The Securities and Trade Fee approved 11 functions this week to create spot Bitcoin ETFs, however notable crypto skeptic Gary Gensler, the company’s chairman, is just not essentially thrilled about it.

Regardless of being the deciding vote in a 3-2 consequence to approve the nearly dozen applications, Gensler, in an interview with CNBC on Friday, stated buyers wanted to stay cautious.

He identified that Bitcoin, which buyers can now straight put cash into by the brand new ETFs, is “highly volatile” and that crypto’s OG has been tied to issues like cash laundering and ransomware.

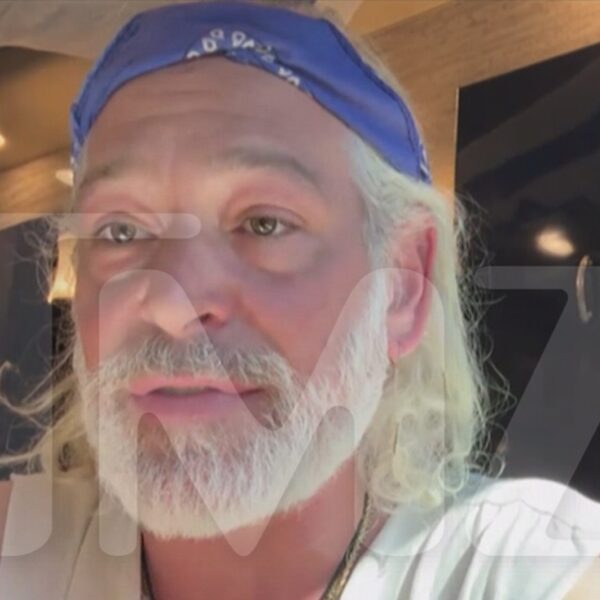

Gensler COPING AND SEETHING

Watch:

(RT to share)

Shout out Joe from CNBC for asking these pic.twitter.com/N3Tn6pTuXo— Cryptik1.eth |🛸 (@Cryptik1E) January 12, 2024

“Bitcoin, itself, we did not approve, we did not endorse,” he stated.

Gensler did admit that Bitcoin is getting used as a store of value however much less in order on a regular basis forex.

“The only payment mechanism it’s being used for in sort of a, in a primary sense, is illicit activity,” he stated within the interview.

The SEC chairman went on to emphasise, as he did in a statement following the approval Wednesday, that letting the Bitcoin ETFs commerce within the public markets was “the most sustainable path forward” within the wake of the Grayscale decision in August.

As a part of the choice, an appeals courtroom decide known as the SEC “arbitrary and capricious” for denying Grayscale the power to transform its Grayscale Bitcoin Trust right into a spot Bitcoin ETF. In October, the company determined not to appeal the ruling, paving the way in which for approval.

Gensler admitted in his preliminary assertion that the courtroom ruling performed a task within the choice, and repeated as a lot within the CNBC interview.

Crypto advocates akin to MicroStrategy founder Michael Saylor joined a handful of TradFi stalwarts like BlackRock’s Larry Fink in cheering the approval of spot Bitcoin ETFs, though others figures have been fiercely crucial.

Vocal crypto skeptic Sen. Elizabeth Warren (D-Mass.) stated in a post on X that the SEC was flat out “wrong.”

The @SECgov is unsuitable on the regulation and unsuitable on the coverage with respect to the Bitcoin ETF choice.

If the SEC goes to let crypto burrow even deeper into our monetary system, then it is extra pressing than ever that crypto observe primary anti-money laundering guidelines.

— Elizabeth Warren (@SenWarren) January 11, 2024

Regardless of the criticism, Gensler informed CNBC that he stood by the choice, though he understood why some individuals opposed it.

“I have deep respect for those who may have been on the other side of this,” he stated. “But, again, I have a deep respect for the law and how courts interpret the law.”