mphillips007/iStock via Getty Images

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are two government-sponsored enterprises (GSEs) that have been in conservatorship since September 6, 2008. Hank Paulson and Dan Jester led Treasury’s efforts to seize the companies and restructure their balance sheets to inject capital via the SPSPA, an agreement that was put in place after they were put in conservatorship that relied on FHFA’s discretionary accounting authority to write down GSE assets to support the narrative of the enterprises needing capital.

The government, for its support, gave itself the SPSPA and 79.9% warrants at a nominal strike price. The next 3 years, the government systematically wrote down the value of the GSE assets, pretending that they were going out of business. In 2012, the government ran out of discretionary writedowns and also ran out of time to shutter Fannie and Freddie as the housing market was rebounding, and it arranged with itself to take all of the profits of Fannie and Freddie for nothing via the net worth sweep. The Supreme Court in 2021 ruled that the net worth sweep was legal. The Court of Federal Claims declared that the net worth sweep was not a taking, either. The only legal claims that are currently prevailing are the breach of implied covenant of good faith, which apparently forgot to include reliance damages in their damage model and so the damages awarded to the shareholder plaintiffs are a few quarters on a $25 preferred, which is like a missing dividend payment, sort of joke if you will for a violated contract. So, why bother owning anything at all here?

Investment Thesis

In September 2019, the government under Trump triggered the beginning of the process of recap and release by retaining earnings. Under Biden, earnings have continued to pile up on the enterprise’s balance sheets. Earlier this year, Fannie Mae CEO said, “(s)omeone somewhere has not taken a victory lap for the work that has been done to rehabilitate the enterprises” while contemplating a future outside of conservatorship. Meanwhile, the Biden administration has prioritized addressing housing as a political issue but has largely so far overlooked that it could fund it if it chose to monetize its position in Fannie and Freddie and allocate the warrant proceeds to incentivize the build out of affordable housing supply nationwide despite this plan being detailed to FHFA’s Sandra Thompson. In any equity restructuring where the conservatorship ends outside of receivership, junior preferred shareholders would be made whole. Common shareholder returns are subject to dilution, potentially significant enough such that I think they largely lack security and am personally not recommending them and I don’t own any myself, but wish good luck to those who do.

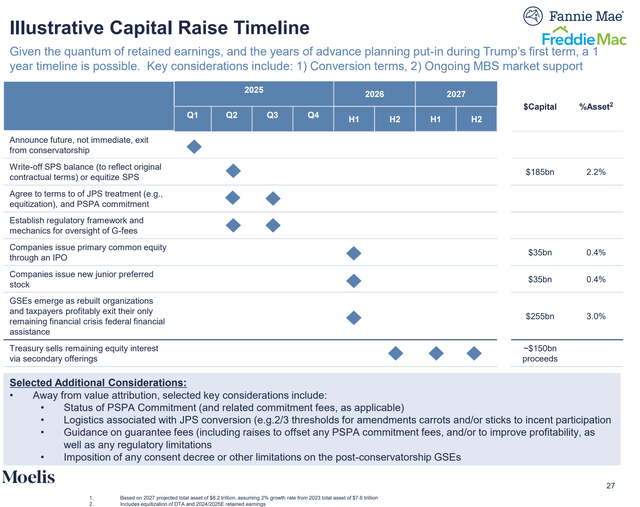

Illustrative Capital Raise Timeline

Moelis put out an update a few months ago in May 2024 outlining how quickly Fannie and Freddie could be restructured by the incoming administration, leading to offerings early 2026:

Illustrative Capital Raise Timeline (GSE Discussion Material – May 2024 – Moelis)

Moelis points out in their plan:

- During the duration of President Biden’s first term in office, the FHFA has made substantial progress in positioning the GSEs for a scenario in which they are no longer under conservatorship

- These efforts included finalizing regulatory capital rules, effectively navigating the post-COVID recovery, and achieving $125bn of combined book value through retained earnings

- However, despite these positive movements, the Biden Administration has shown little-to-no desire to exit the GSEs from conservatorship to date

- As we approach election season, we want to revisit where the GSEs currently stand today and an illustrative framework for a post-election recapitalization and exit from conservatorship

Key Observations

There were a few key observations from the recent Moelis update.

Firstly, a new administration would no longer be burdened by having to do the heavy lifting that the Trump administration had to start with:

- Any settlement and transaction could now occur at the front-end of a new administration, not the tail end

For those unfamiliar, Trump was unable to complete the recap and release of Fannie and Freddie in his first term. For starters, Collins v. Yellen had not yet been ruled on by the Supreme Court, so he was not able to fire Mel Watt on day one. Secondly, they would have been able to get it done but COVID-19 allegedly, according to Craig Phillips and Mark Calabria, delayed it too much, and it ended up being left undone. The companies now have retained 5 years of capital and a lot of the work has been done to prepare them to exit conservatorship, so it is really turnkey at this point.

Secondly, BTIG’s Isaac Boltansky points out that given the capital build, an incoming Democrat administration could also be supportive of recap and release:

We continue to firmly believe that a Republican White House will prioritize ending the GSE conservatorship given the commentary during the Trump administration. We have viewed a second term for President Biden as far less constructive for GSE shareholders given his Treasury Department’s disinterest to date, but we are now increasingly optimistic that administrative GSE reform could fit neatly on a Biden II policy agenda as well.

It remains unclear if a democrat administration would support recap and release from conservatorship.

Trump Surely Supports Recap and Release

On March 27, 2019, Trump issued a Memorandum on Federal Housing Finance Reform where the first section reads:

Section 1. Framework to Reform the GSEs. (A) The Secretary of the Treasury is hereby directed to develop a plan for administrative and legislative reforms (Treasury Housing Reform Plan) to achieve the following housing reform goals:

(i) Ending the conservatorships of the GSEs upon the completion of specified reforms;

On November 11, 2021, Trump wrote a letter to senator Rand Paul:

The Supreme Court’s decision asks what I would have done had I controlled FHFA from the beginning of my Administration, as the Constitution required. From the start I would have fired former Democrat Congressman and political hack Mel Watt from his position as Director and would have ordered FHFA to release these companies from conservatorship. My administration would have also sold the government’s common stock in these companies at a huge profit and fully privatized the companies.

Republicans Looking For Recap and Release Plan

Most recently, Republican Warren Davidson has been asking Janet Yellen about the report due to Congress at the Financial Stability Oversight Council Hearing, two years and counting. This most recent time, he pointed out that the report was due September 30, 2021. He asked Janet Yellen if Treasury could commit to giving Congress the plan. Her response was that it was a promise made by the previous administration. His response was that it was a statutory requirement.

Whatever the plan is, it is already the law to give us the plan.

So far, under Biden, Treasury has still not submitted the plan to Congress. As such, the most recent plan was put together in September 2019, largely by Craig Phillips. As far as I can tell, nothing about the restructuring and recap and release path has materially changed since then.

Election Probabilities

If you assume that an incoming Democrat administration would not end the conservatorships and would be followed by similarly Democratic administrations into the future, the only path to resolution of the conservatorships would be an incoming Trump administration. If you assume that the junior preferred would be made whole two years from today as part of the equity offering and a 10% discount rate. The value of $FNMAS, which has a $25 par value, if we were 100% confident that Trump would win the election, would be $20. $FNMAS currently trades at $4.25. This seems to suggest that junior preferreds are predicting that Trump has less than 25% chance of winning the incoming election. Most of the polls all seem to agree that election odds are closer to 50/50 which would put $FNMAS closer to $10.

I’m not a polling expert, but I have started following Rasmussen Reports, who puts out their polling data on a daily basis and has been explaining what they do to their polling data to take out any bias that they can observably detect and frankly their analysis at face value sounds pretty reasonable. They are currently arguing that Trump’s election odds are over 50%. They also have been vocal in regard to their criticisms of the polling industry and how aggregators, based on their analysis, are biased. That said, the most optimistic poll I was able to find for Harris was she was leading Trump by 7 points. Even if that were true, it would appear that Fannie and Freddie preferreds are undervalued based on election probabilities.

Equity Restructuring Considerations

The legal system does not seem to protect shareholder’s rights if those shareholders are shareholders in government sponsored enterprises that are regulated under the Housing and Economic Recovery Act of 2008. Hopefully, this doesn’t bleed over into the Federal Deposit Insurance Act which regulates the FDIC, but that remains to be seen.

Fannie Mae and Freddie Mac have been retaining earnings since 2019. Treasury has a commitment with Fannie Mae and Freddie Mac that it has neglected since 2021 with respect to submitting plans to Congress on how it intends to restructure its equity position in Fannie and Freddie to enable them to end their conservatorships and attract private third-party capital.

The Congressional Budget Office put together a report in 2020 “Effects of Recapitalizing Fannie Mae and Freddie Mac Through Administrative Actions” where it outlines that the only way to disenfranchise junior preferred shareholders is through receivership. Given the 5 years of retained earnings, receivership is not actionable and so junior preferred shareholders basically are just waiting for the day when the companies undergo the necessary equity restructuring Treasury has promised that will facilitate the ends of their conservatorships. Note that according to this CBO report, additional retained earnings do accrue to help monetize the SPSPA face value in an equity restructuring with a lower earnings multiple.

Summary & Conclusion

In a world where it surely becomes inadvisable to hold the enterprises captive in conservatorship when their net worth eclipses their ERCF capital requirements, and where the Republican Party at large supports the end of conservatorships, my strategy is to continue to accumulate junior preferred at a discount to their intrinsic value. Fannie and Freddie have more net worth than ever before in history and a stronger earnings profile than ever before in history. They are safer than ever before in history. The acting CEO of Fannie Mae indicated that someone doesn’t know how to take a victory lap by ending the conservatorships. I couldn’t agree more.

I own 15371 FMCCG, 6135 FMCCI, 71767 FMCCJ, 2372 FMCCK, 40019 FMCCM, 12719 FMCCN, 1786 FMCCO, 111323 FMCCS, 615 FMCCT, 2701 FMCKI, 5742 FMCKJ, 1746 FNMAJ, 50 FNMAO, 17682 FNMAS, 21644 FNMFN, 5 FNMFO, 773 FREGP and 100 FREJN. Most of those have been bought since the Supreme Court Collins v. Yellen ruling that drove the prices down which drove me to quit my job to raid my 401k to self-direct ROTH IRA, reprioritize my payment schedule and work two to three times as hard since then to buy as much as I can in anticipation in their eventual release from conservatorship.

Looking back, it was not the Supreme Court Summer 2021 that I thought it was going to be. It was a gift horse of lower prices to buy on a collision course with retained earnings, ensuring that I would get paid soon enough. Come on in, the water’s warm! I would file this under one of those things that happens very slowly and then all at once. The current price is remarkable, and that is the purpose of this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.