marekuliasz/iStock Editorial via Getty Images

I have always thought of Garmin as a company offering niche smartwatches for a variety of different consumers. As an outdoor enthusiast, I’ve often researched top running and hiking smartwatches. Garmin’s products are typically always rated very well if not the best in their respective category.

However, after researching this company in more depth, Garmin is much more than niche smartwatches as they have a large variety of products in numerous operating segments.

Let’s dive deeper into Garmin and I’ll discuss why I think this company can be a winner for long-term investors.

The Company

Garmin (NYSE:GRMN) was founded in 1989 by Gary Burrell (representing the “Gar” in the Garmin) and Min Kao. The company’s first product was a GPS unit which was sold to the United States Army.

Over the course of operations, Garmin has delivered over 282 million products to consumers, which included more than 16 million products delivered in the latest fiscal year. As of January 5, 2024 Garmin had over 1,900 patents and more than 1,600 trademarks.

Garmin has created numerous products for their five different reporting segments, fitness, outdoor, aviation, marine, and auto OEM.

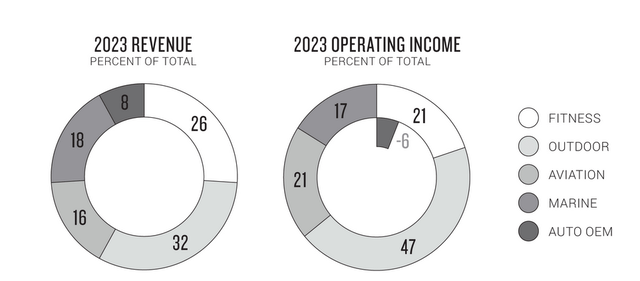

As you can see from the below graphic, Garmin has diverse sources of revenue and operating income with, the outdoor segment generating the most revenue and operating income in 2023:

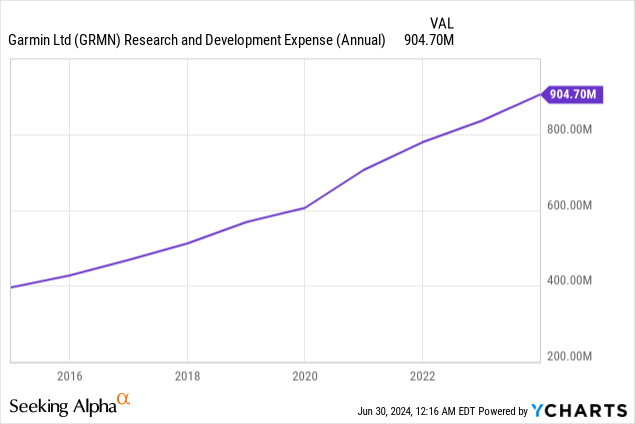

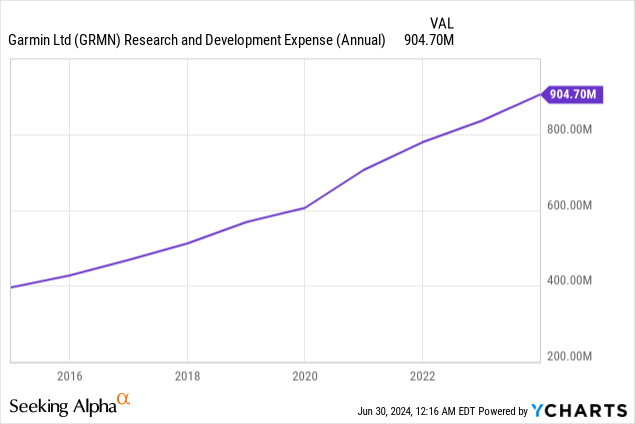

I think one of key factors that has led to Garmin’s success is the focus on innovation through continued R&D spend. On Garmin’s recent 10-K filing the company even stated, “Garmin’s product innovations are driven by its strong emphasis on research and development and the close partnership between Garmin’s engineering and manufacturing teams.”

Garmin proudly informs investors of R&D spend in company presentations and as you can see in the graphic below the company hasn’t moved away from reducing R&D spend as these expenses (like revenue) have continued to climb higher over the years:

Due to Garmin’s focus on innovation, in Garmin’s aviation and marine segments, I think it’s fair to say the company is one of the leaders in both industries as Garmin provides exceptional electronics and equipment that competitors haven’t been able to mirror. In aviation, Garmin has received numerous accolades including being awarded top honors in Aviation International News’ annual Product Support Survey in the Flight Deck avionics category for an incredible twenty consecutive years. In the marine segment, Garmin was recently recognized as the Supplier of the Year by Independent Boat Builders, Inc.

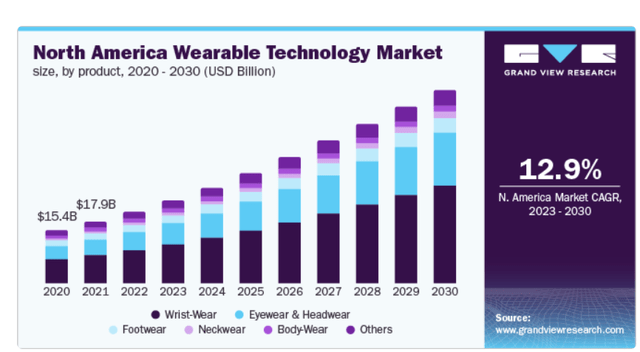

I believe the market is strong for wearables and smartwatches, many of Garmin’s fitness and outdoor products fall into these categories. As reported in a report by Grand View Research, the market for wearables is expected to continue to grow within North America at a CAGR of 12.9%:

Garmin’s market is primarily for “wrist-wear” products which is the most sizeable in the wearable technology market. However, this graphic doesn’t even include international sales which has been growing. America sales still make up the majority of sales and accounted for roughly half of Garmin’s sales for fiscal year 2023, but EMEA sales grew 8% and APAC grew 9% in 2023 compared to 2022.

Management

Clifton Pemble has been the company’s long-term President and CEO. Pemble joined Garmin in 1989 as a software engineer. In 2007, Pemble was appointed President and Chief Operating Officer. Then in 2013, Pemble succeeded the company’s co-founder Min Kao, as CEO.

Douglas Boessen is the company’s longstanding CFO and Treasurer. Boessen has been with Garmin since 2014.

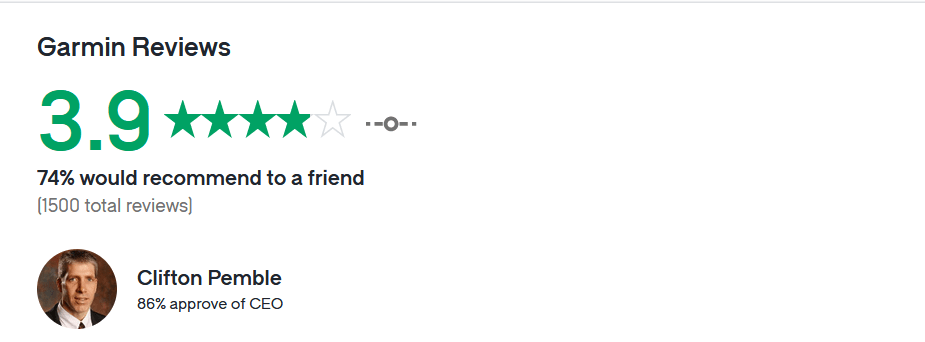

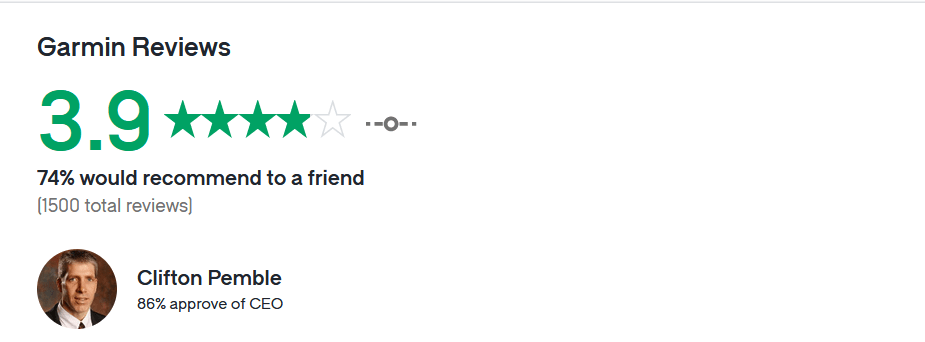

As you can see from these Glassdoor ratings, most employees view Garmin as a good place to work and Garmin’s employees seem to approve of Pemble:

Glassdoor

Furthermore, Garmin was stated as one of the best large firm to work for by Forbes magazine.

As I like to invest in many founder-led companies, I like to see the company’s management team with skin in the game. In reviewing the company’s latest proxy statement, Min Kao and Jonathan Burrell (the son of co-founder Gary Burrell) both hold nearly 10% of the company’s outstanding shares which I certainly like to see.

Financials

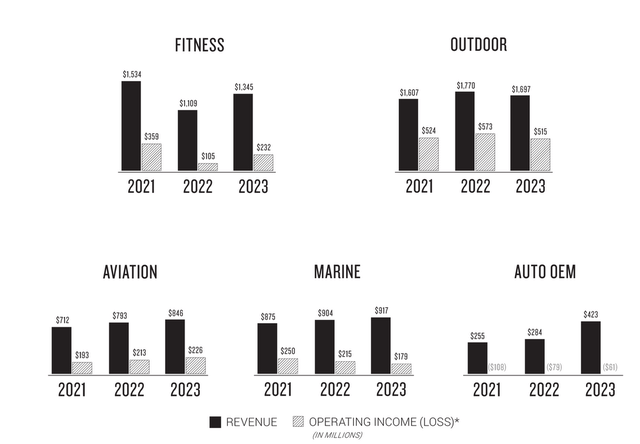

Garmin has done an excellent job of growing revenue over the years as the below graphic illustrates:

The majority of the company’s segments have grown revenue since 2021, and the first quarter of 2024 continued the trend as four segments had double-digit revenue growth.

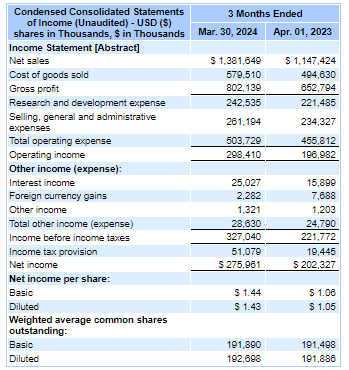

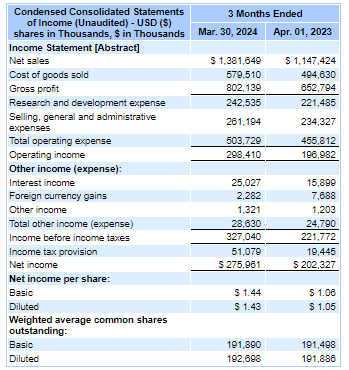

To start, consolidated revenue was roughly $1.38 billion for the quarter which was a 20% increase compared to Q1 2023. However, I think the more impressive feat is margin expansion as you can see below:

SEC.gov

Gross margin for Q1 2024 was roughly 58% and operating margin was roughly 21% which led to operating income increasing by over 50% year-over-year.

The below table from the company’s 10Q illustrates Garmin’s revenue growth with Auto OEM and Fitness leading the way:

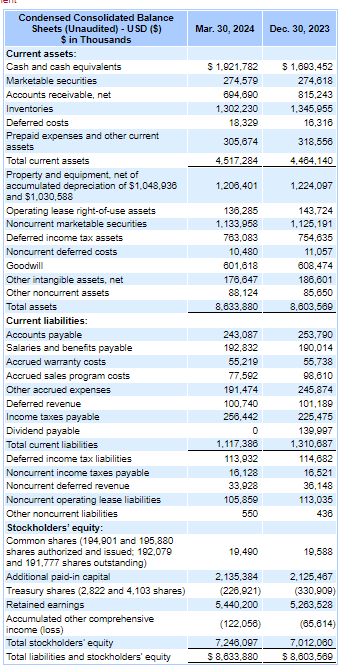

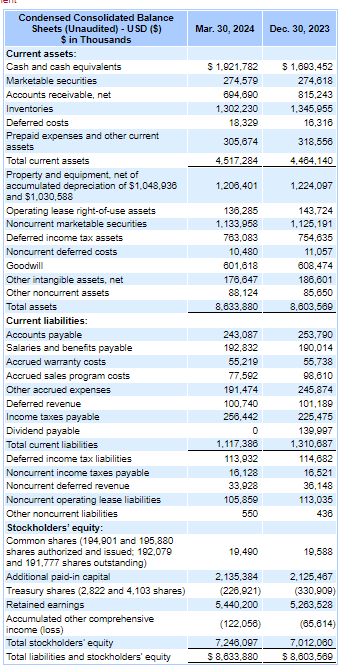

Garmin has a superb balance sheet with roughly $1.9 billion in cash, essentially no debt and more than enough current assets to cover all the company’s liabilities as you can see below:

SEC.gov

Investors may also appreciate Garmin has a dividend although the yield is rather small and the dividend growth has been inconsistent over the last several years.

Risks

In the short-term I view consumer spending as a risk to Garmin. Many consumers are feeling pinched as inflation concerns remain. Garmin does have a wide range of products but many do come at a higher price point.

However, I think Pemble had an insightful response on the Q1 conference call when asked about the macro and consumer spending, “I would say, generally, our customer base are in groups that are probably less affected by the overall sentiment that you hear broadly about. So we certainly have products across all kinds of price ranges, but mostly our products tend to be products with high innovation and high desirability and therefore, their pricing is not necessarily at the bottom of the market.”

Going back to my main point above, given the company’s innovation products and focus on continued R&D spend for long-term investors this risk isn’t too worrisome.

I think the more serious long-term threat to Garmin is that large firms with amble amounts of cash, such as Apple or Google, may decide they want to create more premium wearables to reach specific consumers such as hikers, swimmers, or even golfers.

Valuation

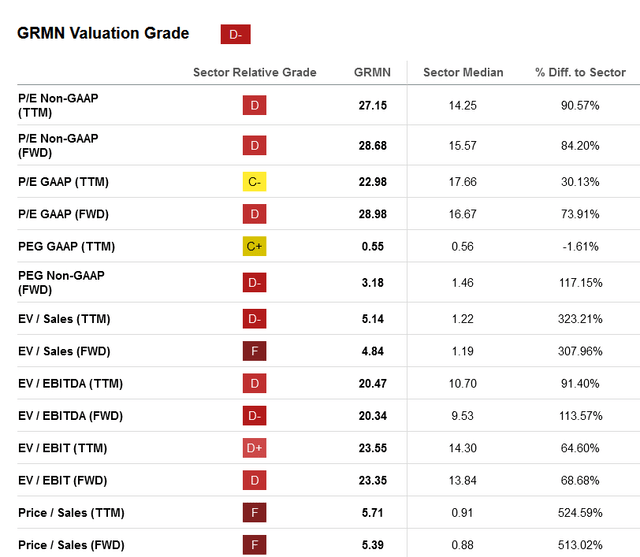

As you can see from the below valuation metrics from Seeking Alpha, the overall value grade for Garmin is a “D-.”

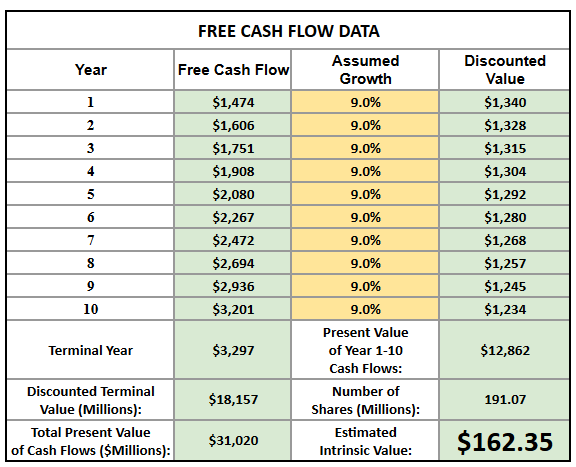

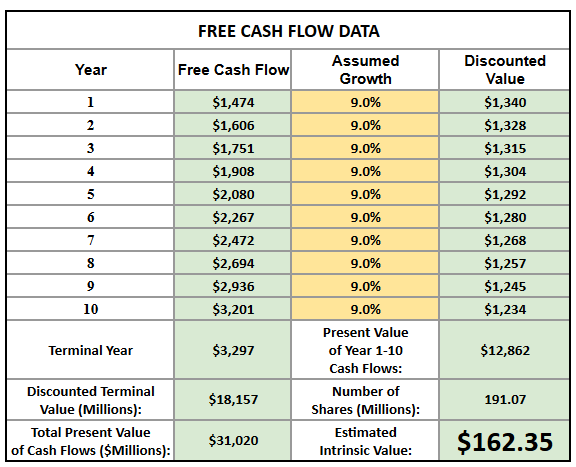

As you can see by most metrics Garmin is a rather expensive company. However, I actually think given the company’s growth prospects, Garmin’s current valuation is reasonable. Using a reverse discounted cash flow model with a discounted rate of 10% and a terminal rate of 3% and assumed growth of 9%, I come to an estimated intrinsic value of roughly $162 a share:

Author Analysis

Many analysts have a similar growth revenue estimate for Garmin over the next five years so I think 9% growth is a fair rate for this company.

Conclusion

Garmin is beating the S&P 500 this year as it’s already up by over 25% YTD. More impressive, Garmin has beat the S&P 500 over the last five years.

The company’s focus on continued to R&D spend has led to top-notch innovation which has kept Garmin as a leader in numerous niche fields such as aviation and marine products.

With a growing wearables market, I believe Garmin can continue to provide specialty smartwatches to certain consumers.

Furthermore, Garmin has a seasoned management team that has done a great job of not only rewarding shareholders but creating a top-notch company culture where employees want to work.

I think Garmin’s success is likely to continue in the years to come and I’m happy to add shares of this successful company to my portfolio.