- Federal Reserve speakers on Tuesday include Kugler, Bostic, Collins, Jefferson

- ECB board member Isabel Schnabel will be speaking Tuesday

- RBA’s Hauser says Bank must remain strong in fight against inflation

- China NDRC conference continues, AUD slips a little further

- AUD/USD dipping as China’s NDRC press conference gets underway

- Bank of England Deputy Governor Breeden speaking on Tuesday

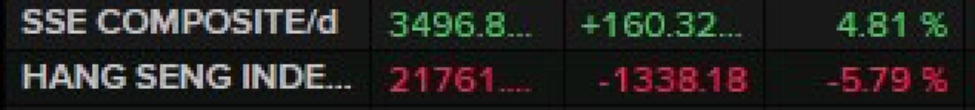

- China stockmarkets leaping higher on reopening: CSI300 benchmark index +9%

- China holiday trips +4.1% y/y

- PBOC sets USD/ CNY reference rate for today at 7.0709 (vs. estimate at 7.0794)

- Japan economy minister Akazawa says drop in real wages is not good news

- Australian September business confidence -2 (prior -5)

- RBA minutes: Board discussed scenarios for both lowering and raising interest rates

- Reserve Bank of New Zealand rate cut coming Wednesday … 75bp cut?

- Australian October Consumer confidence +6.2% to 89.8

- Japan labor cash earnings +3.0% y/y in August (expected +3.1%)

- Japan data – Household spending +2.0% m/m (expected +0.5%)

- Unconfirmed reports of explosions in Iran, Isfahan (nuke site)

- There are reports of a comment from Fed Chair Powell – US equity index futures dropped

- More from Fed’s Musalem – Jobs report did not cause a change in outlook

- Fed’s Musalem: Costs of easing too much outwiegh easing too little

- US stock market headwinds from macro hedge funds offloading longs

- JP Morgan say that U.S. stocks appear overextended

- BNP like the the US dollar ahead of the US election, especially with geopolitical risk

- ECB Cipollone sees deterioration of EU PMI, slower growth, along with faster disinflation

- China reopens today after the long holiday – with a “stimulus” press conference @ 10am

- Goldman Sachs has raised its target for S&P 500 again, as high as 6300

- FX option expiries for 8 October 10am New York cut

- Forexlive Americas FX news wrap: Oil continues to rally as Middle East response awaited

- Major US indices retrace gains from Friday

- Trade ideas thread – Tuesday, 8 October, insightful charts, technical analysis, ideas

There

were high expectations for game-changing fiscal stimulus to be

announced at China’s NDRC press conference today. In the week

leading up to the long holiday monetary stimulus announcements and

implementation drove Chinese markets higher. More of the same was

expected today, but this time from even more important fiscal

stimulus. But, there was no such stimulus announced.

(Mainland)

Chinese equities leapt higher right at the opening but soon subsided

as the disappointing news conference got underway. Hong Kong stocks

had their rally during the long mainland holiday, these dropped hard

on the session.

As

I post Chinese equities are back off their lows.

AUD

and NZD also fell on the disappointment.

–

Apart

from the China news we had plenty more.

St.

Louis Federal Reserve President Alberto Musalem spoke, saying he

supported the recent FOMC 50bp rate cut, but added that he is in

favour of more gradual further rate cuts.

The

Reserve Bank of Australia released the minutes of its September

meeting. The message from the Bank in these minutes is that a rate

cut is not imminent. The minutes emphasized that policy will need to

remain restrictive until Board members are confident inflation is

moving sustainably towards the target range. Of likely even great

significance were the lines explaining that members considered a

formal analysis in which the economy’s supply capacity was more

limited than currently assumed. Limited supply capacity will have a

tendency to encourage inflation. If you argue that there is nothing

the RBA can do about supply constraints you are correct, but what the

RBA will do is work with interest rates (higher for longer) to cap

demand (and thence inflation).

Reserve

Bank of Australia Deputy Governor Andrew Hauser spoke later, also

saying the inflation response is not yet over.

Australian

business confidence and conditions data improved in September.

From

Japan we had wages data, where real (inflation adjusted) wages fell

for the first time in three months. This prompted Japan economy

minister Akazawa to say it was not good news. Sustained wage growth

is what the Bank of Japan wants in order to raise interest rates

again after its first hike in 17 years in March and follow-up hike in

July. This data point will give them something to worry about.

USD/JPY

did not have a large range today.

–

I

should add a little on a curiosity during the session. If you glance

at your ES and other US equity index futures charts you’ll see a

sharp dip around 2230 GMT (1830 GMT) that coincided with social media

reports of Federal Reserve Chair Powell speaking. Of course, Powell

had no speaking engagement and I am not sure where the headline came

from (“JEROME POWELL: PENCILS IN POLICY PATH “SLIGHTLY ABOVE”

THE MEDIAN”). It coincided with, even more significantly,

unconfirmed reports of explosions in Isfahan, Iran. Isfahan is the

site of key Iranian nuclear facilities. These reports remain

unconfirmed as I post.

US

equity index futures soon bounced back, but these imaginative headlines

added to volatility during the session.

Shanghai Composite up, Hang Seng down: