GBP/USD daily chart

With the dollar having rebounded in early October, it is now the pound side of the equation coming into focus for GBP/USD. The pair had retreated back down below 1.3100 since last week but hasn’t really found extra incentive to drive towards a test of 1.3000, at least until today. So, what’s next?

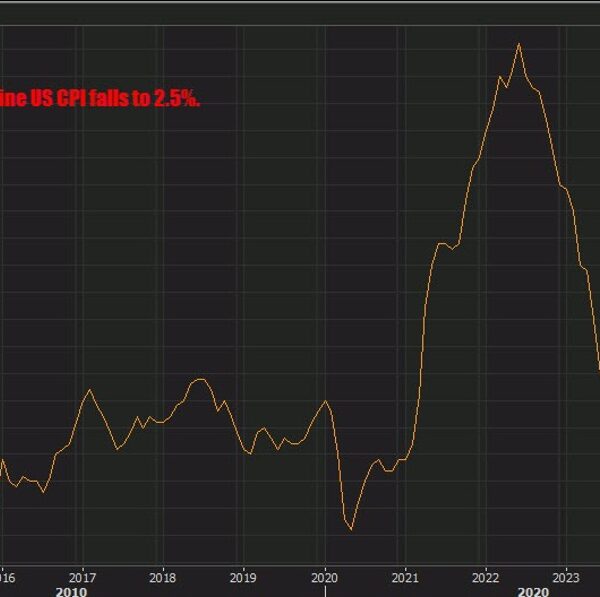

The softer UK inflation data earlier pretty much sets up expectation for the BOE to cut rates in November. Traders had already priced in ~80% odds going into the data and will feel more emboldened to step that up now.

But considering how much is already priced in, perhaps there might not be too much of an extension in that pricing. That being said, the better development also might change up the outlook in the bigger picture.

As things stand, traders are pricing in ~105 bps of rate cuts by June next year. That’s a little over four 25 bps rate cuts in the next six policy meetings. So, there is room to extend that. But is it too soon to get carried away just on one report?

The details were definitely encouraging especially with services inflation cooling. But it is still seen closer to 5% than it is to 2%, so there is still some way to go.

Going back to cable, the pressure point now is on the 1.3000 level. For buyers, that’s the first key line in the sand to defend. A break of that will give sellers more drive to work towards the 100-day moving average (red line) next at 1.2951.

And considering the pressure points i.e. dollar recovery and softer UK inflation on the week, there is a strong bias for sellers to go in search of a move lower in cable on a break of the figure level.