Headlines:

Markets:

- USD leads, AUD lags on the day

- European equities lower; S&P 500 futures up 0.1%

- US 10-year yields up 1.9 bps to 4.394%

- Gold up 0.5% to $2,389.83

- WTI crude down 0.1% to $78.72

- Bitcoin up 1.6% to $66,331

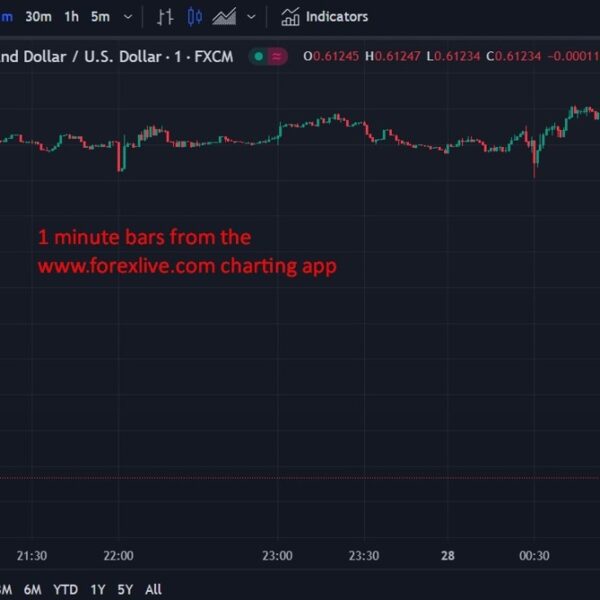

In FX, the reaction to the US CPI earlier in the week is being clawed back somewhat. The dollar is finding a footing in the last few sessions, helped by a bounce in Treasury yields as well.

10-year yields are now at 4.39%, moving off its 200-day moving average. The low after the inflation data was 4.31%, so that is helping to also prop up USD/JPY. The pair is now up over 200 pips since the drop on Wednesday and early Thursday morning.

Meanwhile, EUR/USD is down 0.2% to 1.0843 with large option expiries at 1.0850 still holding price action. The 100-hour moving average at 1.0835 is also a key near-term level to watch in the final stretch of the week.

Elsewhere, USD/CAD is up 0.1% to 1.3635 and AUD/USD is down 0.3% to 0.6655 as commodity currencies also lag slightly in any post-CPI follow through.

In the equities space, European stocks are getting checked back while US futures are more tentative for the most part. The memes are pausing for now as Gamestop shares are down in pre-market following softer revenue sales in Q1.

![TikTok’s Rise as a Discovery Platform [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/06/bG9jYWw6Ly8vZGl2ZWltYWdlL3Rpa3Rva19zZWFyY2hfZW5naW5lLnBuZw.webp.webp)