US supplies of gasoline are being shipped out of the country to travel thousands of miles via the Bahamas before finally ending up in California, a state battling shrinking fuelmaking capacity and high pump prices.

Shipments on the circuitous route are increasing. California imported more gasoline in November than ever before, with more than 40% coming from the Bahamas.

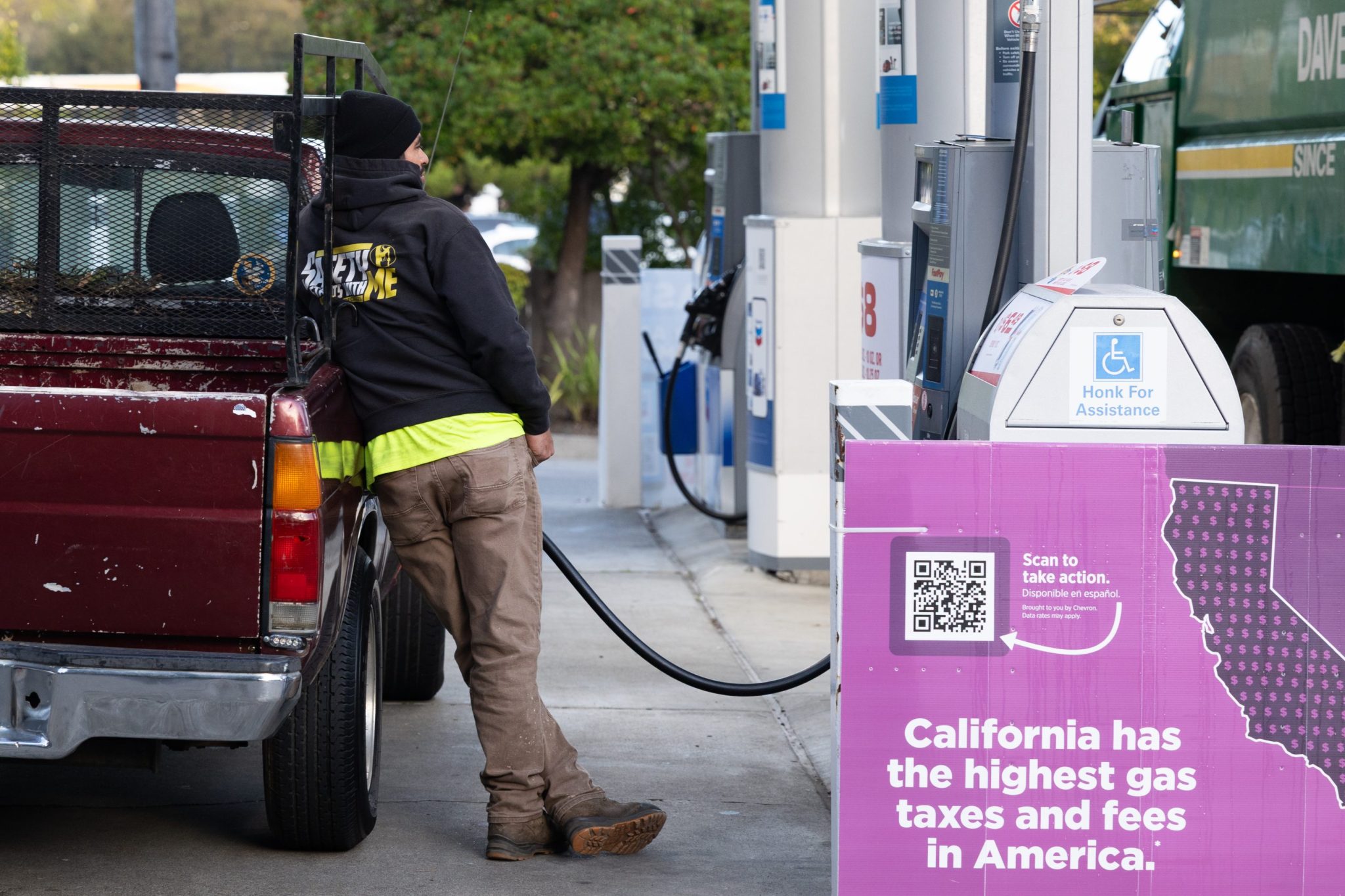

The lengthy journey adds another layer of cost to California’s already expensive gasoline market. Yet the phenomenon isn’t likely to disappear soon, thanks to a combination of disappearing oil refineries, a lack of interstate pipelines and a loophole in a 106-year-old maritime law.

California has among the strictest environmental regulations in the US, making it costly for energy companies to operate in, though a wave of upcoming refinery closures is prompting officials and regulators to soften their stance. On average, the closures could raise the cost of gasoline for consumers by between 5 and 15 cents a gallon, said Patrick De Haan, GasBuddy’s head of petroleum analysis.

Read more: Threat of $8-a-Gallon Gas Forces Newsom to Court Big Oil

After Phillips 66 shuttered its Los Angeles refinery in October, gasoline imports climbed in 2025 to the highest level since at least 2016, Vortexa data show. With Valero Energy Corp. set to close a Northern California refinery this spring, and no fuel pipelines connecting the US Gulf’s oil-producing powerhouse to the West Coast, the nation’s most populous state will likely depend on imports to bridge the gap.

Under the Jones Act, any goods shipped between US ports must travel on US-built, owned and operated vessels. Those tankers are in short supply and expensive to charter. There are about 55 Jones Act-compliant oil tankers worldwide, compared with more than 7,000 oil tankers globally.

“Even if there are such vessels, they would charge more than a foreign-flagged vessel would,” said Martin Davies, director of Tulane University’s Maritime Law Center.

When California’s specialized gasoline trades at a premium, particularly during refinery outages, Gulf Coast refiners can capture higher margins by sending barrels west, De Haan said. Routing through the Bahamas allows them to avoid higher-cost US-flagged shipping and preserve that spread.

In those moments, “there’s going to be plenty of incentive for PADD 3 (Gulf Coast) and Asian refiners to supply Californians,” De Haan said.

The trade has accelerated. Last year, California sourced more barrels of gasoline from the Bahamas than it had in the prior nine years combined – accounting for roughly 12% of gasoline arriving in California by ship all year, including direct deliveries from elsewhere in the US, according to Vortexa.

Imports of gasoline were down from their fall peak in January, according to Vortexa. Japan and India both made up a greater proportion of foreign supply — though the Bahamas was the third-leading non-US supplier.

Asia is a more practical source of gasoline for California, De Haan said, noting that refineries in the region already produce gasoline blendstock at the grade specifically required by California, and it can arrive without paying to transit the Panama Canal. Both India and South Korea supplied more product to California last year than the Bahamas.

The economic appeal of shipping US-refined gasoline on cheaper foreign vessels has been waning in recent months, after the US eased sanctions on Venezuela, a move that triggered an increase in regional freight prices. Foreign ships, which were nearly $4 a barrel cheaper than US-flagged ones in the past year, are now barely $1 cheaper, data from Argus Media show. If freight costs continue to rise, shipments of US gasoline could become too expensive to compete with supplies from South Korea or India.

Still, the Bahamian trade route, which began picking up steam in the early months of 2025, has become a key piece of California’s troubled supply chain. Already this year, two tankers carrying gasoline have arrived in California from the Bahamas, according to customs data.

One of the most recent voyages was made by the Singapore-flagged Silver Moon, which delivered nearly 300,000 barrels of gasoline blendstock to the Los Angeles area in early January after loading in Freeport in mid-December. The vessel transited the Panama Canal and was consigned to Houston-based refiner Phillips 66. The company recently leased storage tanks in the Bahamas, according to people with knowledge of the situation.

Phillips 66 declined to comment.

Earlier this month, the Torm Dulce made the same voyage and delivered gasoline blendstock to San Francisco. The path mirrors a longer-standing workaround to bring fuel to the East Coast when it’s shipped outside pipeline systems, said Matt Smith, lead oil analyst at Kpler.

“This is a trend we have seen become ingrained on the US East Coast: barrels are shipped from the US Gulf Coast via the Bahamas as a way of avoiding using Jones Act vessels,” Smith said. “It makes sense that this is increasingly happening to the US West Coast given refinery retirements and outages — and is a trend we expect to persist.” Imports of gasoline were down from their fall peak in January, according to Vortexa. Japan and India both made up a greater proportion of foreign supply — though the Bahamas was the third-leading non-US supplier.