Headlines:

Markets:

- CHF leads, NZD lags on the day

- European equities larger; S&P 500 futures flat

- US 10-year yields down 0.8 bps to 4.124%

- Gold up 0.1% to $2,020.66

- WTI crude down 1.0% to $76.60

- Bitcoin up 3.8% to $41,408

There wasn’t a lot to work with on the session however the greenback took a slight knock as equities recovered early losses in European buying and selling.

US futures have been extra subdued early on, with tech shares main the draw back, after Intel reported softer Q1 steering in its earnings name. S&P 500 futures have been down as a lot as 0.5% however has pared all of that now whereas Nasdaq futures are down simply 0.2% after having been down roughly 0.8% earlier within the day.

In Europe, French shares are main the best way with luxurious shares gaining after LVMH topped income estimates in This fall final 12 months. A combined begin has now translated to stronger beneficial properties for regional indices amid a rebound in US futures as effectively.

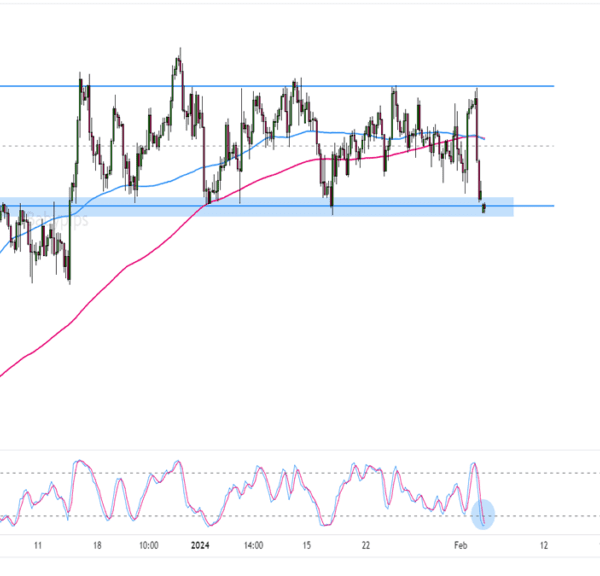

In FX, the greenback was steadier early on however is now barely on the softer facet as we await the US PCE value report. USD/JPY stays regular round 147.75 however EUR/USD moved up from 1.0815 to 1.0870 and is holding on the highs for the day presently. GBP/USD additionally recovered from round 1.2680 to 1.2730 whereas USD/CHF dropped from 0.8680 to 0.8620 on the session.

Apart from some gentle flows and a restoration in equities sentiment, there wasn’t a lot else occurring. The bond market is a little bit of a dud immediately, in order that’s not serving to.

All eyes now flip in direction of the US PCE value report back to see what that has to supply to the inflation image subsequent.