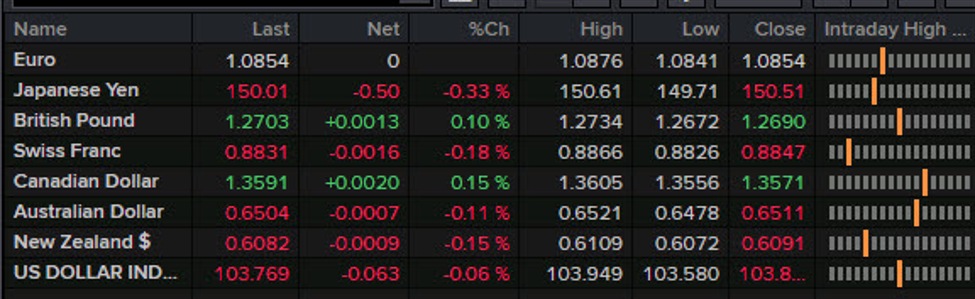

Markets:

- Gold up $13 to $2128

- Bitcoin down 5.5% to $63,854

- US 10-year yields down 7.8 bps to 4.14%

- S&P 500 down 1.0%

- JPY leads, CAD lags

The early indications that it was going to be a tough journey in the present day got here from the bond market, the place Treasury yields started to tick decrease. Inventory markets and yen crosses adopted, although the worth motion in FX was considerably disappointing.

The greenback promoting accelerated after the comfortable ISM knowledge, which was full with decrease employment and value paid metrics in an early signal the US financial system may very well be softening. Fed funds futures priced in barely extra cuts and there was some preliminary shopping for in equities. That transfer additionally led to a report in bitcoin, above $69,000. Nevertheless there have been many bitcoin bulls seeking to promote the ATH and it was crunched down under $60,000 over the subsequent few hours earlier than bouncing to $63,500 late.

Gold additionally hit an all-time excessive earlier within the day at $2140 and likewise backed off however solely barely and it nonetheless completed the day increased.

USD/JPY was caught within the greenback promoting and danger aversion however these two might solely mix for a 50-pip drop, although it was briefly greater than that as stops had been run under 150.00.

The euro hit highs at 1.0876 after ISM and cable reached 1.2734 however each gave again round 30 pips afterwards as the chance image dimmed.

Surprisingly, the commodity currencies held up regardless of the temper and a scarcity of enthusiasm about Chinese language stimulus bulletins to this point. Beijing did contact on year-long stimulus for shoppers however the market is ready to listen to the main points.