Richard Darko/iStock by way of Getty Pictures

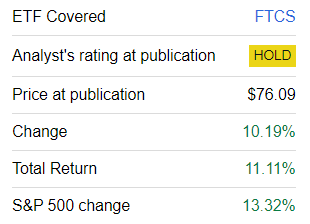

The First Belief Capital Energy ETF (NASDAQ:FTCS) is a wonderful consultant of the ETF league of subtle, brilliantly tailor-made methods that, sadly, repeatedly underdeliver. And since my earlier word was published in September 2023, this ETF has as soon as once more underperformed the S&P 500 index, which could trace that the considerations that I expressed within the article had been justified.

Looking for Alpha

Nonetheless, I ought to acknowledge that my skepticism was solely partly appropriate. Most probably, it was comparatively small publicity to the expansion issue, not comparative expensiveness, that detracted from FTCS’s efficiency over the interval that was notable for an brisk rebound in longer-duration equities.

Immediately’s replace is important for a number of causes. First, FTCS is a high-turnover ETF, so with two reconstitution of the index it tracks since September 2023, it could be attention-grabbing to see how the portfolio has advanced. Second, I wish to assess contributors to and detractors of its efficiency. And at last, it must be mentioned whether or not there are causes for a extra optimistic ranking for FTCS.

What Are The Core Ideas Of FTCS’s Technique?

Based on the ETF’s web site, the very basis of its technique is the Capital Energy Index. For my part, this index has a properly calibrated, potent methodology able to filtering out poor-quality firms with purple flags on the monetary place entrance. Briefly, as described within the investor guide, it’s purported to signify 50 much less risky shares and REITs chosen from the Nasdaq US Benchmark Index that handed a number of screens, together with the next:

- There should be at least “$1 billion in cash or short-term investments.” For context, the median whole money & ST investments of FTCS’s holdings as of February 28 had been $4.13 billion, as per my calculations, vs. $4.1 billion as of the earlier word. Ecolab (ECL) has the smallest result at $919.5 million. The highest result’s Microsoft (MSFT) with $80.98 billion.

- The Lengthy-term debt/Market cap ratio should be sub-30%.

- ROE should be above 15%. The median for the portfolio is at present at 28.7%, as per my evaluation.

Constituents are weighted equally, with ICB trade caps utilized. I like to recommend studying the prospectus for a greater understanding of the nuances.

What Has Detracted From FTCS’s Efficiency This Time?

Since September 2023, FTCS has changed a stable share of its portfolio because the Capital Energy index has been reconstituted twice. Extra particularly, 15 shares that had a weight of barely lower than 30% within the portfolio as of September 8, 2023, have been eliminated, with 15 newcomers now accounting for over 30%. On this regard, I’ll handle solely contributors and detractors that had been current in each variations of the portfolio (35 shares).

Wanting on the knowledge, we see that there are simply 4 firms (about 10% weight in September) within the group of 35 that noticed their share costs decline over the interval, as proven under:

| Inventory | % decline |

| Gilead Sciences (GILD) | -4.9% |

| PepsiCo (PEP) | -5.8% |

| Cisco Programs (CSCO) | -14.5% |

| Archer-Daniels-Midland Firm (ADM) | -32.7% |

Calculated utilizing knowledge from Looking for Alpha and FTCS. Primarily based on the share costs as of September 8 and February 29

There have been a number of notable shares that truly outperformed the S&P 500 index throughout the interval, together with the next trio of names with the very best worth returns:

| Inventory | % worth return |

| Costco Wholesale (COST) | 35.6% |

| W. R. Berkley (WRB) | 34.9% |

| Garmin (GRMN) | 34.1% |

Calculated utilizing knowledge from Looking for Alpha and FTCS

Anyway, it was partly the equal weighting of the index that hindered these equities from contributing extra to the ETF’s efficiency. As common, weighting is a double-edged sword: throughout bear markets, sensible beta can cut back losses (FTCS’s decline in 2022 was 10.2% vs. IVV’s 18.2%). However it will probably additionally stymie portfolios from capturing extra upside throughout recoveries with ease.

Clearly, FTCS’s current underperformance shouldn’t be new. Extra particularly, because it adopted the brand new index in June 2013, it has failed to realize an annualized whole return above the one delivered by the iShares Core S&P 500 ETF (IVV) as illustrated under.

| Portfolio | FTCS | IVV |

| Preliminary Steadiness | $10,000 | $10,000 |

| Closing Steadiness | $32,122 | $36,762 |

| CAGR | 11.66% | 13.09% |

| Stdev | 13.71% | 14.94% |

| Finest 12 months | 26.74% | 31.25% |

| Worst 12 months | -10.22% | -18.16% |

| Max. Drawdown | -20.75% | -23.93% |

| Sharpe Ratio | 0.78 | 0.82 |

| Sortino Ratio | 1.27 | 1.29 |

| Market Correlation | 0.94 | 1 |

Knowledge from Portfolio Visualizer. The interval is July 2013-January 2024

Its decrease volatility was unable to compensate for gentle returns, so each Sharpe and Sortino ratios had been additionally weaker.

What I like is that it does ship some margin of security throughout bear events on the Avenue, as its draw back seize ratio illustrates, but this was not sufficient for constant alpha, and I suppose it will probably not be sufficient going ahead.

| Ratio | FTCS | IVV |

| Upside Seize | 86.97% | 100.47% |

| Draw back Seize | 84.99% | 97.08% |

Knowledge from Portfolio Visualizer

How Has FTCS’s Issue Combine Developed?

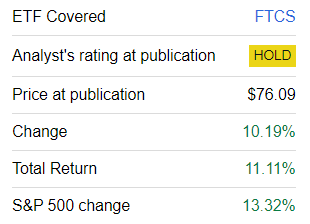

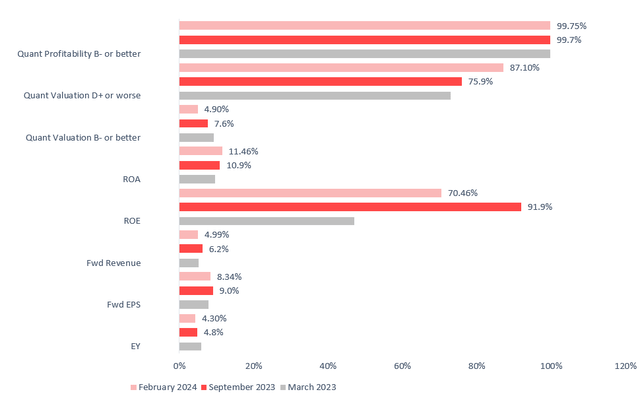

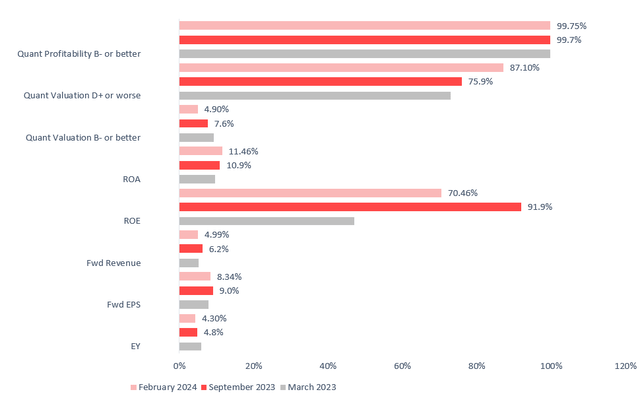

One of many core options of this ETF that I consider buyers ought to take note is that its issue combine fluctuates solely barely regardless of profound modifications in portfolio composition. So though the portfolio composition modifications talked about above have been reasonably deep, I might not say something substantial occurred with the ETF’s model issue exposures. It’s nonetheless a relatively richly priced, top-quality mixture of much less risky shares. For higher context, I created the chart under. I’ve additionally added issue knowledge from the March 2023 model of the portfolio I analyzed within the respective article final yr.

Holdings as of February 28. Monetary knowledge as of February 29 (Created by the creator utilizing knowledge from Looking for Alpha and FTCS)

Nonetheless, my most attentive readers will probably level out right here that there was a major lower within the weighted common Return on Fairness. Nonetheless, this isn’t one thing worrisome. The offender right here is Residence Depot (HD), which has seen its ROE fall from 2,066% to round 1,162%. This metric is distorted by the corporate’s heavy debt, so it’s principally pointless. The ETF’s median ROE has not modified a lot, now standing at round 28.7% vs. 29.4% beforehand.

There are different parameters price sharing:

| Metric | Holdings as of March 22, 2023 | Holdings as of September 8, 2023 | Holdings as of February 28, 2024 |

| Market Cap, billion | 128.58 | 214.11 | 259.37 |

| P/S | 3.55 | 4.78 | 4.82 |

Calculated utilizing knowledge from Looking for Alpha and FTCS

As it may be seen, the portfolio continues to be dominated by mega-caps, as illustrated by the weighted common market cap. P/S factors to its perennial valuation problem.

Ought to The Ranking On FTCS Be Upgraded Immediately?

FTCS takes a smart-beta, concentrated strategy to high quality investing. That is an alluring technique at first blush, but returns gave the impression to be not as strong as some buyers may anticipate from a portfolio of firms that reveal ‘capital power.’ That is one thing that’s omnipresent in extremely subtle smart-beta investing, so the ETF’s case shouldn’t be distinctive.

I consider the first drawback with FTCS’s maximalist high quality technique is the upside seize, which is proscribed as a result of low-volatility element. As an illustration, within the present model, the weighted common 24-month and 60-month beta coefficients are each effectively under 1.

| 24M Beta | 60M Beta |

| 0.83 | 0.86 |

Calculated by the creator utilizing knowledge from Looking for Alpha and the ETF

So within the base case, I see little to no chance that FTCS might be able to delivering alpha on this bull market. This definitely doesn’t imply the ETF must be ignored. Contrarily, buyers who shun volatility and prioritize stability sheet resilience ought to shortlist it. Nonetheless, the Maintain ranking is maintained.