HeliRy

Overview

We have written articles about large and small, high seas, container or dry bulk marine shipping companies. This article features Frontline plc (NYSE: FRO), a mid-sized international seaborne transportation company of crude oil and refined products with a $5B market cap.

Analysts rate the stock as a buy-to-strong buy opportunity. Seeking Alpha’s Quant Rating has often characterized Frontline stock as a Strong Buy opportunity in 7 out of the last 11 months; otherwise, as in the past few weeks, Seeking Alpha judges the stock with a Hold assessment. We believe the stock is potentially a worthwhile Buy for retail value investors after the share price dropped from its 52-week high from $29.39 to $22.76 per share, its lowest since last February.

Opportunities

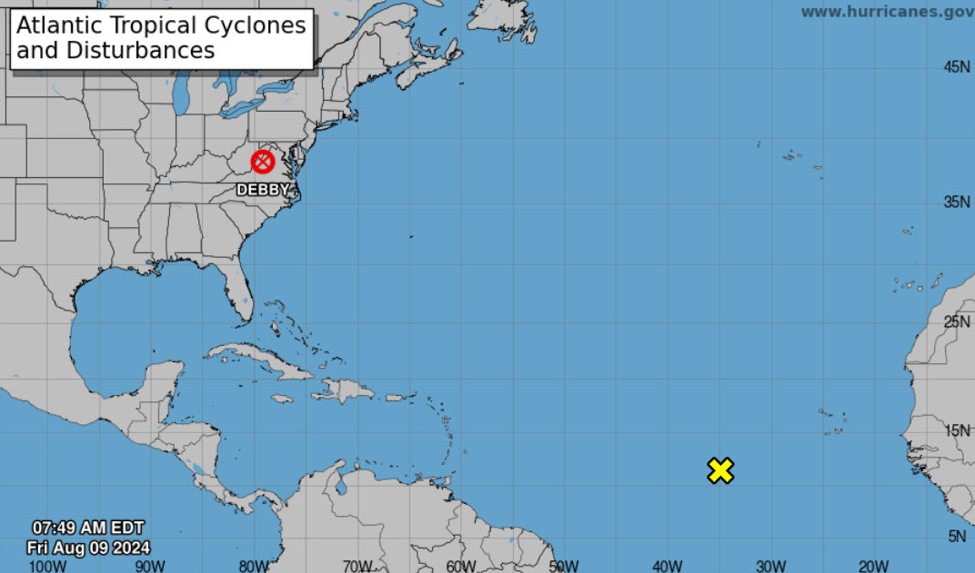

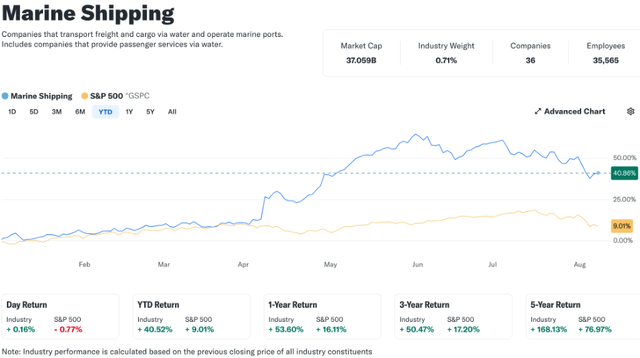

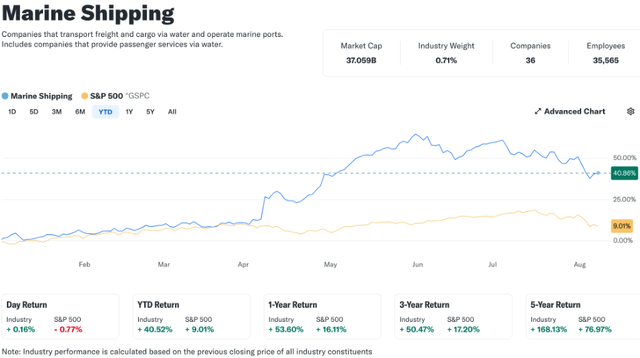

The growth opportunities outweigh the risks. Marine shipping industry stocks have been on a great run since the end of the pandemic in 2021. The October massacre of Israelis andsubsequent attacks effectively strangling Red Sea shipping and global economic recovery drove up freight rates, created crew, container and ship shortages, and congestion in ports worldwide among other emanations. Despite Frontline’s ~23% share price drop since May ’24, the stock is up ~32% over the last 12 months and 13.5% YTD.

Marine Shipping Industry (Yahoo Finance)

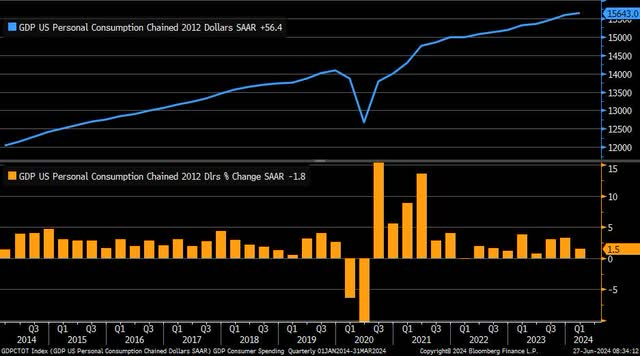

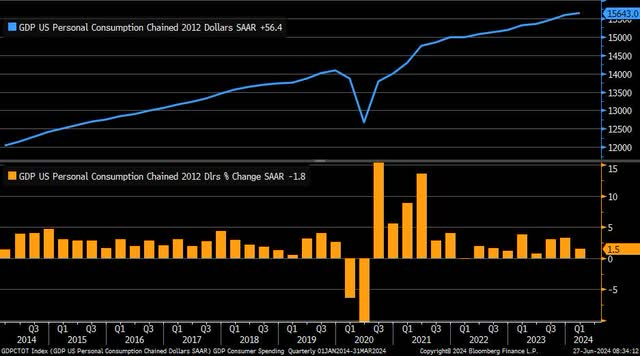

Goldman Sachs (GS) recently determined that “peak oil demand is still a decade away.” EVs are no longer an imminent threat to gas-powered vehicles. Consumer incomes are up and spending momentum as a percentage of GDP is good. Oil demand is rising worldwide along with its by-products: petrochemicals, heating oil, diesel fuel, jet fuel, gasoline, andlubricants shipped by tankers.

US Personal Consumption (LizAnnSonders Charles Schwab & Co)

Bimco, an agency monitoring the shipping industry, concludes that demand for crude tankers will remain high through 2024 and 2025 but weaker into next year. Bimco additionally attributes the Houthi attacks to “longer sailing distances” keeping ladened ships at sea for a longer time traveling greater distances. Hellenic Shipping News foresees a “healthy and profitable (tanker) market…even after 2030. All Seeking Alpha growth metrics for Frontline result in A and B Factor Grades.

Tanker Demand/Supply (Bimco)

This is also an opportunity for retail value investors to earn a 10.9% dividend yield. Frontline increased the dividend when the share price ticked up; however, the company has only paid a dividend consistently since March ’23. Seeking Alpha assigns Factor Grades of D+ and F for safety and consistency. It has a high-side 73% payout ratio compared to the sector’s 41%. Earnings cover dividend payments but have no free cash flow per share -$7.29 TTM and -$3.48 Dec ’23. We expect the dividend will be cut the last amount of $0.62 to the $0.40 range as of previous quarters.

Profile and Valuation

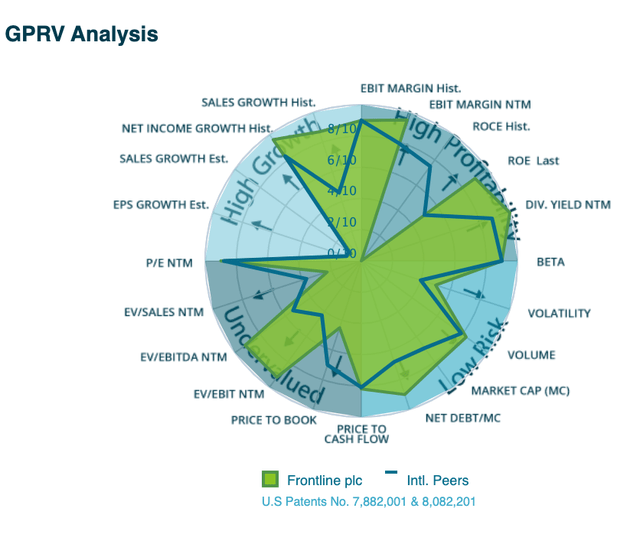

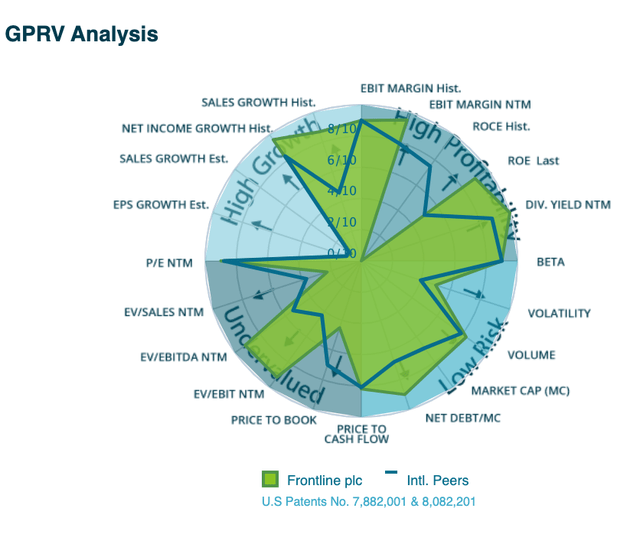

Frontline plc grew out of the dry bulk business into the tanker business over the last 25 years. A Swedish family-owned holding company remains the majority shareholder. Frontline charters, buys, and sells vessels. It delivers crude and other liquids. It last reported earning $2.86 per share; the consensus and our forecast is for 2024 earnings to be between $3.06 and $3.22 per share. Depending on the twists and turns of geopolitical and global economic events, 2025 earnings can be ~12% more. Ships are not likely to return to Red Sea ports shortly, tensions are not easing in the seaways around China-Taiwan-Philippines, and talk of a recession is elliptical.

Highlights of the Q1 ’24 earnings report ending March 31 showed a profit of nearly $220M or $0.62 after adjustments compared to $199.6M in Q1 ‘23. Gross margin hit 54% on revenue of $578.4M in Q1’24 versus revenue of $497.3M Y/Y. Multiplying the current P/E of 7.88 by a low estimate of $2.89 annual EPS suggests the current stock price is a fair value; using the higher estimate of $3.22 EPS has a fair value at $25.37 per share or about 20% below the high for the year.

Maritime shipping stocks have momentum. Frontline’s price performance and growth metrics give the stock the potential to move into the mid-$30 range over the next three quarters. A consensus of analysts agree. Short interest is a low 3.1%. The current Levered/Unlevered Beta of 0.76 suggests there is not much volatility in the share price; changes are more the result of current events and financial reports. One analyst using a discounted cash model has a fair value of +$40 per share. Frontline’s next earnings announcement is scheduled for August 22, 2024.

Revenue/Earnings (Seeking Alpha)

Risks

The major assets and liabilities of ship owners are the ships. They are expensive and expensive to maintain requiring a healthy cash flow. For instance, Frontline took possession of 13 vessels in Q1 ‘24 of 24 purchased from one company after taking delivery of 11 in December ’23 from another company. Financing increases debt and eats at profitability. The Seeking Alpha metrics for profitability that get a C- Factor Grade reveal an F for Levered FCF Margin (TTM) of 101.1% and a D- for asset turnover ratio. All other metrics get As and Bs for profitability: margins, returns, CAPEX/Sales, cash from operations ($757.5M TTM), andnet income ($725M TTM).

Shareholder equity is about $2.4B. Debt is up from $3.61B in 2023 to $4.1B. The debt-to-equity ratio is high, +172%, and is rising as more ships are added to its fleet; the fleet increased to some 86 to 89 vessels with recent purchases “making it,” the CEO claims, “the largest pure-play tanker owner” financed by asset sales and credit. Assets are valued at $6.6B somewhat off-setting concerns that might make us skittish in another industry. Though debt is not well-covered by cash from operations or by cash and equivalents ($404M), it is covered by EBIT. We foresee little chance of any financial distress in the near term. The two hedge funds still holding shares increased holdings by nearly a million shares in the last quarter. 20 other funds dumped their shares as the price rose. A host of other risks are detailed in the company’s SEC filings.

Analysis (Infront Analytics)

Last Sailing

Frontline plc has accumulated debt to finance the building of its 86-vessel fleet of tankers. The company services an industry that is not showing signs of a slow-down in consumption as once feared. The liquids Frontline hauls across oceans and seas are in increasing demand. The debt, the biggest risk to investors, is manageable under current circumstances. Under economic stress, the company will have to improve its liquidity, but the next debt payback is not due for three more years. Management uses debt to build a fleet that generates good income and returns. Margins are good as are almost all the other financial metrics, especially the dividend yield. These factors justify our position that Frontline plc deserves the Buy rating we give the stock.