RapidEye/iStock by way of Getty Photos

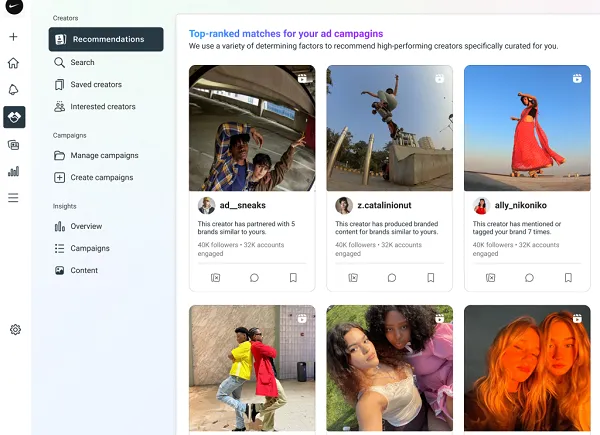

Gauzy Is Rising However Producing Excessive Working Losses

Gauzy Ltd. (GAUZ) has filed to lift $75 million in an IPO of its abnormal shares, in response to an SEC F-1 registration statement.

Gauzy supplies gentle and imaginative and prescient management applied sciences for varied end-user industries and environments.

Whereas top-line income development has been spectacular, the corporate continues to generate excessive working losses.

Additionally, it has important operations positioned in Israel, which can be topic to unpredictable disruption as a result of political, financial, or navy actions within the nation and area.

What Does Gauzy Do?

Tel Aviv, Israel-based Gauzy Ltd. was based to develop proprietary applied sciences within the areas of suspended particle units and liquid crystal movies for aerospace, automotive, and architectural working environments.

Administration is headed by co-founder, Chairman, and CEO Mr. Eyal Peso, who has been with the agency since its inception in 2009 and was beforehand a enterprise supervisor at Alvarion Applied sciences Ltd.

The corporate’s main choices embrace the next:

-

Good glass

-

Good movies

-

Driving video imaging and alerting applied sciences

As of December 31, 2023, Gauzy has booked a good market worth funding of $106 million from traders, together with Ibex Companions, Olive Tree, Infinity Holding Ventures, Avery Dennison Israel, South Lake One, and Blue-Crimson Capital.

The agency seeks clients from amongst unique tools producers or subcontractors within the aerospace, automotive, and architectural industries.

Gauzy is a Tier 1 provider of methods for industrial airliners, enterprise jets, and helicopters. It’s a Tier 2 provider of sunshine management applied sciences in automotive and architectural markets.

Gross sales and Advertising bills as a share of complete income have fallen as revenues have elevated, because the figures under point out:

|

Gross sales and Advertising |

Bills vs. Income |

|

Interval |

Share |

|

Yr Ended Dec. 31, 2023 |

19.6% |

|

Yr Ended Dec. 31, 2022 |

21.8% |

(Supply – SEC)

The Gross sales and Advertising effectivity a number of, outlined as what number of {dollars} of extra new income are generated by every greenback of Gross sales and Advertising expense, was 1.9x in the newest reporting interval. (Supply – SEC)

What Is Gauzy’s Market?

In accordance with a 2022 market research report by Verified Market Analysis, the worldwide marketplace for industrial imaginative and prescient methods was an estimated $11.2 billion in 2021 and is forecasted to achieve $22 billion by 2030.

This represents a forecast CAGR of 8.53% from 2022 to 2030.

The first causes for this anticipated development are an rising want for automated high quality assurance and guided robotic methods requiring larger imaginative and prescient acquisition and processing capabilities.

Additionally, the corporate operates in a lot of adjoining and associated markets.

Main aggressive or different business individuals embrace the next:

-

View Inc.

-

Sage (Saint-Gobain Glass)

-

Merck

-

Gentex

-

Orlaco

-

Mekra

-

Others

Gauzy Ltd. Latest Monetary Outcomes

The corporate’s latest monetary outcomes will be summarized as follows:

-

Rising top-line income

-

Rising gross revenue and gross margin

-

Excessive working losses

-

Rising money utilized in operations

Under are related monetary outcomes derived from the agency’s registration assertion:

|

Whole Income |

||

|

Interval |

Whole Income |

% Variance vs. Prior |

|

Yr Ended Dec. 31, 2023 |

$77,980,000 |

59.0% |

|

Yr Ended Dec. 31, 2022 |

$49,033,000 |

|

|

Gross Revenue (Loss) |

||

|

Interval |

Gross Revenue (Loss) |

% Variance vs. Prior |

|

Yr Ended Dec. 31, 2023 |

$19,941,000 |

105.9% |

|

Yr Ended Dec. 31, 2022 |

$9,687,000 |

|

|

Gross Margin |

||

|

Interval |

Gross Margin |

% Variance vs. Prior |

|

Yr Ended Dec. 31, 2023 |

25.57% |

29.4% |

|

Yr Ended Dec. 31, 2022 |

19.76% |

|

|

Working Revenue (Loss) |

||

|

Interval |

Working Revenue (Loss) |

Working Margin |

|

Yr Ended Dec. 31, 2023 |

$(31,994,000) |

-41.0% |

|

Yr Ended Dec. 31, 2022 |

$(32,383,000) |

-66.0% |

|

Complete Earnings (Loss) |

||

|

Interval |

Complete Earnings (Loss) |

Web Margin |

|

Yr Ended Dec. 31, 2023 |

$(78,040,000) |

-100.1% |

|

Yr Ended Dec. 31, 2022 |

$(39,645,000) |

-80.9% |

|

Money Move From Operations |

||

|

Interval |

Money Move From Operations |

|

|

Yr Ended Dec. 31, 2023 |

$(31,115,000) |

|

|

Yr Ended Dec. 31, 2022 |

$(29,755,000) |

|

(Supply – SEC)

As of December 31, 2023, Gauzy had $4.6 million in money and $194 million in complete liabilities.

Free money stream throughout the twelve months ended December 31, 2023, was unfavourable ($37 million).

Gauzy Ltd.’s IPO Particulars

Gauzy intends to lift $75 million in gross proceeds from an IPO of its abnormal shares, though the ultimate quantity could fluctuate.

As of the agency’s most up-to-date submitting, no shareholders have agreed to or indicated an curiosity in buying extra IPO shares.

The agency can be a ‘international personal issuer’ and an ‘rising development firm’. Which means administration would have the ability to disclose considerably much less info to shareholders.

Recently, many such firm shares have carried out poorly post-IPO.

Assuming a profitable IPO, the corporate’s market capitalization at IPO would possible approximate $210 million ($78 million TTM income x 2.7 a number of).

The management mentioned it is going to use the web proceeds from the IPO as follows:

We intend to make use of considerably all the web proceeds from this providing for normal company functions, together with the acquisition of kit and supplies for the growth of our manufacturing strains, analysis and improvement, promoting and advertising and marketing, expertise improvement, working capital, working bills and different normal company functions.

We additionally intend to make use of a portion of the web proceeds to pay to the credit score funds below a facility settlement we entered into on January 19, 2022 with sure credit score funds for a mortgage facility, or the Facility Settlement, quantities as a result of them below their “phantom warrant,” which entitles them to a money fee within the occasion that we conduct an IPO of our shares, amongst different occasions, which fee obligation can be triggered by this providing except such credit score funds elect to obtain such fee obligation below the “phantom warrant” in our shares in lieu of money…

We additionally intend to make use of a portion of the web proceeds to repay the remaining balances of First Earn Out Cost and the Second Earn Out Cost below the Earnout Settlement, as amended, pursuant to the Imaginative and prescient Lite SPA.

(Supply – SEC)

Management’s presentation of the corporate roadshow will not be presently obtainable for on-line viewing.

Relating to excellent authorized proceedings, the agency is topic to authorized motion for potential patent infringement associated to sure licensed applied sciences. The plaintiff has been sanctioned for submitting a frivolous lawsuit, and Gauzy is awaiting a ruling on its movement to obtain lawyer’s charges.

The listed ebook runners of the IPO are Barclays, TD Cowen, and Stifel.

Gauzy Is Rising Shortly However Producing Heavy Working Losses

GAUZ is searching for U.S. public capital market funding to pay down debt, pay earnout settlement quantities due and for normal functions.

The corporate’s financials have proven rising top-line income, rising gross revenue and gross margin, however very excessive working losses and rising money utilized in operations.

Free money stream for the twelve months ended December 31, 2023, was unfavourable ($37 million).

Gross sales and Advertising bills as a share of complete income have fallen as income has elevated; its Gross sales and Advertising effectivity a number of was 1.6x in the newest calendar 12 months.

The agency presently plans to pay no dividends and to maintain any future earnings for reinvesting into the corporate’s development plans and dealing capital necessities. Gauzy is proscribed by the Corporations Legislation in Israel as to its capacity to declare and pay dividends.

GAUZ’s latest capital spending historical past signifies it has continued to spend materially on capital expenditures regardless of unfavourable working money stream.

The market alternative for offering gentle and imaginative and prescient management methods like Gauzy Ltd. is giant and more likely to develop at a big price of development within the coming years as transportation system suppliers and public area demand improved applied sciences.

Dangers to the corporate’s outlook as a public firm embrace its lack of working revenue historical past and the probability it might want to increase extra capital in as little as 12 months after the IPO, probably diluting fairness shareholders or rising its debt load.

Additionally, the agency faces the prospect of excessive restore and alternative prices for its merchandise if its clients situation a recall, which is out of the corporate’s management.

Gauzy additionally has important operations positioned within the nation of Israel, which can engender dangers of disruption as a result of adjustments in political, financial, and navy situations in and round Israel.

Once we be taught extra IPO particulars from administration, I am going to present a ultimate opinion.

Anticipated IPO Pricing Date: To be introduced.