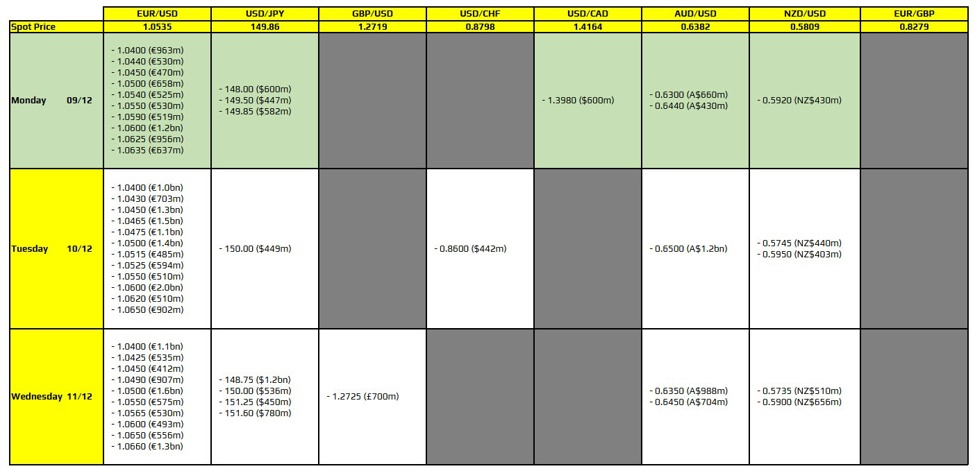

There aren’t any major expiries to take note of on the day. As such, trading sentiment will start to move towards focusing on the US inflation data later this week as well as key central bank meetings over coming two weeks. The dollar remains vulnerable after the non-farm payrolls report on Friday, which served to reaffirm a 25 bps rate cut later this month.

We’ll see how much those odds will shift around in the week ahead. But all else being equal, there shouldn’t be any big repricing moves taking place in the next week.

As such, just be wary that we’re in December trading already and there might be times when the flows don’t square up with the market action. It’s just one of those down periods in markets in terms of traffic. Maybe not so much this year but still a consideration if you’re looking to dive much deeper into some of the moves we’re seeing since last week.

For more information on how to use this data, you may refer to this post here.