Markets:

- Gold down $60 to $2977

- US 10-year yields up 21 bps to 4.20%

- S&P 500 down 0.2%

- WTI crude oil down $1.00 to $60.97

- USD leads, GBP lags

It was a wild one.

All the talk of a ‘Black Monday’ stoked fears early and equity futures fell by as much as 5% in the US after some brutal selling in Asia. There was some modestly better sentiment at the start of US trading but margin calls hit when the market opened and there was good selling, though not to the pre-market lows.

In the broader market, there is a sense that risk assets could be spared if Trump delays some tariffs scheduled to hit at the end of the US day on Tuesday. The sentiment exploded after twitter erupted with tweets from widely-followed accounts claiming that Kevin Hassett talked about a 90-day pause. That led to a +7% swing in stock markets, though the moves were much smaller in FX.

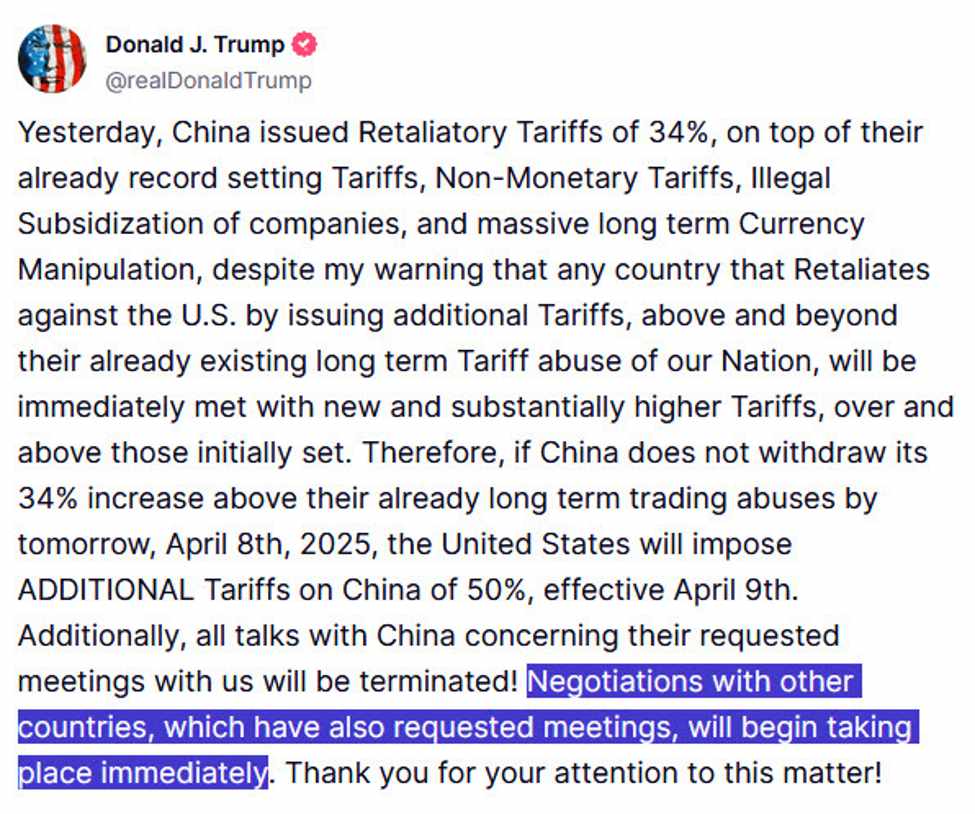

The reports were denied in about 10 minutes and shares fell again but not all the way to the earlier lows. Despite that, there continued to be some speculation about better news ahead. Both worrying and potentially positive was Trump’s message about higher China tariffs — something that would take them above 100%.

Buried in that was the talk of negotiations with others. Some later noted that Trump also never signed anything about China tariffs like an executive order so we will see where this collision heads soon.

Later, Bessent confirmed negotiations with Japan and Netanyahu talked about bringing things to Trump quickly on lowering tariff barriers.

For now, my sense is that the US will let the scheduled tariffs happen and then negotiate to remove them but there is clearly some room for talks here. I also think that many in the market are front-running some positive expected news in the day ahead around tariffs. The common thinking is: Why would Trump delay the tariffs until April 9 without a reason?

In FX, the US dollar rebounded in a big way and a 12-25 surge in Treasury yields was a big reason why. Some of that could be optimism about a tariff walk-back, or pessimism about fiscal deficits but there is plenty of talk of forced selling, particularly as high-yield debt struggles.

With much of the market action on Monday, you got the sense that equities and fixed-income/FX are in different worlds at the moment. The latter tends to win out. The US dollar as broadly stronger so you could read that as some optimism on trade/growth and that came with Fed futures rate cut probabilities falling to 105 bps in the year ahead from as high as 125 bps.

All this to say that when you try and back out all the factors, this is a market that’s waiting for headlines more than anticipating them. There is also a lively debate about how much irreversible damage is already done.