In a latest court docket listening to in Delaware, the failed crypto exchange FTX introduced its choice to desert efforts to restart its crypto trade and as an alternative liquidate all property to refund its clients, based on an legal professional representing the corporate.

Per a Reuters report, FTX had negotiated with potential bidders and buyers for a number of months. Nonetheless, no celebration was keen to supply ample funding to rebuild the trade.

FTX Shifts Focus To Asset Liquidation And Repayments

Throughout the court docket listening to, Dietderich emphasised that the target of returning funds to clients was not a assure however an “ambitious goal.” He acknowledged the “considerable” quantity of labor and related dangers concerned however expressed confidence within the firm’s technique to realize it. The lawyer asserted:

I would really like the court docket and stakeholders to grasp this not as a assure, however as an goal. There may be nonetheless a large amount of labor, and threat, between us and that consequence. However we imagine the target is inside attain and we have now a method to realize it.

The failed negotiations make clear the truth that FTX had vital underlying flaws. Founder Sam Bankman-Fried allegedly lacked the mandatory expertise and administrative infrastructure to maintain the corporate as a viable enterprise, said Dietderich.

Moreover, the previous CEO of the corporate Bankman-Fried has been convicted of fraud expenses associated to his involvement with FTX.

Dietderich additional highlighted that FTX’s creation was an irresponsible sham led by a convicted felon, asserting that the prices and dangers of reworking the remnants left behind by Bankman-Fried right into a functioning trade had been just too excessive.

In consequence, FTX will now deal with liquidating its property to repay clients whose cryptocurrency deposits had been locked when the corporate filed for chapter in November 2022.

Dietderich knowledgeable the court docket that FTX had managed to get better over $7 billion in property to satisfy buyer repayments. Moreover, agreements have been reached with varied authorities regulators, who’ve agreed to postpone their claims till clients are totally repaid, amounting to roughly $9 billion.

Bitcoin Worth Surge Sparks Discontent Amongst Prospects

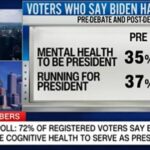

In keeping with Reuters, regardless of the corporate’s efforts, some FTX clients have expressed dissatisfaction, arguing that they’re being “shortchanged” through the use of cryptocurrency costs from November 2022 as a foundation for compensation.

As an illustration, as of this writing, Bitcoin’s worth has considerably elevated from $16,872 in November 2022 to round $43,600. Regardless of these complaints, US Chapter Decide John Dorsey dominated favor of FTX, approving the usage of 2022 costs for compensation.

Decide Dorsey defined that US chapter legislation mandates money owed to be repaid based mostly on their worth on the time of the corporate’s bankruptcy filing. Decide Dorsey said:

I’ve no wiggle room on that. The Chapter Code says what it says, and I’m obligated to observe it.

General, the court docket’s choice units the stage for FTX to proceed with its asset liquidation plan and fulfill its obligation to repay clients.

Nonetheless, the controversy surrounding utilizing 2022 costs could proceed to generate scrutiny and additional authorized challenges because the compensation course of unfolds.

Featured picture from Shutterstock, chart from TradingView.com