The

yen adopted on from its good points on Wednesday by including to them right here

at present. USD/JPY is beneath 148.50 as I publish and yen crosses are decrease

just about throughout the board.

USD/JPY

dropped beneath 149.00 after wages information in Japan for January. The information

confirmed good nominal wage good points, including to the perfect wage rises in 2

many years. However, as for inflation-adjusted wages, whenever you combine in CPI at

its highest for 30 years actual wages fell once more within the information at present, for

the 22nd

consecutive month. The extra optimistic take is that the drop was the

slowest in over a 12 months. As an apart, this

is partly why the Shunto wage

talks are

important

for

the BOJ in contemplating their coverage choices

– to tighten or not. As a reminder, the following BoJ assembly is on

March 18 and 19.

Following

the small dip decrease for USD/JPY we had a string of yen-bullish objects

cross the wires:

- There

had been studies that the Financial institution of Japan has approval from some authorities

officers to finish its unfavorable rate of interest coverage within the close to time period - BOJ

board member Nakagawa stated the Japanese financial system was making regular

progress in direction of reaching the Financial institution’s 2% inflation goal, an indication of

her conviction that circumstances for phasing out its large stimulus

had been clicking into place - Japan’s

largest industrial labour group stated 25 of its member unions have so

far had their wage calls for met in full throughout annual wage talks that

finish subsequent week. Full-time staff’ pay is about to rise 6.7%.

As

this stuff crossed USD/JPY fell additional.

Nonetheless

to come back is Financial institution of Japan Governor Ueda talking in parliament from

3.10 pm Tokyo time (0610 GMT, 0110 US Japanese time).

From

China at present we had January-February commerce figures. China mixed

import and export information for January and February into one ‘YTD’

launch to clean out the affect of the Lunar New 12 months holidays,

which fall in both January or February yearly. Each imports and

exports improved y/y. Chinese language equities rose, as did ‘China proxy’

FX like AUD.

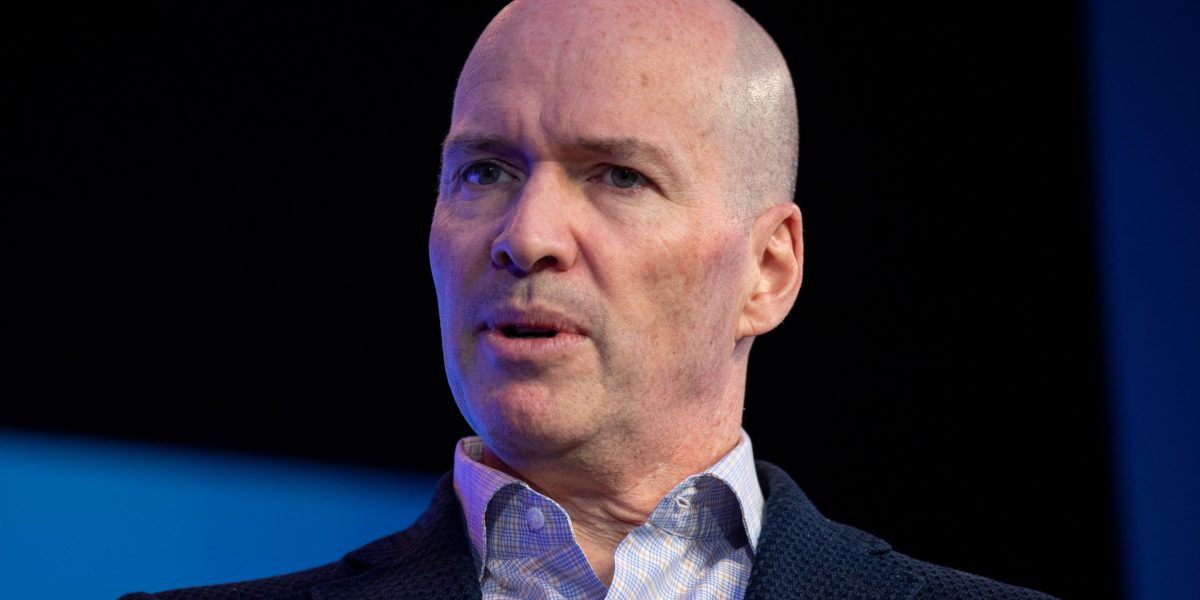

Federal

Reserve Financial institution of Minneapolis President Neel Kashkari, in an interview

with the Wall Avenue Journal, stated he might change his forecast on the

upcoming March 19 and 20 Federal Open Market Committee (FOMC) assembly

from his December projection of two cuts in 2024 to just one. He says

he has not but determined.

AUD/JPY not as gentle as different yen crosses with AUD catching a small bid from the Chinese language information: