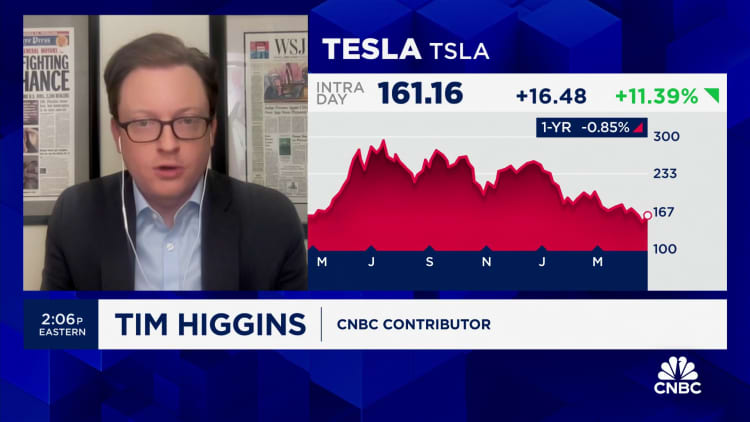

In an aerial view, model new Tesla vehicles sit parked in loads on the Tesla Fremont Manufacturing facility on April 24, 2024 in Fremont, California.

Justin Sullivan | Getty Photos

Former Tesla government Drew Baglino, who introduced his resignation earlier this month, bought shares within the electrical car firm value round $181.5 million, in keeping with a filing on Thursday with the SEC.

Baglino, who joined Tesla in 2006, is promoting about 1.14 million of his shares, the submitting mentioned, itemizing an “approximate date of sale” of April 25, and describing it as an train of inventory choices.

Tesla introduced on April 15 that it is shedding 10% of its international workforce, following a drop in first-quarter deliveries and a steep slide within the inventory value. That day, Baglino and fellow firm veteran Rohan Patel mentioned they have been leaving the corporate.

Baglino introduced his departure in a statement posted to X.

“I made the difficult decision to move on from Tesla after 18 years yesterday,” he wrote. “I am so thankful to have worked with and learned from the countless incredibly talented people at Tesla over the years.”

Baglino started as an engineer and climbed the ranks, most not too long ago serving as senior vice chairman of powertrain and power engineering, a job he’d held since 2016. Reporting on to Musk, Baglino was seen because the unofficial chief of operations by many colleagues.

Previous to the most recent sale, Baglino had unloaded about $4 million value of shares in two transactions this yr — one in late February and the opposite in early April, filings present. In every case, he bought 10,500 shares, exercising inventory choices in each.

Throughout earnings calls and different main firm occasions, together with a presentation of Tesla’s “Master Plan part 3” within the spring of 2023, Baglino had turn into a well-recognized voice and face to shareholders, usually discussing mining, battery manufacturing and efficiency.

Baglino did not reply to requests for remark. Tesla additionally did not present a remark.

Baglino’s resigned as Tesla appeared to embark on a significant strategic shift.

Musk mentioned on the company’s earnings call this week that whereas Tesla nonetheless intends to supply reasonably priced, new mannequin electrical vehicles in 2025, traders ought to focus extra on Tesla’s “autonomy roadmap.” Tesla mentioned it plans to unveil a robotaxi, or CyberCab, design on Aug. 8.

Musk additionally touted Tesla’s investments in AI infrastructure and the corporate’s potential to lastly ship self-driving car expertise, robotaxis, a driverless ride-hailing service, and a “sentient” humanoid robotic. He even advised doubters to keep away from the inventory.

“If somebody doesn’t believe Tesla’s going to solve autonomy, I think they should not be an investor in the company,” Musk mentioned on the decision.

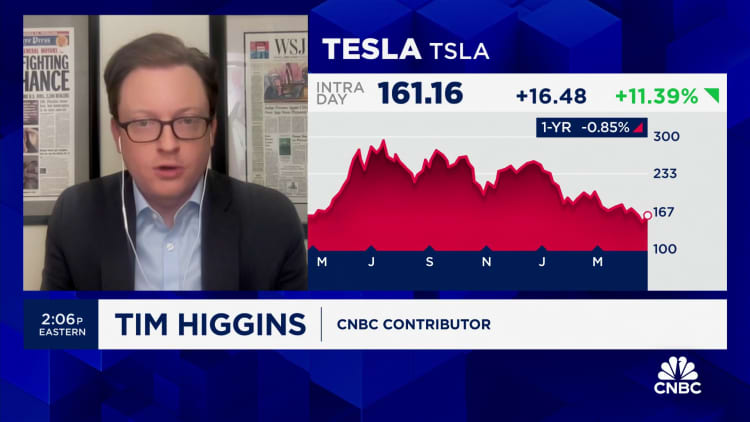

Tesla’s share value, which was down about 40% for the yr previous to the earnings report, jumped 18% within the two buying and selling days after Musk’s commentary, closing on Thursday at $170.18.

Bernstein analyst Toni Sacconaghi is among the many skeptics. In an interview with CNBC’s “Squawk on the Street,” Sacconaghi questioned whether or not the reasonably priced EVs Musk promised will “really be new models, or tweaks on existing models.” He additionally mentioned that opponents, notably Waymo, have already got robotaxi companies on the street, whereas Tesla continues to be grappling with autonomous car analysis and improvement.

Tesla reported a 9% drop in first-quarter income, its steepest year-over-year decline since 2012, as a result of declining demand and elevated international competitors. The corporate additionally reported a 55% drop in internet revenue within the quarter.

Whereas Musk mentioned he expects the second quarter to be higher than the primary, the corporate hasn’t issued steering for the yr.

On the finish of the earnings name, Martin Viecha, Tesla’s vice chairman of investor relations, introduced that he, too, was resigning.