grandriver

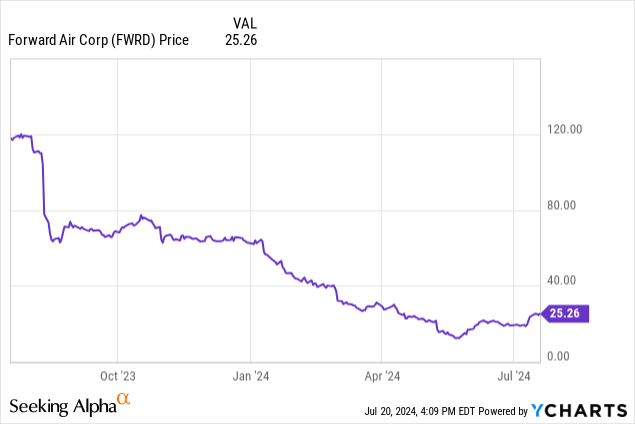

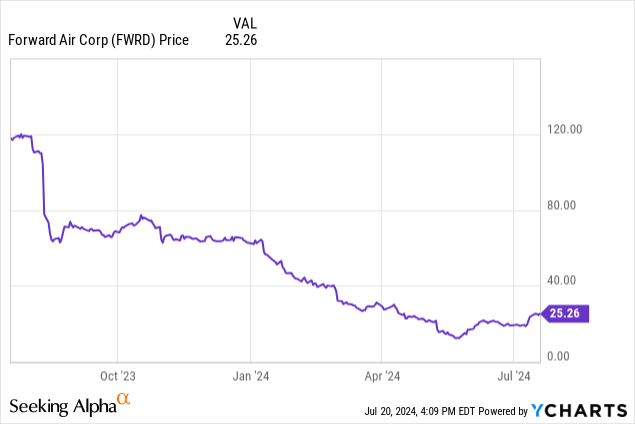

As you can see, Forward Air Corporation (NASDAQ:NASDAQ:FWRD) has gone down precipitously from where it was this time last year. The company has gone from a relatively profitable ground freight company to a disappointingly bad Q1 loss, worse than even the worst estimates expected.

Today we’ll be taking a closer look at Forward Air, with an eye toward where the company stands after the acquisition of Omni Logistics in January, and whether its prospects for growth can overcome recent and future losses. Is this a value play or too big a risk? Hopefully we’ll find out.

Looking at Forward Air’s Balance Sheet

|

Cost and Equivalents |

$152 million |

|

Total Current Assets |

$569 million |

|

Total Assets |

$3.96 billion |

|

Total Current Liabilities |

$445 million |

|

Long-Term Debt |

$1.6 billion |

|

Forward Air Shareholder Equity |

$926 million |

(source: most recent 10-Q from SEC)

Forward Air took on a fair amount of debt with the acquisition of Omni Logistics. Still, the company is well capitalized, and can sustain a short period of not being profitable as it tries to grow back to profitability.

The thing I really appreciate through is the shareholder equity, which gives us a price/book value of 0.72. That’s a nice discount to book at these prices, which isn’t surprising for a company whose stock price has declined so much in the past year. It does make me want to take a closer look at Forward Air from a value perspective.

The new debt is not a huge concern, as the company is large enough to service its debt as necessary going forward. Still, once profitability returns, paying down that debt would go a long way toward showing the company’s strength.

The Omni Logistics Acquisition

In January, Forward Air completed its acquisition of Omni Logistics LLC. The company took on a fair bit of debt, as mentioned above, but the acquisition came it a fair bit lower of a price than was originally agreed to.

Forward Air paid $20 million and 35% of the common equity of the company for Omni Logistics. The original terms were reported as $150 million and 37.7%, but activist investors rose up and resisted the acquisition at this price.

Forward Air said that the goal was to become the premier provider of freight transportation, and for the combined company to save costs. Analysts of the industry suggest the real target war less than truckload (“LTL”) business, which is one of their premium offerings,

Being a premier LTL business would be favorable for general growth and as a premium offering one of its better margin businesses. Indeed, LTL was on the rise, increasing weight per shipment 11% in spite of the general decrease in demand for shipping services.

The one real downside, besides the general decline in demand that likely would have happened with or without the acquisition, is the adding of $1.4 billion of debt to the balance sheet. That’s not a terrifying amount of debt for the company, but again its a lot to be paid given the market being what it is.

The Risks

So debt poses a risk for Forward Air, but the company faces several other risks which are worth bringing up, and which are documented in the company’s SEC filings.

Forward Air is very economically sensitive. Shipments are a lot more consistent in a strong economy, and inflation would increase operating expenses, which would have a negative impact on the bottom line.

Forward Air depends on third party transportation providers, and the cost of attracting and retaining them could be substantial, and cause a serious problem if the competition starts trying to attract them away.

The company is also dependent highly on its biggest customers, with the top ten customers amounting to 26% of their overall revenue in 2023.

The acquisition of Omni Logistics is a key to the company’s future, with the combined company trying to be in a better position to compete going forward. Dealing with the difficulties of operating the new, combined company is non-trivial, and failure to do so could be a serious hindrance to the future of Forward Air.

Statements of Operations and the Q1 Failure

|

2021 |

2022 |

2023 |

2024 Q1 |

|

|

Operating Revenue |

$1.38 billion |

$1.68 billion |

$1.37 billion |

$542 million |

|

Operating Income |

$147 million |

$247 million |

$88 million |

($66 million) |

|

Net Income |

$106 million |

$193 million |

$167 million |

($62 million) |

|

Diluted EPS |

$3.85 |

$7.14 |

$6.40 |

($2.81) |

(source: 10-K from SEC)

The operating results from the last three years are impressive for an approximately $25 stock. The most recent diluted EPS gives us a P/E ratio of just under 4.0. That’s extremely promising for a value stock, and there should be a lot to like here between that and the sub 1 price/book ratio. So what happened?

Unfortunately the first quarter happened, with the company coming in well below their estimates. The market was expecting a 14¢, but non-GAAP EPS came in at 64¢ loss. Revenue also came in $62.2 million below what the estimates were supposed to be.

That’s a problem, but going forward things aren’t going to get immediately better. The Q2 loss is expected at 21¢ with a revenue of $651.39 million. For the full year we’re to expect $1.11 loss on $2.54 billion.

2025 looks better, at least somewhat, as estimates are for a full year revenue of $2.83 billion and positive earnings of $1.02. That gives us a return to profitability, something that’s extremely important for Forward Air.

Conclusion

Normally a company that has fallen so dramatically off of its 52-week high after years of profitability is something I like to look for as a long-term buy and hold. That said, there are too many questions for me to view this as anything but a hold, even that the depreciated prices.

There are just too many questions about the road to the return to profitability for Forward Air, and even for the projected 2025 earnings of $1.02 per share its just not enough value to justify the risks taken by the company after the acquisition of Omni Logistics.

I like Forward Air’s business, and I want to like it at some price. Unfortunately, even after dropping from $120 to $25 the price is still too high. It’s a company worth keeping an eye on, because the market has soured on it, but unless the price drops precipitously further, I’d stay away.