It seems that Zuckerberg’s realignment with the Trump Administration hasn’t paid off in the first key test of that relationship.

This week, Meta will head to court to defend itself against the FTC’s bid to force the divestiture of both Instagram and WhatsApp, over what the FTC argues is anti-competitive behavior from Zuckerberg’s social behemoth.

The case has gone back and forth for years.

Back in 2020, the FTC launched legal action against Meta, which alleged that the company had illegally maintained its social networking monopoly “through a years-long course of anticompetitive conduct”.

The suit specifically focused on Facebook’s acquisitions of Instagram and WhatsApp, claiming that Meta had acquired both to “neutralize competition,” in violation of antitrust law, and called for the divestment of the two apps in response.

In 2021, however, the FTC’s suit was rejected by a federal judge, citing failure to “plausibly establish” Facebook’s monopoly power. The FTC then re-launched an amended case along the same lines, which was approved to go to trial a year later.

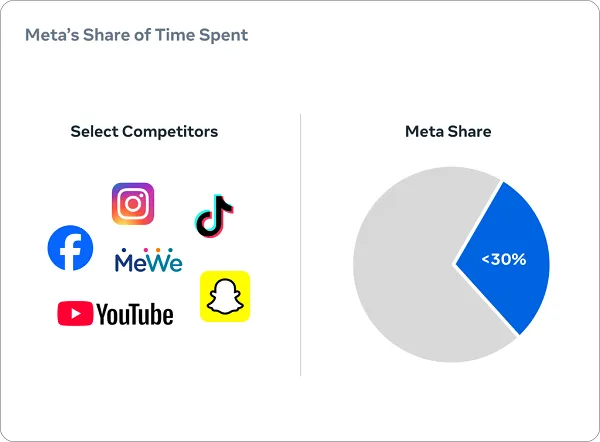

The legal wrangling over the case has been going on ever since, with Meta seeking to have the case dismissed entirely last year, by arguing that it doesn’t have a monopoly on the digital ads market, citing ongoing competition from X, YouTube, TikTok and Snapchat, among others.

That clearly wasn’t a convincing enough case, and now, Meta will have to present its arguments in court, with its broader business empire at risk if it loses the case.

Which Meta has once again dismissed as meritless:

“The FTC’s case ignores how the market actually works and chases a theory that doesn’t hold up in the real world. Instagram and WhatsApp provide a model for what successful acquisitions can achieve: Meta has made Instagram and WhatsApp better, more reliable and more secure through billions of dollars and millions of hours of investment.”

Indeed, according to Meta, the FTC’s case fails to establish the company’s alleged dominance:

“In order for the FTC to win this case, they need to prove both that Meta has a dominant share in a properly defined product market that includes all competitors, and that the two acquisitions harmed competition and consumers. They are wrong on both claims. That’s why they’ve gerrymandered a fictitious market in which Facebook and Instagram compete only with Snapchat and an app called MeWe. In reality, more time is spent on TikTok and YouTube than on either Facebook or Instagram – if you only add TikTok and YouTube into the FTC’s social media market definition, Meta has <30% market share.”

In this sense, the rapid growth of TikTok has actually been a blessing for Meta, because it shows that a new challenger can emerge and become a significant player in the space. If Meta held monopoly power, as the FTC claims, then this could not happen, while YouTube also generates tens of billions in revenue every year.

As such, it does seem like the FTC is going to have a significant challenge on its hands in proving Meta’s market dominance. Armed with more recent stats and data, Meta pretty clearly doesn’t hold such power, but a lot also depends on how the arguments are presented, and the historical frame of reference for each.

In any event, Meta had hoped that its new allegiance to Trump would save it from having to face trial, with Zuckerberg’s various efforts, including buying a mansion in Washington, establishing the foundation for a more fruitful partnership with the White House.

This is one of many fronts on which Zuck is hoping Trump can save it, with the company also facing a range of fines and penalties overseas. The Trump team has said that it’s opposed to fines of U.S. companies, but thus far, it hasn’t taken action on such. And with the FTC proceeding with its case, you can imagine that Zuckerberg’s hopes of Trump’s full support are evaporating pretty quick.

Which is also why this will be an interesting test, because if the FTC wins the case, and Meta is asked to divest Instagram and WhatsApp, you can bet that it’ll be calling on Trump once again for support.

Has Meta done enough to win Trump’s trust and action in this respect? Will Trump ask for more in return for any such action?

Trump’s “Art of the Deal” approach to the presidency generally relies on these types of quandaries, where he can exert more of his own will when companies like Meta are up against it.

As such, it could well be that the Trump Administration hasn’t stepped in as yet because it wants Meta to feel the heat, so it really needs to make compromises to secure its business. That could mean a more favorable approach across Meta’s apps for Trump throughout his second term.

It’s a fascinating case study either way, which could have significant ramifications, both for Meta and for social media more broadly.

The Meta/FTC trial begins on Monday.