Markets:

- S&P 500 up 1.4%

- WTI crude down $2.81 to $71.00

- US 10-year yields down 3 bps to 4.01%

- Gold down $17 to $2028

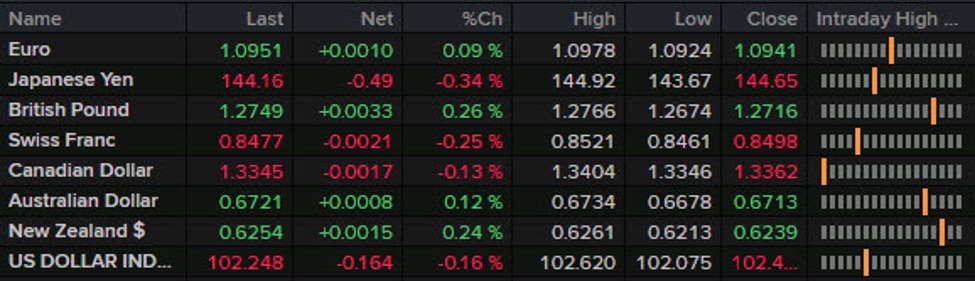

- JPY leads, USD lags

The temper was largely bitter coming into the day after one other poor buying and selling day in China but it surely was typically quiet and with little on the US financial calendar, there wasn’t going to be a lot to commerce off.

Nonetheless it was oil that kicked issues off after Saudi Arabia introduced a value lower on its grades. That led to a 5% rout in oil that made the market really feel higher about inflation, resulting in a fall in Treasury yields and the US greenback.

Compounding that was a launch from the NY Consumed inflation expectations. That survey confirmed a giant drop in anticipated inflation over 1, 3 and 5 years and that is one thing the Fed ought to take consolation in. The greenback bears actually favored it as that led to extra promoting, together with a dip in USD/JPY all the way down to the ISM lows, which finally held.

Cable additionally tried Friday’s highs at 1.2770 however could not get by way of, although it stays shut.

USD/CAD may need been the largest shock given the autumn in oil. The pair rose to 1.3400 early however steadily tracked decrease. Oil firm shares had been additionally suspiciously robust with some merchants pointing to ongoing resilience within the oil crude curve. As danger urge for food improved, USD/CAD fell to 1.3349.

One factor that did not profit a lot because the market turned was gold. It tried to get above $2030 however could not maintain and finally completed solely $10 off the lows. For a metallic with robust seasonals in January, you’d have favored to see extra power as Treasury yields turned decrease.

The euro rode the wave of US greenback weak spot early and hit 1.0980 earlier than monitoring again to 1.0950, up only a handful of pips on the day.

Wanting forward, eyes will stay on bonds with auctions on the size Tues, Wed and Thurs.