at $85.32 down $1.11 or -1.28%

- Gold continues its transfer to the upside with a achieve of $13.70 or 0.59% at $2352.40. The intraday excessive reached $2365.30 (a brand new intraday excessive)

- Bitcoin traded above and under 70,000 however is buying and selling at $68,959 at present. The excessive worth reached 71,007 or 48 hours earlier than rotating to the draw back