Markets:

- Gold down $17 to $3006

- US 10-year yields up 8.3 bps to 4.33%

- WTI crude oil up 94-cents to $69.22

- S&P 500 up 1.8%

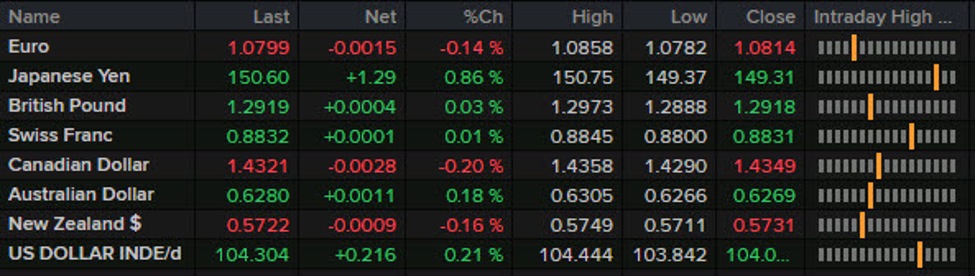

- CAD leads, JPY lags

The tone for Monday was set on the weekend with various reports suggesting Trump wasn’t planning any extra tariffs on April 2 aside from the reciprocal ones and those ones would be reserved for a shorter list of countries with large trade surpluses with the US. Trump himself confirmed that Monday, though not in the clearest terms.

It was good enough to spark a big rally in stock markets, a jump in yields to the top of the recent range and some USD strength. The latter move isn’t exactly intuitive but it was helped along by flows into some beaten-up stocks like Tesla and a strong S&P Global services PMI. That report helped to ease some of the recessionary fears that have percolated.

Fed officials added to that as well by saying that their business contacts haven’t seen a big slowdown in activity. The yen was the big loser as the ‘recession’ trade unwound to some extent. USD/JPY added 138 pips to 150.68 and accelerated as it broke above the figure and last week’s high near 150.20.

Aside from the yen, most moves today were limited to a dozen pips. An exception was the loonie as it was helped along by more constructive Trump tones on trade and perhaps the weekend election call (though that was widely expected). Oil climbing nearly $1 despite OPEC+ continuing to bring back barrels also helped. In any case, the slide lower in USD/CAD was limited to 40 pips and remains firmly within recent ranges.

Tomorrow we get the latest US consumer confidence report, new home sales and the latest Richmond Fed.