Headlines:

Markets:

- GBP leads, CHF lags on the day

- European equities decrease; S&P 500 futures down 0.4%

- US 10-year yields up 2.5 bps to 4.243%

- Gold up 0.3% to $2,169.77

- WTI crude up 0.4% to $80.98

- Bitcoin down 0.5% to $66,841

It was a comparatively quiet session as markets quiet down after the hectic interval final week. That is the ultimate buying and selling week for March, so month-end and quarter-end flows would possibly issue into the equation within the days forward. However for at the moment, there is not a lot of something as broader markets have been extra blended.

The greenback is down barely after a modest rebound in the direction of the tip of final week. That comes regardless of barely greater Treasury yields on the day whereas equities are marked decrease in European buying and selling.

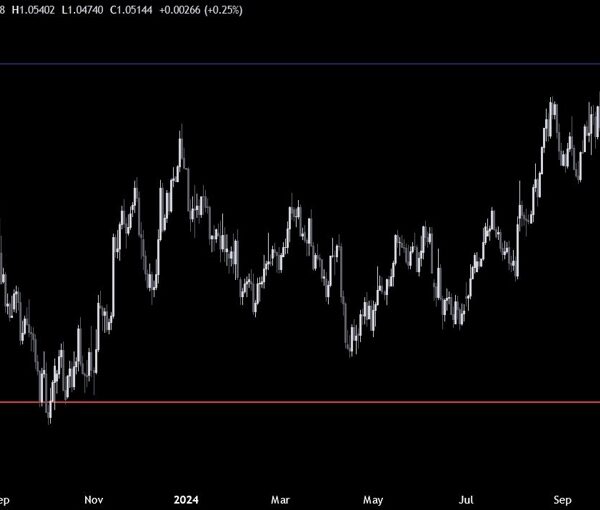

EUR/USD is up 0.2% to 1.0828 however the lower than 30 pips vary for the day remains to be leaving loads to be desired. In the meantime, USD/JPY is flattish round 151.30 as Tokyo ramps up verbal intervention towards additional yen weak spot for now.

The commodity currencies are up barely with USD/CAD down 0.2% to 1.3585 whereas AUD/USD is up 0.3% to 0.6530 on the day. The adjustments aren’t something to shout about in comparison with the strikes on the finish of final week.

In different markets, US futures tilted decrease through the session with S&P 500 futures now down 0.4%. European indices have been flippantly modified on the open however are additionally now barely within the crimson, consolidating at latest highs.

The financial calendar this week is going to be less eventful however we’ll see how markets take to issues in wrapping up Q1 buying and selling. As a reminder, it will likely be a holiday-shortened week in Europe amid the upcoming Easter holidays.