Dennis Diatel Pictures

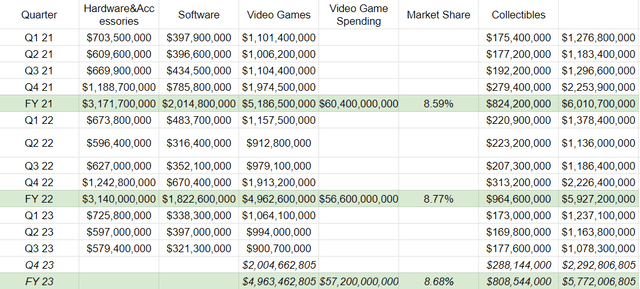

Whereas its inventory is nowhere close to the height it reached in the course of the meme inventory mania of 2021, GameStop Corp. (NYSE:GME) has the potential to rebound from present ranges, in my view, when it posts its This fall and full yr 2023 outcomes on March 26 after market shut. Analysts count on the online game retailer to report This fall income of $2.05 billion and an EPS of $0.25, whereas full yr estimates are for $5.53 billion in income and an EPS of $0.13.

That stated, I count on GameStop to beat analysts’ estimates attributable to stronger online game gross sales within the vacation season in comparison with 2022. Though my mannequin forecasts one other YoY decline in gross sales, I don’t consider the projected decline warrants the low cost the inventory is buying and selling at relative to its friends. As such, I’m score GameStop as a purchase with a value goal of $21.18 per share, representing 62% upside from present ranges.

Video Recreation Gross sales Rebound

Since GameStop is a online game retailer, the corporate’s gross sales are impacted by the power or weak point in shopper spending on video video games. In 2021, US shopper spending on video video games reached $60.4 billion pushed by robust demand for next-gen consoles PlayStation 5 and Xbox Collection X.

In 2022, nonetheless, US shopper spending on video video games declined 5% YoY to $56.6 billion primarily attributable to a lightweight slate of latest releases and macroeconomic circumstances that led shoppers to alter their spending patterns. In consequence, GameStop’s 2022 gross sales noticed a 1.4% decline. Whereas some might argue that GameStop’s declining gross sales are primarily attributable to its outdated brick and mortar enterprise mannequin, I don’t share that view as there’s nonetheless demand for purchasing video video games from bodily places.

A survey performed by YouGov final August discovered that 16% of US players present desire for buying video video games at a bodily retailer. On condition that the variety of video players within the US is estimated to be 212.6 million, which means that GameStop has an addressable market of greater than 34 million players within the US.

With that in thoughts, online game spending within the US elevated in 2023 to $57.2 billion pushed by a robust vacation season the place online game gross sales reached $7.91 billion within the interval from November twenty sixth to December thirtieth. In keeping with Circana’s government director of video video games, Mat Piscatella, the spike in online game gross sales in 2023 was due to “one of the best release slates in industry history”.

Income Projection

The aforementioned data is essential to forecast GameStop’s revenues for This fall and the complete yr 2023. GameStop realizes revenues from the sale of {hardware}, equipment, software program, and collectibles. The online game section within the firm’s income includes {hardware}, equipment, and software program. In the meantime, the collectibles section consists of the gross sales of motion figures, replicas, and buying and selling playing cards.

By way of the online game section, GameStop’s revenues from {hardware}, equipment, and software program represented 8.59% of whole online game spending in 2021 and eight.77% in 2022. As such, I’m forecasting GameStop’s share of 2023’s whole online game spending to be 8.68% representing its common share prior to now 2 years. Primarily based on this, my projection for GameStop’s full yr revenues from {hardware}, equipment, and software program to be $4.9 billion which might consequence on this section realizing simply greater than $2 billion in This fall 2023.

As for the collectibles section, toy gross sales declined 8% in 2023 in unit gross sales and greenback phrases. Even within the vacation season, toy gross sales declined 8% in greenback phrases and 6% in unit gross sales. Which means buyers purchased fewer toys and likewise traded down in costs to cheaper toys. As such, I’m forecasting GameStop’s collectibles income to say no 8% YoY given its 28% market share within the US collectibles toys market. Such a decline implies that my projection for GameStop’s collectibles income for the complete yr 2023 is $808.5 million leading to This fall income of $288.1 million.

Primarily based on my projections for GameStop’s online game and collectibles segments, I count on the corporate to report This fall revenues of just about $2.3 billion and full yr income of $5.7 billion. These figures are larger than analysts’ estimates of $2.05 billion and $5.53 billion, respectively.

|

Income Section |

This fall |

Full 12 months |

|

Video Video games |

$2,004,662,805 |

$4,963,462,805 |

|

Collectibles |

$288,144,000 |

$808,544,000 |

|

Whole Income |

$2,292,806,805 |

$5,772,006,805 |

EPS Projection

Shifting on to the remainder of GameStop’s earnings assertion, the corporate’s gross margin averaged 25.1% within the first 3 quarters of 2023 which is my projection for This fall’s gross margin. This may be consistent with GameStop’s historic efficiency as This fall’s gross margin is lower than Q3, leading to a gross revenue of 25.18% for the complete yr. Subsequently, I’m projecting the corporate’s price of income for This fall and the complete yr to be $1.7 billion and $4.3 billion, respectively, resulting in gross earnings of $362.8 million and $1.3 billion, respectively.

|

Quarter |

Income |

CoR |

Gross Revenue |

Gross Margin |

|

Q1 21 |

$1,276,800,000 |

$946,700,000 |

$330,100,000 |

25.85% |

|

Q2 21 |

$1,183,400,000 |

$862,500,000 |

$320,900,000 |

27.12% |

|

Q3 21 |

$1,296,600,000 |

$978,000,000 |

$318,600,000 |

24.57% |

|

This fall 21 |

$2,253,900,000 |

$1,875,700,000 |

$378,200,000 |

16.78% |

|

FY 21 |

$6,010,700,000 |

$4,662,900,000 |

$1,347,800,000 |

22.42% |

|

Q1 22 |

$1,378,400,000 |

$1,079,900,000 |

$298,500,000 |

21.66% |

|

Q2 22 |

$1,136,000,000 |

$853,800,000 |

$282,200,000 |

24.84% |

|

Q3 22 |

$1,186,400,000 |

$894,800,000 |

$291,600,000 |

24.58% |

|

This fall 22 |

$2,226,400,000 |

$1,726,600,000 |

$499,800,000 |

22.45% |

|

FY 22 |

$5,927,200,000 |

$4,555,100,000 |

$1,372,100,000 |

23.15% |

|

Q1 23 |

$1,237,100,000 |

$949,800,000 |

$287,300,000 |

23.22% |

|

Q2 23 |

$1,163,800,000 |

$857,900,000 |

$305,900,000 |

26.28% |

|

Q3 23 |

$1,078,300,000 |

$796,500,000 |

$281,800,000 |

26.13% |

|

This fall 23 |

$2,292,806,805 |

$1,714,698,633 |

$578,108,172 |

25.21% |

|

FY 23 |

$5,772,006,805 |

$4,318,898,633 |

$1,453,108,172 |

25.18% |

By way of working prices, the corporate solely acknowledges promoting, basic, and administrative prices in addition to asset impairments. For the reason that firm hasn’t acknowledged any impairment fees since This fall 2022, I’m not projecting any impairment fees in 2023.

As for promoting, basic, and administrative prices, GameStop has managed this price to signify 27% of revenues within the first 3 quarters of 2023. In the meantime, this price has traditionally elevated by 22.37% QoQ in This fall because of the seasonality of GameStop’s enterprise. Primarily based on this, I’m projecting promoting, basic, and administrative prices to be $362.8 million in This fall, main the complete yr determine to be $1.3 billion.

|

Quarter |

SG&A |

QoQ Change |

|

Q1 21 |

$370,300,000 |

|

|

Q2 21 |

$378,900,000 |

2.32% |

|

Q3 21 |

$421,500,000 |

11.24% |

|

This fall 21 |

$538,900,000 |

27.85% |

|

FY 21 |

$1,709,600,000 |

– |

|

Q1 22 |

$452,200,000 |

-16.09% |

|

Q2 22 |

$387,500,000 |

-14.31% |

|

Q3 22 |

$387,900,000 |

0.10% |

|

This fall 22 |

$453,400,000 |

16.89% |

|

FY 22 |

$1,681,000,000 |

– |

|

Q1 23 |

$345,700,000 |

-23.75% |

|

Q2 23 |

$322,500,000 |

-6.71% |

|

Q3 23 |

$296,500,000 |

-8.06% |

|

This fall 23 |

$362,825,125 |

22.37% |

|

FY 23 |

$1,327,525,125 |

– |

Primarily based on my projections, I count on GameStop to publish an working earnings of $215.2 million in This fall and $125.5 million for the complete yr, resulting in working margins of 9.4% and a couple of.2%, respectively.

|

Quarter |

Gross Revenue |

% of Income |

Impairment |

Working Revenue/Loss |

Working Margin |

|

Q1 21 |

$330,100,000 |

29.00% |

$600,000 |

-$40,800,000 |

-3.20% |

|

Q2 21 |

$320,900,000 |

32.02% |

$0 |

-$58,000,000 |

-4.90% |

|

Q3 21 |

$318,600,000 |

32.51% |

$0 |

-$102,900,000 |

-7.94% |

|

This fall 21 |

$378,200,000 |

23.91% |

$6,100,000 |

-$166,800,000 |

-7.40% |

|

FY 21 |

$1,347,800,000 |

28.44% |

$6,700,000 |

-$368,500,000 |

-6.13% |

|

Q1 22 |

$298,500,000 |

32.81% |

$0 |

-$153,700,000 |

-11.15% |

|

Q2 22 |

$282,200,000 |

34.11% |

$2,500,000 |

-$107,800,000 |

-9.49% |

|

Q3 22 |

$291,600,000 |

32.70% |

$0 |

-$96,300,000 |

-8.12% |

|

This fall 22 |

$499,800,000 |

20.36% |

$200,000 |

$46,200,000 |

2.08% |

|

FY 22 |

$1,372,100,000 |

28.36% |

$2,700,000 |

-$311,600,000 |

-5.26% |

|

Q1 23 |

$287,300,000 |

27.94% |

$0 |

-$58,400,000 |

-4.72% |

|

Q2 23 |

$305,900,000 |

27.71% |

$0 |

-$16,600,000 |

-1.43% |

|

Q3 23 |

$281,800,000 |

27.50% |

$0 |

-$14,700,000 |

-1.36% |

|

This fall 23 |

$578,108,172 |

15.82% |

$0 |

$215,283,047 |

9.39% |

|

FY 23 |

$1,453,108,172 |

23.00% |

$0 |

$125,583,047 |

2.18% |

This leaves curiosity earnings, different losses, and tax advantages to forecast in GameStop’s earnings assertion. For these things, I’ll be utilizing the identical figures as Q3 2023. Nonetheless, these things might range from my projections relying on how GameStop managed its money holdings in This fall 2023.

Accordingly, I’m projecting GameStop to report a This fall web earnings of $226.8 million and a full yr web earnings of $170.4 million, resulting in EPS of $0.74 and $0.56, respectively. These projections are larger than analysts’ estimates of a This fall EPS of $0.25 and a full yr EPS of $0.13.

|

This fall 2023 |

FY 2023 |

|

|

Income |

$2,292,806,805 |

$5,772,006,805 |

|

CoR |

$1,714,698,633 |

$4,318,898,633 |

|

Gross Revenue |

$578,108,172 |

$1,453,108,172 |

|

SG&A |

$362,825,125 |

$1,327,525,125 |

|

Working Revenue |

$215,283,047 |

$125,583,047 |

|

Curiosity Revenue |

$12,900,000 |

$47,100,000 |

|

Different Loss |

$2,500,000 |

$4,900,000 |

|

Revenue Earlier than Tax |

$225,683,047 |

$167,783,047 |

|

Tax Profit |

$1,200,000 |

$2,700,000 |

|

Internet Revenue |

$226,883,047 |

$170,483,047 |

|

OS |

305,514,315 |

305,514,315 |

|

EPS |

$0.74 |

$0.56 |

Valuation

Primarily based on my projections, GameStop can be buying and selling at an EV/Gross sales a number of of 0.62 in comparison with an business common of 1.29. That stated, I consider the corporate ought to nonetheless commerce at a reduction relative to its friends attributable to its declining gross sales which is why I’ve a goal EV/Gross sales a number of of 1. Subsequently, my value goal for GameStop is $21.18 per share, implying 62% upside from its present share value of $13.10.

|

Projected Gross sales |

$5,772,006,805 |

|

EV |

$3,570,000,000 |

|

EV/Gross sales |

0.62 |

|

Business Common |

1.29 |

|

Goal A number of |

1 |

|

Worth Goal |

$21.18 |

|

Upside |

62% |

Dangers

Because the core of my bullish thesis on GameStop is its potential to beat analyst estimates when it broadcasts its full yr monetary outcomes, dangers to my thesis embody an anticipated slowdown in online game spending this yr attributable to a weaker launch slate in comparison with 2023. As is, Circana’s Mat Piscatella is forecasting online game spending in 2024 to decline between 2% to 10% YoY. Nonetheless, Piscatella expects spending to rebound in 2025 because of the a lot anticipated launch of GTA VI.

One other threat dealing with GameStop is the brand new investment policy that enables CEO Ryan Cohen and the administration staff to spend money on the identical securities as the corporate, as a substitute of the earlier coverage of investing in funding grade short-term earnings securities. In consequence, GameStop’s money stability of $909 million might dwindle quickly if its investments flip bitter.

Conclusion

With the inventory buying and selling close to multi-year lows, I consider GameStop may very well be a possibility at present ranges forward of its upcoming earnings report on March 26. As is, I count on the corporate to beat analyst estimates for income and EPS in gentle of robust online game gross sales within the vacation season along with its prudent price administration. Contemplating the steep decline GameStop is buying and selling at relative to its friends, I’m score it as a purchase with a value goal of $21.18 per share, implying 62% upside from its present valuation.