USD

- The Fed left interest rates unchanged as

anticipated on the final assembly whereas dropping the tightening bias within the

assertion however including a slight pushback towards a March price minimize. - The US CPI beat

expectations for the second consecutive month with the disinflationary development

reversing. - The US PPI beat

expectations throughout the board by an enormous margin. - The US Jobless Claims beat

expectations with the info remaining regular. - The newest US PMIs

elevated farther from the prior month with the Manufacturing PMI beating

expectations and the Providers PMI lacking. - The US Retail Sales missed

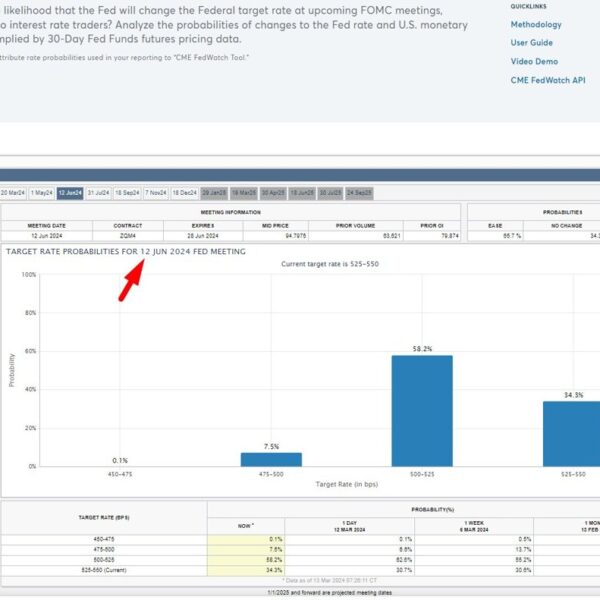

expectations throughout the board by an enormous margin. - The market now expects the primary price minimize in June.

GBP

- The BoE left interest rates unchanged as anticipated on the final assembly

eradicating the tightening bias however reaffirming that they may hold charges excessive for

sufficiently lengthy to return to the two% goal. - The employment report beat expectations throughout the board

with a constructive revision to the December’s unfavourable payroll determine. - The UK CPI missed expectations throughout the board however with

Providers inflation remaining sticky, which continues to assist the BoE’s

affected person stance. - The newest UK PMIs improved from the prior month with the

Providers PMI beating expectations and the Manufacturing PMI lacking. - The newest UK Retail Sales beat expectations throughout the board

by an enormous margin. - The market expects the primary price

minimize in June.

GBPUSD Technical Evaluation –

Day by day Timeframe

GBPUSD Day by day

On the every day chart, we will see that GBPUSD continues

to commerce contained in the vary with a uneven value motion. This is without doubt one of the worst

market environments as merchants can get whipsawed on both course. There’s

not a lot to glean from this chart, so we have to zoom in to see some extra

particulars.

GBPUSD Technical Evaluation –

4 hour Timeframe

GBPUSD 4 hour

On the 4 hour chart, we will see that we’ve a

robust resistance on the

1.2685 stage which is the excessive of the recent US CPI launch. We will additionally see that

we’ve an upward trendline defining

the present uptrend the place the consumers have been leaning onto to place for

increased highs. That is precisely the place we will count on them to step in once more as they

may also discover the pink 21 moving average for confluence. The

sellers, then again, will need to see the worth breaking decrease to

invalidate the bullish setup and place for a drop into the 1.25 assist.

GBPUSD Technical Evaluation –

1 hour Timeframe

GBPUSD 1 hour

On the 1 hour chart, we will see extra

intently the current value motion with the a number of failed breakouts of the

1.2685 resistance. What occurs right here will probably determine the place the pair will go

within the subsequent few days as a profitable break to the upside ought to result in a rally

into the 1.28 deal with, whereas a break to the draw back will probably set off a

selloff into the 1.25 stage.

Upcoming Occasions

This week we’ve some essential financial information on the

agenda. We start as we speak with the discharge of the US Shopper Confidence report.

On Thursday, we are going to see the US PCE and the newest US Jobless Claims figures.

Lastly, on Friday, we conclude the week with the US ISM Manufacturing PMI.