USD

- The Fed left interest rates unchanged as anticipated on the final assembly with a shift in

the assertion that indicated the tip of the tightening cycle. - The Abstract of Financial Projections confirmed a

downward revision to Progress and Core PCE in 2024 whereas the Unemployment Price

was left unchanged. Furthermore, the Dot Plot was revised to indicate three price cuts

in 2024 in comparison with simply two within the final projection. - Fed Chair Powell did not push again towards the sturdy dovish pricing

and even mentioned that they’re targeted on not making the error of holding charges

excessive for too lengthy, which suggests a price lower coming quickly. - The US CPI final week got here in keeping with expectations

with the disinflationary progress persevering with regular. This was additionally confirmed by

the US PPI the day after the place the information missed

estimates. - The labour market has been displaying indicators of

weakening these days however we obtained some sturdy releases lately with the US Jobless Claims and the NFP coming

in strongly. - The US Retail Sales final week beat expectations throughout the board as

client spending continues to carry. - The US Consumer Confidence report yesterday beat expectations throughout the

board. - The most recent ISM Manufacturing PMI missed expectations falling additional into

contraction, whereas the ISM Services PMI beat forecasts holding on in enlargement. - The market expects the Fed to begin reducing charges

in Q1 2024.

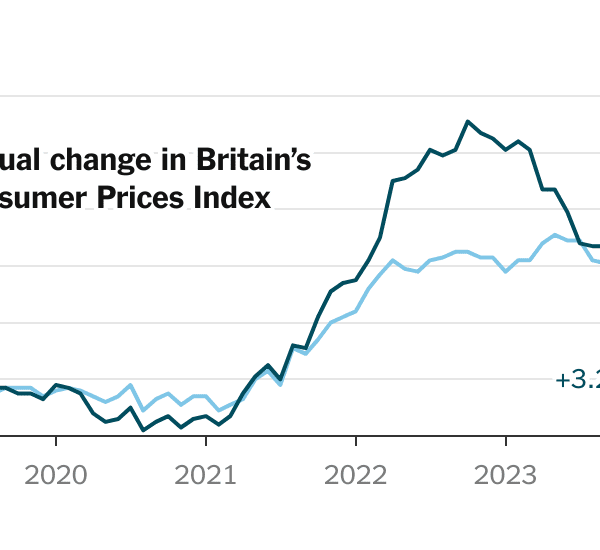

GBP

- The BoE left interest rates unchanged as anticipated on the final assembly

with no dovish language as they reaffirmed that they may hold charges excessive for

sufficiently lengthy to return to the two% goal. - Governor Bailey pushed again towards price cuts

expectations as he mentioned that they can’t say if rates of interest have

peaked. - The most recent employment report missed forecasts with wage development

coming in a lot decrease than anticipated and job losses in November. - The UK CPI right this moment missed expectations throughout the board,

which is one other welcome improvement for the BoE. - The UK PMIs confirmed the Manufacturing sector falling

additional into contraction whereas the Providers sector continues to broaden. - The most recent UK Retail Sales missed expectations throughout the

board by an enormous margin as client spending stays weak. - The market expects the BoE to begin

reducing charges in Q2 2024

GBPUSD Technical Evaluation –

Each day Timeframe

GBPUSD Each day

On the each day chart, we will see that GBPUSD lately

probed above the 1.2743 resistance however obtained

smacked again down quickly after. The divergence with the

MACD was additionally

a warning signal of a potential pullback because it typically alerts pullbacks or

reversals. On this case, the value is pulling again to the important thing trendline the place we

can discover the confluence with the

1.2593 help and the 50% Fibonacci retracement degree of

your complete fall since July.

GBPUSD Technical Evaluation –

4 hour Timeframe

GBPUSD 4 hour

On the 4 hour chart, we will see extra intently the

bullish setup across the help zone. That is the place the patrons are more likely to

step in with an outlined threat under the trendline to place for a rally into

new highs. The sellers, however, will wish to see the value breaking

under the trendline to invalidate the bullish setup and place for a drop

into the 1.2374 degree.

GBPUSD Technical Evaluation –

1 hour Timeframe

GBPUSD 1 hour

On the 1 hour chart, we will see extra

intently the present value motion with the pair buying and selling into the help zone.

If the value breaks above the minor downward trendline, the patrons ought to

improve their bullish bets into new highs. The sellers, however,

may wish to lean on the minor trendline to place for a draw back breakout

with a greater threat to reward setup.

Upcoming Occasions

Today we get the newest US Jobless Claims figures,

whereas tomorrow we conclude the week with the UK Retail Gross sales and the US PCE information.