Ivanb-photo/iStock Editorial through Getty Photographs

Introduction

Because it has been greater than six months since I last discussed Galp Energia (OTCPK:GLPEF) (OTCPK:GLPEY) right here on Looking for Alpha, it’s maybe time for an replace. Not solely has the corporate launched its full-year outcomes, it additionally made what seems to be a large new discovery in Namibia whereas the Brent oil worth is now buying and selling above $90/barrel. Loads of tailwinds for Galp however the share worth is at the moment simply 15% larger than the place it was buying and selling seven months in the past, so I needed to test if this maybe created an fascinating alternative.

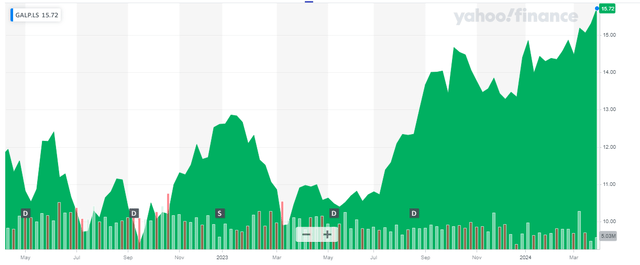

Yahoo Finance

Galp’s major itemizing is on Euronext Lisbon, the place the inventory is buying and selling with GALP (simple) because the ticker image. The average daily volume is approximately 1.6 million shares, which makes it the buying and selling venue which provides the very best liquidity numbers. There are currently 773.1M shares outstanding, leading to a market capitalization of roughly 12.15B EUR on the present share worth of 15.72 EUR per share.

Ending 2023 on a robust observe

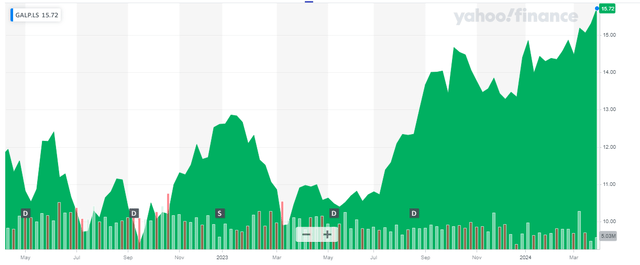

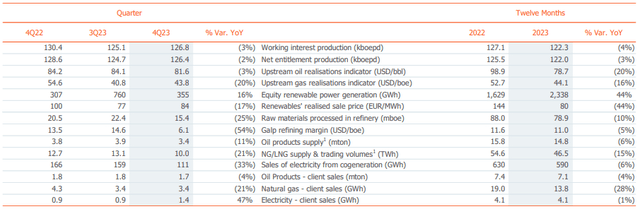

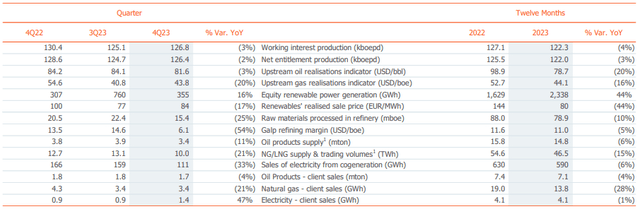

The corporate produced a median of simply over 122,000 barrels of oil-equivalent per day in 2023 however the common manufacturing fee was positively weighed towards the second half of the 12 months because the Q3 manufacturing fee was just over 125,000 boe/day whereas in This fall, the overall working curiosity manufacturing got here in at virtually 127,000 boe/day. The production cost per barrel of oil-equivalent was just $2.1 within the fourth quarter of 2023 which explains the wonderful margins generated by Galp.

Galp Investor Relations

Because the desk above exhibits, the typical oil worth positively decreased (which once more didn’t come as a shock) however it was good to see the refining margin throughout 2023 remained comparatively steady though there was a extreme lower within the closing quarter of 2023 when the refining margin fell to simply $6.1 per barrel of oil-equivalent.

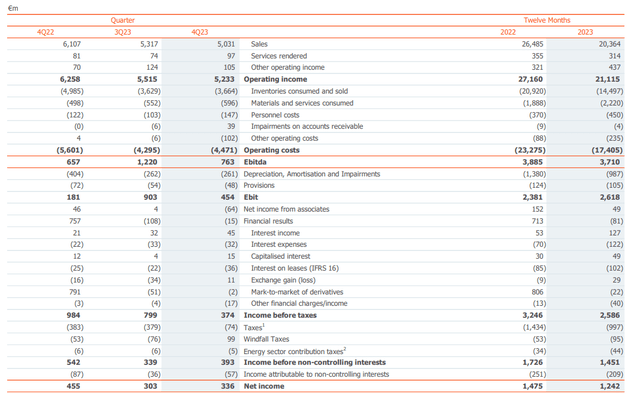

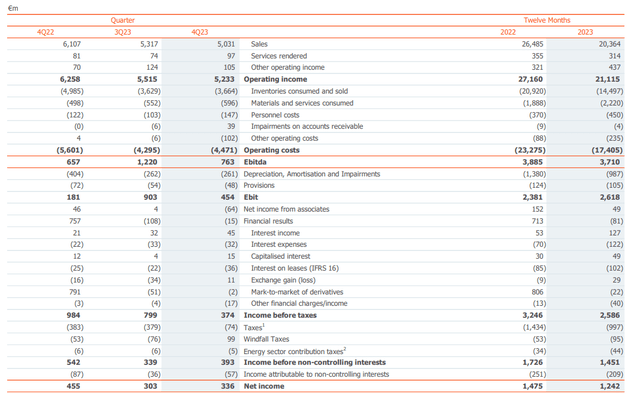

Galp’s This fall outcomes, it reported a complete income of 5.23B EUR (Galp calls the income “operating income” which is fairly complicated) whereas it reported a complete EBITDA of 763M EUR. That’s a 40% lower in comparison with the previous quarter as a consequence of a decrease whole income and better working bills. Happily there have been no additional further damaging outcomes and the EBIT of 454M EUR was about 50% decrease than within the third quarter of the 12 months.

Galp Investor Relations

Because the revenue assertion above exhibits, the pre-tax revenue was 374M EUR which resulted in a internet revenue of 393M EUR of which 336M EUR was attributable to the frequent shareholders of Galp. That’s a rise of roughly 12% in comparison with the previous quarter which is sort of a stunning transfer given the 50% EBIT lower. The distinction could possibly be defined by the 175M EUR distinction in windfall taxes. Whereas Galp recorded 76M EUR in windfall taxes in Q3 2023, it was capable of reclaim a few of its previously-recorded taxes leading to a internet tax profit within the fourth quarter.

Trying on the firm’s full-year outcomes, the overall EBITDA was fairly flat, a lower of lower than 5% is a fairly first rate end in a 12 months the place the oil worth was considerably decrease and the refining margin barely decrease. The reported internet revenue was roughly 1.24B EUR which incorporates roughly 1.1B EUR in taxes (together with a internet windfall tax of 95M EUR). Divided over the present share depend of 773M shares, the EPS was roughly 1.42 EUR (the reported EPS of 1.33 EUR per share relies on the typical share depend).

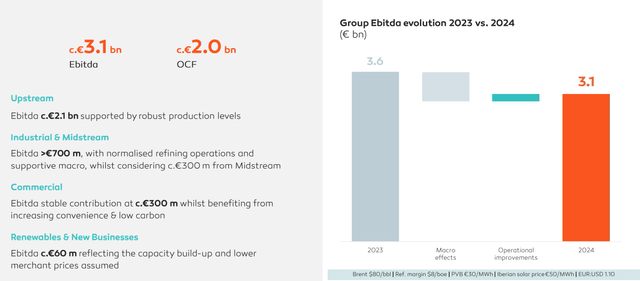

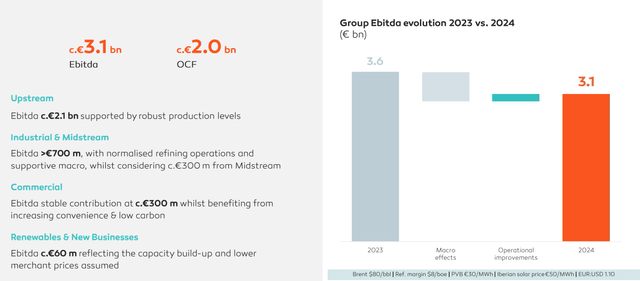

The excessive oil worth will profit Galp in 2024

With Brent oil costs exceeding $90/barrel, there’s little doubt the 12 months has began nicely for Galp Energia. The corporate’s FY 2024 outlook relies on an oil worth of $80 for Brent, so it’s protected to say the 3.1B EUR EBITDA guidance and the 2B EUR working money move steerage are comparatively conservative based mostly on the present oil worth. Ought to the Brent oil worth proceed to commerce round these ranges, I’d assume it’s reasonable to see Galp climbing its full-year steerage.

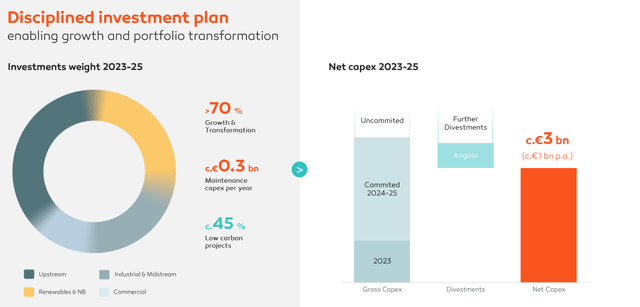

Galp Investor Relations

Curiously, Galp’s capex plan to spend 1B EUR per 12 months consists of roughly 700M EUR per 12 months in development and transformation capex. Certainly, Galp is guiding for a sustaining capex of 300M EUR per 12 months which implies that utilizing an working money move of 2B EUR per 12 months, the underlying internet free money move on a sustaining foundation is roughly 1.7B EUR or 2.20 EUR per share. Based mostly on how Galp Energia offers its steerage, we must always nonetheless deduct roughly 300M EUR in curiosity and lease bills from this consequence, indicating an underlying free money move of 1.4B EUR or 1.81 EUR per share. On a reported foundation, the 1B EUR in free money move (together with the 700M EUR in development and transformation capex, primarily within the renewables phase the place Galp talked about it has a 14% ROIC) would nonetheless end in a free money move results of 1.3-1.35 EUR per share and 1.15 EUR per share after taking funds to minority pursuits into consideration. The attributable FCFPS may probably be even larger if the corporate continues its share buyback program.

Galp Investor Relations

Galp additionally offered a sensitivity evaluation and for each $5 change within the Brent worth, the working money move will likely be impacted by 85M EUR per 12 months. So if the Brent oil worth averages $85 for the 12 months, the free money move consequence per share will enhance by roughly 11 eurocents per share.

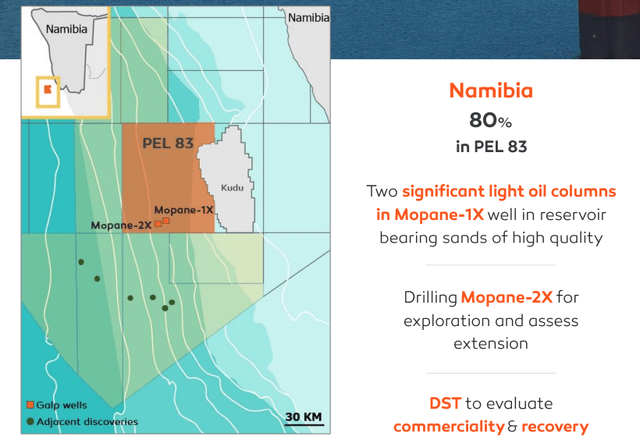

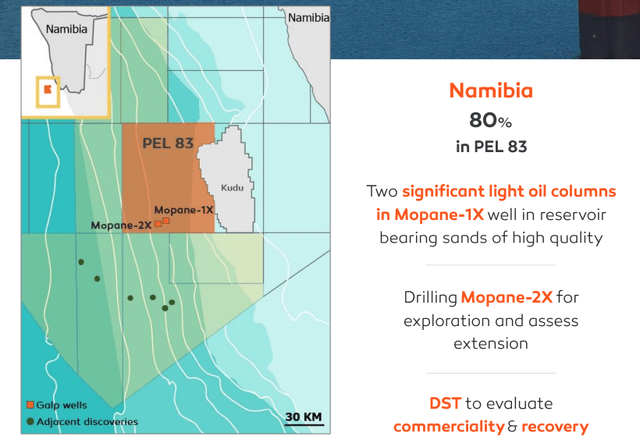

I’m additionally trying ahead to seeing extra particulars on its current discovery offshore Namibia. Galp Energia owns an 80% stake within the licenses however is preserving its playing cards near the chest for now.

Galp Investor Relations

For what it’s price, Canada-listed Sintana Vitality (SEI:CA) has a 5% oblique stake within the license and at the moment has a market capitalization of roughly 138M EUR. Though Sintana has different belongings as nicely, the vast majority of its valuation is underpinned by the 5% stake within the licenses.

Funding thesis

I’ve a small lengthy place in Galp Energia as I like the corporate’s low working bills due to its publicity to low-cost oil fields. The sustaining capex is low which creates further monetary flexibility for the corporate. Galp pays a 0.54 EUR dividend per share (topic to the 35% Portuguese dividend withholding tax) whereas it has kicked off a brand new 350M EUR share buyback program which ought to scale back the share depend by roughly 3%.

I am trying ahead to seeing the outcomes of the Namibia discovery and though I don’t assume this can add billions to Galp’s market capitalization, it may additional fill its improvement pipeline. The Bacalhau oil mission needs to be up and operating in the summertime of 2025 and this can add a couple of 10,000 barrels per day of low-cost oil to Galp’s manufacturing foundation.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.