Dr_Microbe

Fusion Prescribed drugs (NASDAQ:FUSN) emerges as an fascinating story within the oncology sector, particularly within the area of interest however rising radiopharmaceuticals section. The attraction of Fusion lies in its strategy to precision oncology, notably with its medical candidates’ portfolio for a spread of cancers. The firm’s funding attractiveness is anchored by its dedication to innovation, together with its proprietary expertise and strategic partnerships to enhance the therapeutic index of its radiopharmaceuticals.

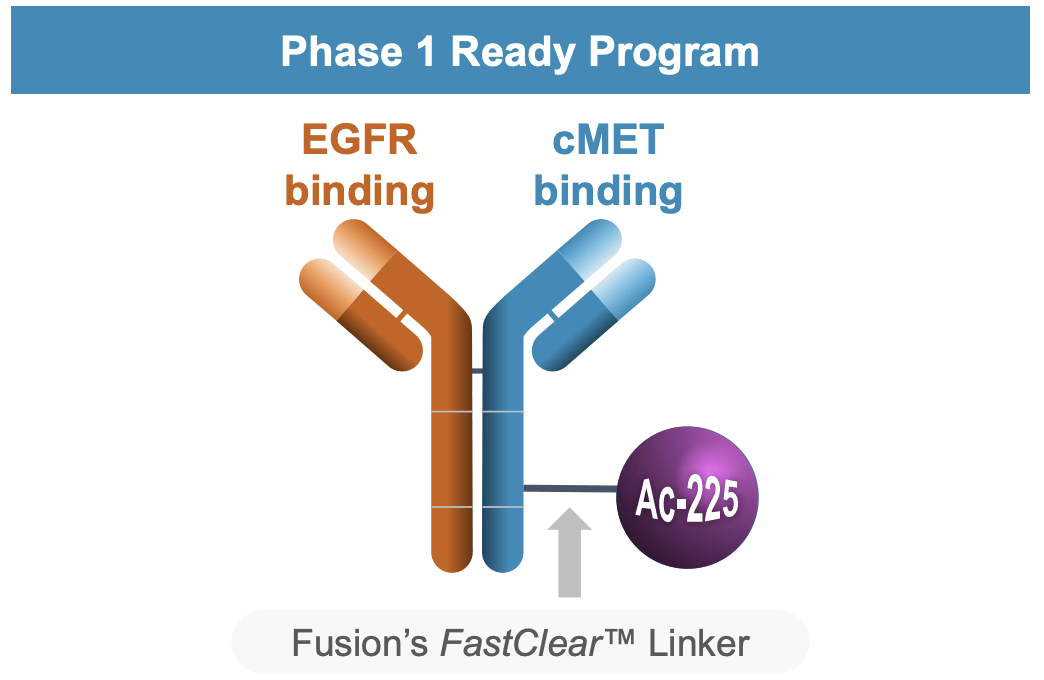

A necessary a part of this thesis is the strategic orientation of Fusion towards the rules of security and efficacy, which manifests itself in medical trials with the goal of optimizing the dosing regimens for the best impact on tumors with minimal hematological toxicity. Such an strategy isn’t solely medically sound but additionally a strategic driver in a aggressive surroundings. As well as, the recent FDA clearance for IND purposes for his or her collaboration candidate, FPI-2068, represents a serious milestone within the firm’s medical growth.

By way of funds, Fusion has a snug cushion of money that’s anticipated to fund its actions nicely into Q2 2025, indicating a strong monetary place to help its trials. This stability is pushed by the collaborative revenues and managed R&D and G&A bills, which spotlight strategic useful resource allocation. Additional, the online lack of Fusion has lessened, which signifies that the corporate’s enterprise mannequin is turning into extra mature and the opportunity of its sustainable growth is growing.

The strategic partnership with BWX Applied sciences (BWXT) gives Fusion with an essential provide of actinium-225, which helps to strengthen the corporate’s funding narrative. This partnership is greater than only a strategic moat and never only a provide settlement, and doubtlessly offers Fusion a large manufacturing flexibility and capability benefit, which is essential to supporting its medical pipeline and future business necessities.

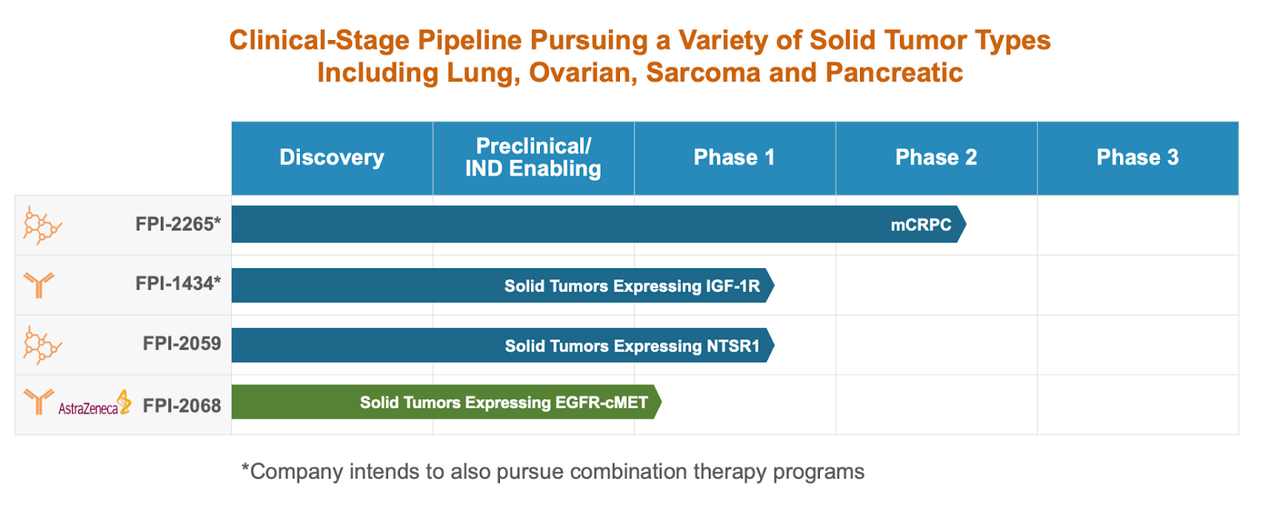

Scientific Pipeline

Fusion Prescribed drugs’ alternative is present in its clinical pipeline, which is broad and novel. Each candidate demonstrates a well-considered technique for concentrating on and treating cancers which have giant areas of unmet want. Of curiosity, FPI-1434, at present in Part 1 trials, to this point, is exclusive attributable to its chilly/scorching dosing routine trying to enhance the therapeutic index with out compromising security in strong tumors expressing the IGF-1R. This may signify a brand new therapy paradigm for strong tumor therapy if additional trials help these early outcomes that confirmed optimistic leads to tumor uptake and hematological toxicity management.

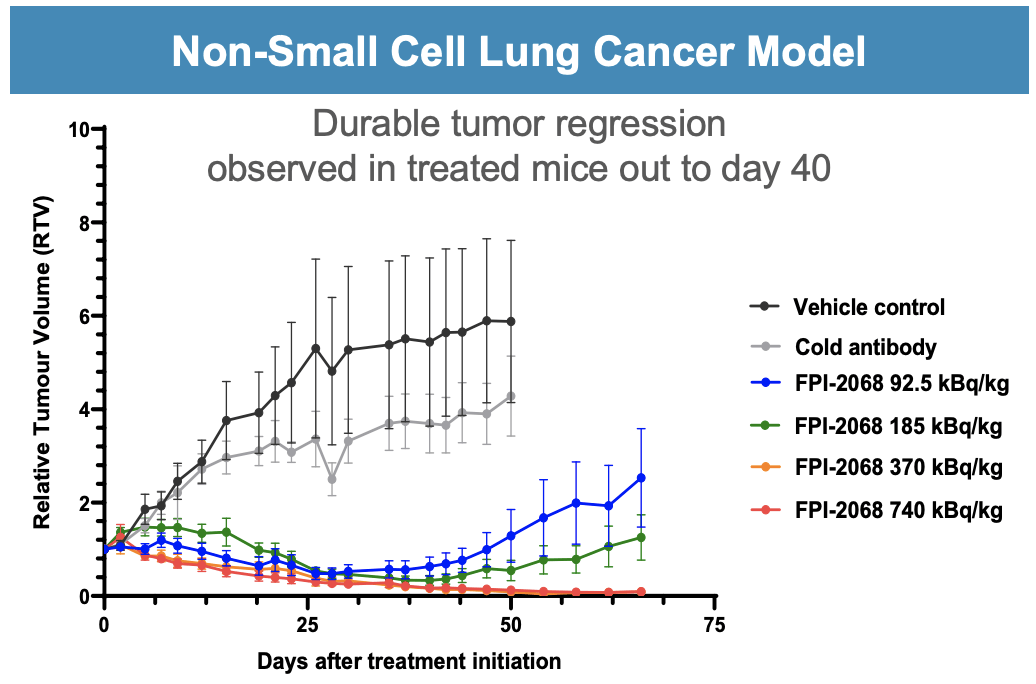

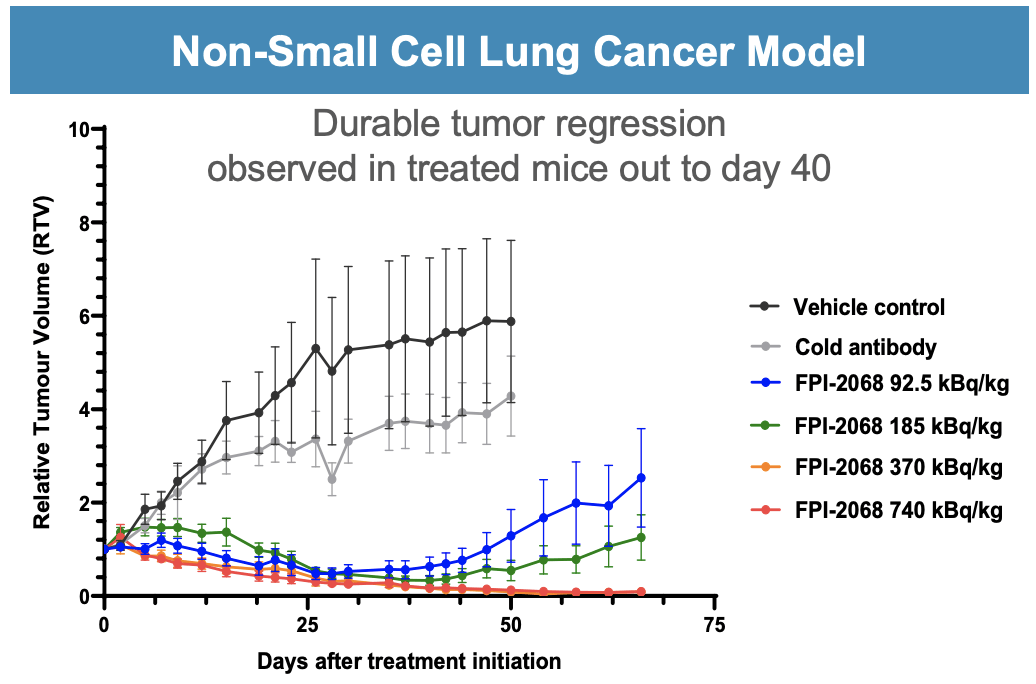

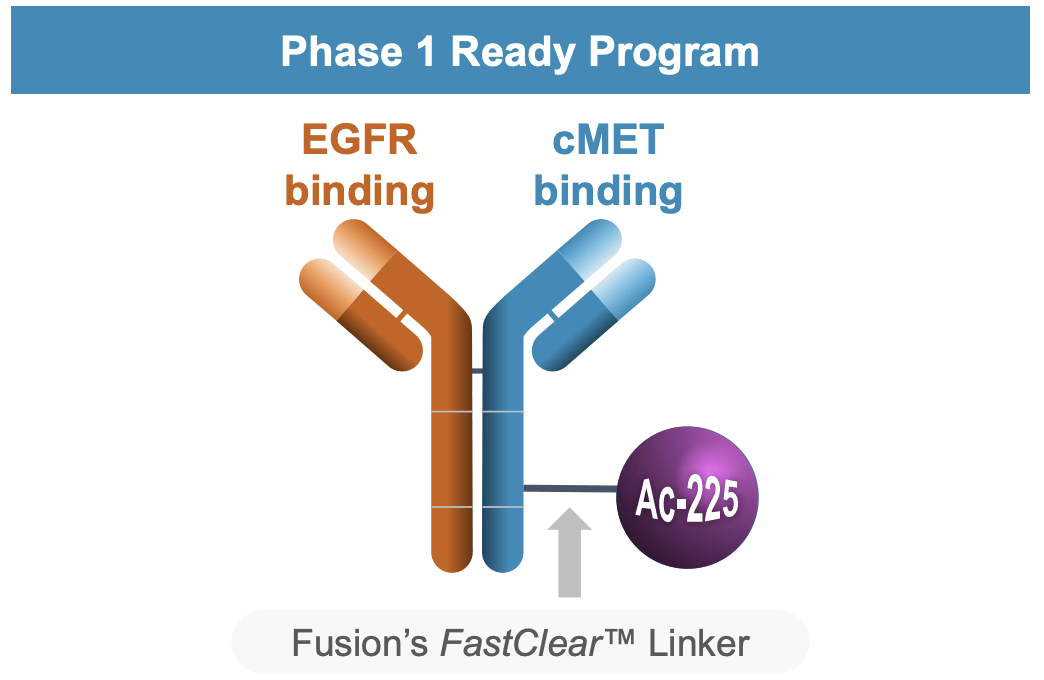

The investigational security and preliminary antitumor exercise of FPI-2059 in strong tumors that specific NTSR1 additionally exhibits appreciable promise. The candidate’s continued affected person enrollment demonstrates the corporate’s dedication to a complete medical evaluation. Likewise, the partnership with AstraZeneca (AZN) on FPI-2068 is a strategically advantageous transfer, concentrating on EGFR and cMET in lots of strong tumors. Receiving FDA clearance for IND purposes is greater than only a procedural achievement; it signifies the regulatory belief within the scientific rationale that the candidate’s mechanism of motion has been constructed upon.

ir.fusionpharma.com

This may be seen from the event of every candidate; the corporate’s strategic focus is on TATs (Focused Alpha Therapies). Utilizing radiopharmaceuticals, these therapies can provide higher outcomes and fewer negative effects, which is likely one of the major benefits over conventional oncology remedies. The TATCIST trial for metastatic castration-resistant prostate most cancers is at present underway, which is a testomony to the dedication of Fusion to this novel therapeutic modality.

Monetary State

From the monetary perspective, Fusion Prescribed drugs has sound monetary well being that presents it as an organization that practices fiscal self-discipline however strategically invests in its future. As of September 30, 2023, the corporate had money and money equivalents of $207.3 million, which was a rise from the top of the final fiscal 12 months. This capital cushion is projected to help operations nicely into 2Q 2025, offering a major runway to progress its medical pipeline with out the near-term want for extra funding. This kind of monetary stability is essential for traders who need to spend money on firms that can have the ability to stand up to the high-cost and time-consuming means of drug growth.

On the price aspect, the agency has proven respectable work in price management, with R&D prices lowering because of strategic reprioritization and medical growth effectiveness. This discount, notably within the mild of the terminated FPI-1966 program, denotes a disciplined useful resource allocation strategy that permits funding to be channeled to probably the most promising medical candidates.

The overall and administrative bills have additionally gone down, which displays a leaner company construction and prudent management of working prices. Such a fiscal management is important to maintain a lean operation that may be versatile and aware of the biotech trade’s continuously altering circumstances.

Nonetheless, even with these positives, the reported internet loss, albeit narrower than the earlier 12 months, exhibits that the biotech sector faces monetary struggles. Nonetheless, the declining loss per share indicators a agency that’s slowly advancing in the direction of a extra viable monetary construction because it develops.

Provide Chain Mastery: Actinium-225 Manufacturing

The power of the availability chain within the biopharmaceutical sector is likely one of the most important but missed elements for fulfillment, particularly for firms equivalent to Fusion Prescribed drugs that depend upon particular isotopes. Fusion has positioned itself in a strategically advantageous place with a aggressive benefit within the manufacture of actinium-225, a key ingredient in its focused alpha therapies (TATs). The corporate’s collaboration with BWXT Medical ensures not solely a most well-liked provide of radium-225 but additionally a possibility to make use of breakthrough generator expertise for onsite manufacturing of high-purity actinium-225.

ir.fusionpharma.com

Within the means of having the ability to develop actinium-225 internally, Fusion reduces the chance of isotope scarcity and good points a major higher hand by way of manufacturing flexibility. Such agility is essential within the high-speed world of medical trials, the place an on-demand dose-filling skill can speed up examine completion and doubtlessly pace up time to market.

Moreover, the partnership with BWXT Medical goes far past provide; it’s a mixture of Fusion’s radiopharmaceutical growth data and BWXT’s established manufacturing capacities. This cooperation is an indication of forward-thinking by Fusion itself to affiliate with the established leaders in medical isotope manufacturing, which can strengthen its strategic place within the trade.

The latest improve of their supply contract for actinium-225 underlines the enlargement of Fusion’s medical pipeline and the expectation of elevated demand for its TATs. By securing and scaling this provide, Fusion isn’t just preparing for present medical trials but additionally laying the muse for potential commercialization, demonstrating a proactive strategy to Provide Chain Administration.

World Licensing Settlement with Heidelberg College and Euratom

Fusion has obtained worldwide unique rights to make use of, develop, manufacture, and commercialize compounds beneath the patent, together with 225 Ac-PSMA I&T (FPI-2265) for the therapy of PSMA-expressing cancers by an exclusive global license agreement with Heidelberg College and Euratom. The strategic transfer resolves the earlier argument over an inter partes overview of a U.S. patent and paves the best way for Fusion to be on the forefront within the growth of actinium-based PSMA-targeted radiotherapy. Fusion has partnered with the U.S. Meals and Drug Administration on the Part 2/3 protocol for FPI-2265 in mCRPC sufferers who’ve failed lutetium-based remedies. This growth plan is nicely organized, with a Part 2 dose optimization lead-in, deliberate to be accomplished by the top of the 12 months, which can result in a pivotal Part 3 registrational trial anticipated to start in 2025. Financially, the deal gives for Fusion to pay the licensors an upfront charge of €1.0 million, in addition to regulatory milestones upon approval and low single-digit royalties on future internet gross sales. This collaboration isn’t solely proof of Fusion’s dedication to the event of most cancers therapy, but additionally a possible breakthrough within the radiopharmaceutical space, with the trade eagerly awaiting the approaching milestones and knowledge from the TATCIST examine in April 2024.

Updates To Manufacturing

The validation of Fusion Prescribed drugs’ state-of-the-art Good Manufacturing Apply (GMP) facility has been accomplished as the corporate seeks to advance the event of radiopharmaceuticals, which incorporates the manufacturing of its first medical dose of focused alpha therapies (TATs). This accomplishment demonstrates Fusion’s strategic strategy to enhancing its manufacturing capabilities. The corporate states that the in-house manufacturing of Fusion not solely enhances their operational effectivity but additionally makes use of their data in world radiopharmaceutical logistics and distribution. On this step, Fusion is additional improved by way of the trendy mills’ expertise that can allow the onsite manufacturing of actinium-225, and, due to this fact, considerably improve the corporate’s manufacturing capability and adaptability.

The newly GMP-accredited facility can be a key a part of Fusion’s development technique, which is designed to help each medical and commercial-scale manufacturing of TATs. This facility, with the capability of manufacturing 100,000 doses per 12 months, is a essential part of Fusion’s technique to satisfy the growing demand for its TATs pipeline, together with the help of FPI-2265 manufacturing. Furthermore, the output of the power is projected to extend to satisfy the manufacturing wants of Fusion’s proprietary and partnered applications, which demonstrates the corporate’s skill to hold out its formidable medical growth plans. This additionally not solely additional consolidates Fusion’s model as a serious radiopharmaceutical firm but additionally emphasizes the corporate’s dedication to innovation and high-quality manufacturing processes.

Market Place

The market place of Fusion Prescribed drugs within the oncology therapeutics trade is outlined by the corporate’s slender concentrate on radiopharmaceuticals focused at precision drugs. The corporate’s particular place in growing next-generation remedies makes it a distinguished participant in a market that’s step by step gaining momentum for focused therapies. By way of specializing in explicit mechanisms equivalent to IGF-1R, NTSR1, EGFR, and cMET, Fusion is figuring out a section the place it might pioneer by very particular remedies.

The collaborative work of the agency, particularly with AstraZeneca, not solely improves its status but additionally shares the dangers related to the event of medication. These alliances additionally characterize a strategic recognition of the challenges confronted in treating oncology, the place pooling assets may end up in the creation of higher therapies.

The corporate’s market standing can be fortified by the potential first-mover benefit with FPI-2265, which is on a path to turning into the primary actinium-based radiopharmaceutical concentrating on PSMA. The corporate, due to this fact, acts with loads of foresight by following a registration-enabling path for this candidate as it might result in a major market share within the therapy of metastatic castration-resistant prostate most cancers, particularly for sufferers that progress on or after lutetium-based remedy.

The development with FPI-2265 and the preliminary optimistic outcomes of the FPI-1434 program implies that Fusion not solely develops its medical trials but additionally efficiently transforms scientific analysis into therapy alternatives. Its functionality to report early indicators of antitumor exercise strengthens the corporate’s aggressive place by displaying the practical effectiveness of its product candidates.

The sector is evolving quick; firms with the likes of Actinium Pharmaceuticals (ATNM) and Orano Med are producing TATs for various cancers. This development might end in different firms competing with Fusion in particular oncology segments. Competing profitable regulatory milestones equivalent to breakthrough-designations or fast-track statuses would affect Fusion’s market place. Such regulatory successes are normally adopted by sooner growth timelines and elevated investor attraction. Many biotech companies have partnerships with bigger pharmaceutical firms, on this approach, they may make the most of one another’s robust factors in growth, manufacturing, and commercialization. Fusion’s partnerings, together with AstraZeneca, are obligatory however not a typical nature of the trade.

The divergence of Fusion lies in its TATs and proprietary actinium-225 platform, which is an alternative choice to those of different rivals concentrating on beta-emitters or exterior radiation therapies. Strong IP safety for its applied sciences and therapies is essential in a state of affairs whereby patent disputes can delay or fully halt market entry. With the development of Fusion’s medical pipeline, the event of the manufacturing functionality to deal with business demand can be key, contemplating the specialised nature of radiopharmaceutical manufacturing. The duty is more durable for radiopharmaceuticals to acquire favorable reimbursement, they’re typically costlier than conventional therapies, and thus, a major medical profit and cost-effectiveness must be proven to payers.

Present Worth

When in comparison with the sector median, Fusion’s figures appear to be outliers primarily based on the EV/Gross sales ratio. An EV/Gross sales TTM of 284.77 and an EV/Gross sales FWD of 262.55 in comparison with sector medians of three.98 and three.78 respectively are dramatically divergent. Though this will appear shocking at first, it’s a typical state of affairs for clinical-stage firms that haven’t but managed to fully commercialize their pipelines. The excessive multiples painting traders’ confidence within the anticipated income development sooner or later, pegged on the profitable commercialization of the corporate’s product candidates. With that being stated, such excessive multiples could be considerably misleading within the trade with trade friends equivalent to Actinium Prescribed drugs demonstrating ahead EV/Gross sales ratios of 693.27, practically 18k% larger than the sector median.

The Worth/E book TTM ratio is a extra modest 3.89, in comparison with a sector median of two.25, for Fusion. This ratio, which is a comparability of the corporate’s market capitalization to its e-book worth, implies that traders are recognizing Fusion for the value of its property, together with its IP and medical knowledge.

The numbers that Fusion makes use of in its valuation metrics stand out for not solely what they’re, but additionally for the story that they inform. They painting the state of an organization within the stage of transition, the place the profitable transfer from medical trials to the market might generate giant revenues. Traders look like wagering on Fusion’s strategic collaborations, superior medical pipeline, and proprietary manufacturing capabilities as indicators of future profitability.

Takeaways

The corporate’s lead program, FPI-2265, is on monitor for a Part 3 medical trial, positioning it as a possible market chief in PSMA-targeting radioligand remedy. The design of the trial relies on cautious consideration of the dosage optimization to enhance affected person outcomes. Fusion’s FPI-2265 might, if profitable, revolutionize the marketplace for metastatic castration-resistant prostate most cancers (mCRPC) therapies, notably for sufferers with few choices after lutetium-based therapy.

As for the early-stage candidates of Fusion, together with FPI-1434 and FPI-2059, the emphasis remains to be on the necessity to showcase security and antitumor efficacy, with future trial outcomes doubtlessly producing further leverage. The latest FDA IND clearance for FPI-2068, which was developed at the side of AstraZeneca, solely provides to the richness of Fusion’s portfolio, which is an indication of wholesome pipeline development. Fusion has to steer by the regulatory maze, preserve its medical successes, and prepare for the business realities of the oncology market. It is going to be essential to type strategic partnerships, and the corporate’s skill to vary its enterprise mannequin to adapt to adjustments in drugs and pharmacology can be essential.

With Fusion set to launch its This fall earnings, the corporate is predicted to outperform its earlier monetary outcomes. Fusion’s partnership revenues, particularly from its collaboration with AstraZeneca, are in focus, in addition to the progress of its medical pipeline, notably the event of FPI-2265 and FPI-1434. The approaching launch of preliminary knowledge for FPI-2265 is a crucial occasion which will have an effect on Fusion’s development path.

Investor consideration can be drawn to Fusion’s strategic collaborations and pipeline growth, the latter being essential for the corporate’s long-term prospects within the radiopharmaceutical space. In view of the Fusion earnings surprises historical past and its strategic developments, the This fall report is predicted with enthusiasm to provide insights into the monetary well being and operational progress of the corporate. All these elements collectively make the subsequent earnings launch a vital occasion for Fusion Prescribed drugs because it makes an attempt to barter the aggressive surroundings of the next-generation radiopharmaceuticals.