The

two items of most interest during the session here were the inflation

data from China and the Reserve Bank of New Zealand monetary policy

Review for July.

The

RBNZ dropped a dovish bombshell. I explained it at the time (see bullets above):

***

From the RBNZ statement:

- Committee

expecting headline inflation to return to within the 1 to 3 percent

target range in the second half of this year

If

that’s the case why wouldn’t we expect a rate cut soon? I think the

RBNZ agree, judging by this:

- The

Committee agreed that monetary policy will need to remain

restrictive. The extent of this restraint will be tempered over time

consistent with the expected decline in inflation pressures.

The

TL;DR version of all this is ‘if inflation goes down, rates go down’.

***

The

interest rate and FX market agreed. NZD/USD dropped away after the

statement and rates markets moved to price in nearer-term rate cuts.

The Reserve Bank of New Zealand next meet in August (14th), markets

are close to pricing in a 40% chance of a 25bp rate cut at that

meeting. There is CPI data due from New Zealand next week – this will be a critical data point for the RBNZ in timing a rate cut.

From

China we had June inflation data. Headline CPI came in at 0.2% y/y

vs. the 0.4% expected and 0.3% in May. While it appears China is in

danger of flirting with a deflationary CPI again the core rate

offered some sign that’s not the case. Core came in at 0.6% y/y,

unchanged from May. The PPI, of course, remained in deflation. The

disappointment on the CPI has reignited calls for People’s Bank of

China easing. The yuan weakened on the session. USD/CNY hit its

highest (weakest for CNY) since November 14 last year.

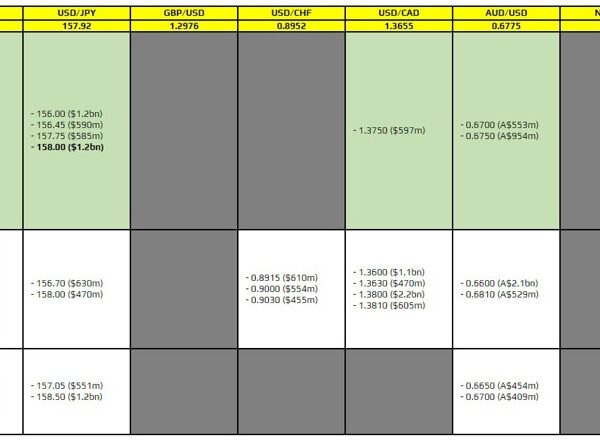

Japanese

wholesale

inflation data

showed an acceleration

in

June. The

PPI (aka the corporate

goods price index (CGPI)) rose 2.9% y/y. The

yen-based import price index increased 9.5% y/y

in June, from 7.1% in May, a sign of how much impact the weak JPY is

inflating

the price firms

charge each other for imported raw material.

NZD/USD

fell on the day, as did the yuan and yen.