Home costs in Germany dropped by a file 10.2pc within the third quarter in an extra signal of the struggles confronted by Europe’s largest economic system for the reason that pandemic.

It was the fourth consecutive quarter of declines in comparison with the identical time a 12 months earlier, and the most important since Germany’s statistics workplace started preserving data within the 12 months 2000.

The drop comes amid the most important property disaster in a long time in Europe’s largest economic system.

Konstantin Kholodilin of the German Institute for Financial Analysis stated: “Till 2022, there was a speculative value bubble in Germany, one of many largest within the final 50 years.

“Prices have been falling ever since. The bubble has burst.”

For years, the property sector in Germany and elsewhere in Europe boomed as rates of interest had been low and demand robust.

However a pointy rise in charges and prices has put an finish to the run, tipping builders into insolvency as financial institution financing dries up and offers freeze.

It comes as official knowledge confirmed Germany is the worst performing G7 economic system for the reason that pandemic, rising by simply 0.3pc.

Britain slipped again behind France to be the subsequent worst performer after downward revisions to development left the UK on the brink of recession.

Learn the most recent updates under.

06:01 PM GMT

Pleased Christmas – and see you subsequent 12 months

Thanks for becoming a member of Chris, me and our workforce of contributing reporters this 12 months on the Markets reside weblog.

Christmas cake beckons, so we’ll be again within the New 12 months running a blog breaking enterprise information. We actually admire your views within the vibrant remark part and sit up for writing for you in 2024.

Within the meantime, I’ll depart you with among the newest headlines from The Telegraph’s wider Enterprise part:

05:33 PM GMT

Tesla doubles down on battery manufacturing in China

Elon Musk’s Tesla has signed a deal at the moment to accumulate land for a brand new manufacturing facility in Shanghai, after the world’s second-largest economic system struggles skilled a 10pc drop in international funding within the first 11 months of the 12 months.

Building of the manufacturing facility is anticipated to start out early subsequent 12 months with manufacturing to come back on line by the top of the 12 months, the Xinhua Information Company stated.

The manufacturing facility is not going to construct batteries for automobiles however for power corporations corporations to retailer energy. These are more and more necessary with the expansion in solar energy and wind power, which solely generate electrical energy when climate situations are favorable and have to retailer it for when residential and industrial customers want it.

05:25 PM GMT

Warren Buffett-backed BYD opts for European manufacturing facility

The Chinese language electrical car producer backed by Warren Buffett is to construct a automobile manufacturing facility in Hungary, the corporate has stated, because it plans to ram up its market share in Europe.

With the brand new manufacturing facility, the rival of Tesla “hopes to accelerate the entry of new energy passenger vehicles into the European market, further deepen (the firm’s) global layout, and actively promote the green transformation of the global energy structure”, it stated on Chinese language social media, in line with AFP.

Mr Buffett’s Berkshire Hathaway initially purchased into BYD stake in 2008, however has been promoting down his stake from a reported 21pc in late 2021 to beneath 8pc by the top of November.

Mr Buffett informed CNBC in April that he had been promoting shares in BYD due to the valuation of his stake had grow to be round $6.5bn, saying “I think it’s an extraordinary company … we haven’t sold all our BYD by a long shot. We are not in a hurry to sell it.”

05:09 PM GMT

Retailers put hopes on a last-minute Christmas procuring

Retailers are hoping for a “last minute dash” from consumers after some disappointing gross sales figures in latest months.

It comes after gloomy knowledge was launched by the CBI suggesting that retailers have endured eight consecutive months of year-on-year gross sales happening.

However the newest knowledge from the ONS means that November would possibly even have seen some inexperienced shoots.

Darren Morgan, of the ONS, stated:

Retail gross sales grew strongly in November as heavy Black Friday discounting inspired consumers to spend. Nonetheless, with the three-month development persevering with to fall and total gross sales nonetheless under pre-pandemic ranges, it’s nonetheless a difficult time for retailers.

The commerce physique representing main retailers nonetheless struck an upbeat notice. Helen Dickinson, chief govt of the British Retail Consortium, stated:

Many retailers tried to offer gross sales a wanted enhance in November by beginning their Black Friday gross sales even earlier this 12 months. Cosmetics and toiletries had one other robust month as shoppers continued to splurge on smaller indulgences.

Retailers anticipate that buyers can be making a last-minute sprint to their favorite shops within the closing days main as much as Christmas.

04:49 PM GMT

Footsie closes within the inexperienced

The FTSE 100 was up 2.78pc at the moment. Lloyds Banking Group was the most important riser, up 1.81pc, adopted by funding fund Pershing Sq., up 1.73pc. The largest faller was JD Sports activities, down 5.15pc, adopted by Ocado, down 4.25pc.

In the meantime, the FTSE 250 rose 0.31pc, with PureTech Well being main the pack, up 20.95pc, adopted by Harbour Vitality, up 5.82pc. Industrial refractory enterprise RHI Magnesita fell 4.55pc, adopted by industrial thread firm Coats Group, down 3.68pc.

04:44 PM GMT

Lionsgate to spin off studio enterprise

Lionsgate will spin off its studio unit – well-known for the John Wick and Starvation Video games movies – right into a a so-called “blank cheque” firm listed on Nasdaq.

The studio enterprise is to be marged into Screaming Eagle Acquisition Corp, a particular purpose-acquisition firm (Spac) to create a listed firm representing Lionsgate’s tv and movie belongings that embrace an enormous again catalogue.

The present Lionsgate, formally referred to as the Lions Gate Leisure Company, is listed on the New York Inventory Alternate and can retail its pay-for cable and satellite tv for pc channels, in line with reviews.

Lions Gate Leisure Company will acquire £350m from the cut up and retain 87.3pc of the Spac, which is anticipated to be renamed Lionsgate Studios.

04:30 PM GMT

Bristol Myers Squibb plans £11bn takeover of schizophrenia drug developer

Pharmaceutical big Bristol Myers Squibb will purchase drugmaker Karuna Therapeutics for $14bn (£11bn), the 2 American corporations introduced this afternoon.

Bristol will acquire Karuna’s experimental drug KarXT, which has the potential to be a recreation altering drugs to deal with schizophrenia, Alzheimer’s illness and bipolar dysfunction.

Bristol chief Christopher Boerner stated: “We expect KarXT to enhance our growth through the late 2020s and into the next decade.”

KarXT might hit the marketplace for schizophrenia remedy as quickly as September, relying on regulatory approvals.

In the meantime, scientific trials for Alzheimer’s remedy are underway, with knowledge anticipated by 2026.

04:20 PM GMT

North Sea oil big Equinor hit by promoting ban over ‘misleading’ local weather claims

An advert for North Sea oil big Equinor has been banned by regulators over “misleading” environmental claims. Our reporter James Warrington has the main points:

The Promoting Requirements Authority (ASA) censured Equinor over an advert that urged wind and carbon seize performed a balanced function within the firm’s power output when oil and gasoline nonetheless make up the overwhelming majority of its enterprise.

The ruling utilized to an advert in The Economist in June, which stated that “wind, oil, gas, carbon capture and new jobs” had been “all part of the broader energy picture”.

In September, Equinor secured approval to develop Britain’s largest untapped oil discipline within the North Sea, sparking fury from environmental activists.

In response to the ruling, the state-owned Norwegian firm stated the advert was aimed toward politicians, advisers and journalists, moderately than most people.

The corporate added that the phrases “oil” and “gas” featured prominently within the advert and that textual content on the backside stated that it was “producing the oil and gas the UK needs now”.

The advert additionally featured an image of a employee on an oil rig.

However in its ruling, the ASA argued that the advert can be seen by shopper and enterprise readers, in addition to decision-makers.

It stated the adverts had been “likely to mislead” after omitting “significant information”.

A spokesman for Equinor stated: “We respect, but are disappointed by, the ruling of the Advertising Standards Authority Council. We will take note of it for future campaigns.”

04:14 PM GMT

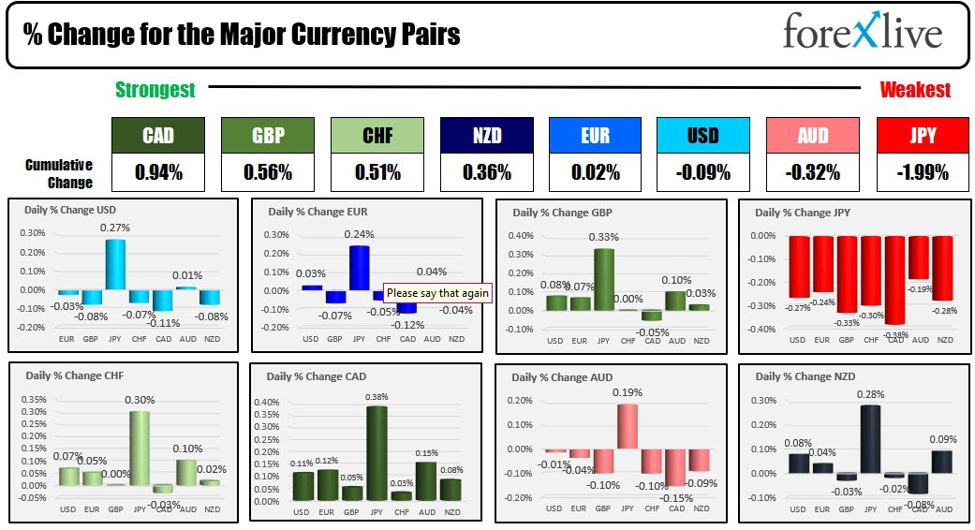

US greenback drops amid expectations of a March rate of interest minimize

The greenback fell on Friday, hitting a virtually five-month low towards a spread of different nations after knowledge confirmed annual American inflation slowed additional in November. This had the impact of cementing market expectations for a US rate of interest minimize subsequent March.

Inflation within the US was simply 2pc within the third quarter of 2023 in line with new figures.

Within the 12 months to November, inflation stood at 2.6pc, down from 2.9pc in October.

Stuart Cole, chief macro economist at Equiti Capital, defined:

The market will view the information as very a lot including weight to the Fed’s latest tilt in direction of a better financial stance.

That is the Fed’s most well-liked measure of inflationary pressures, so should you keep in mind the truth that among the impact of the tightening delivered thus far continues to be to be felt, then I feel the FOMC might be beginning to privately really feel that it’s job carried out as regards getting inflation again beneath management.

04:06 PM GMT

Main London workspace firm BE Places of work goes into administration

BE Places of work, which supplies “all-inclusive, inspirational office space solutions” throughout London and in Birmingham, Belfast and Southampton, has gone into administration, in line with a report.

It has beforehand been in a voluntary association with collectors.

The corporate was not answering its essential phone line this afternoon.

It follows the collapse of WeWork, which entered Chapter 11 chapter safety in the USA, after its mannequin of taking out long-term leases and promoting on modern area with workplace buildings on a short-term foundation got here unstuck.

03:54 PM GMT

Excessive rates of interest are cooling the American housing market

Gross sales of latest American properties cooled greater than anticipated in November, slipping to the bottom degree in a 12 months, in line with official knowledge that lends additional help to the rising consensus that the Fed will quickly begin chopping curiosity.

The marketplace for new properties has been boosted in latest months by a scarcity of current properties, as excessive mortgage charges dissuaded householders – who beforehand locked in decrease charges – from placing their homes up on the market.

Final month, gross sales of latest single-family homes got here in at a seasonally adjusted annual price of 590,000, round 12 p.c under October’s determine, the US Commerce Division stated. This was barely above November 2022’s tempo of 582,000, nonetheless.

Whereas the most recent weak point seems to replicate elevated mortgage charges earlier within the 12 months, charges have since come down.

03:44 PM GMT

China’s inventory market drops additional in robust 12 months for American shares

Should you’re fearful about development within the FTSE 100, spare a thought for what’s occurring in China.

The Nasdaq Golden Dragon China Index, which tracks listed corporations based mostly in China however with shares traded within the US, is down greater than 11pc in 2023. This has occurred in a 12 months the place the Nasdaq Composite index (closely skewed in direction of American know-how companies) is up 45pc.

In the present day that Chinese language index has dropped 2.4pc, prompting Rajeev De Mello, a fund supervisor on the Geneva-based GAMA Asset Administration, to inform Bloomberg: “In a way it is a fitting end for a year that has severely disappointed China bulls. The performance gap between US and China equities is staggering.”

03:30 PM GMT

Handing over

I’m heading off for the festive holidays so I’ll take this chance to want you a really glad Christmas.

Concern not, although, as Alex Singleton can be doing his greatest Santa impression as he delivers you little presents of stories as they come up.

Talking of which, I have to seize a couple of final items earlier than the massive day, very like these consumers bustling round Covent Backyard in London at the moment:

03:09 PM GMT

Guardian workers worry for his or her pets in do business from home crackdown

A workers revolt is looming at The Guardian over the newspaper’s return to the workplace amid issues the brand new coverage will give some employees less time to spend with their pets.

Our reporter James Warrington has the main points:

Bosses have informed workers they need to come into the workplace for at least three days every week from January after many did not return following the pandemic.

However the mandate has been met with anger by the National Union of Journalists (NUJ), which has requested members for his or her views on the problem.

In a survey distributed earlier this month, Guardian workers had been requested how a lot they agreed with varied statements in regards to the influence of returning to the workplace.

These ranged from issues in regards to the monetary influence of commuting, to points round work-life stability and distractions within the workplace.

Learn how the Guardian has been plunged into in-fighting over the policy.

02:54 PM GMT

Tesla ‘suspension failure’ claims investigated by Swedish regulators

Swedish regulators are investigating alleged suspension failures in Tesla automobiles in a probe much like that of neighbouring Norway’s site visitors security regulator.

The nation’s Transport Company informed Reuters “that investigative work is also underway with us”.

A spokesperson for the Swedish regulator declined to touch upon particulars of the probe because it was nonetheless ongoing.

The Norwegian Public Roads Administration (NPRA) on Thursday stated it began questioning Tesla in September 2022 and requested the carmaker to evaluate shopper complaints about decrease rear management arms breaking on its Mannequin S and X automobiles.

The Norwegian company might advocate that Tesla recall the automobiles to exchange the elements if it determines they pose a “serious risk.”

Nonetheless, it might additionally shut the overview if there isn’t any security concern or determine to increase the investigation.

02:37 PM GMT

Wall Avenue positive aspects after inflation falls

The S&P 500 and the Nasdaq opened greater after a key US inflation studying got here in softer than anticipated, boosting latest investor optimism that the Federal Reserve might decrease borrowing prices subsequent 12 months.

The Dow Jones Industrial Common fell 55.08 factors, or 0.2pc, on the open to 37,349.27.

The S&P 500 opened greater by 7.17 factors, or 0.2pc, at 4,753.92, whereas the Nasdaq Composite gained 42.31 factors, or 0.3pc, to fifteen,006.18 on the opening bell.

01:50 PM GMT

US inflation falls sooner than anticipated

A measure of inflation favoured by the US Federal Reserve weakened by greater than anticipated in November amid decrease power costs, authorities knowledge confirmed, offering additional reassurance to policymakers a few slowdown in value rises.

The non-public consumption expenditures (PCE) value index rose 2.6pc from a 12 months in the past in November, markedly under October’s 2.9pc determine, the Division of Commerce stated.

In contrast with a month in the past, the index decreased 0.1pc, on the again of a hunch in power costs and decrease meals prices.

With the risky meals and power segments eliminated, “core” PCE inflation cooled to an annual price of three.2pc, down barely from October as effectively.

This provides to knowledge indicating that inflation is coming down because the Fed holds rates of interest regular at a 22-year excessive in a bid to firmly decrease inflation again to its long-term 2pc goal.

With consumption and the roles market remaining comparatively resilient, hopes of a so-called “soft landing” – the place inflation comes down with out triggering a harmful recession – have risen.

12:40 PM GMT

UK markets shut flat as Britain susceptible to recession

The FTSE 100 has closed early for the Christmas vacation, with Britain’s blue-chip index ending the shorter day little modified at 7,697.51.

The midcap FTSE 250 ended the day 0.1pc greater at 19,598.24 amid robust retail gross sales knowledge for November, though positive aspects had been held again by knowledge displaying the UK economic system is susceptible to recession.

In the meantime, the pound has risen 0.3pc towards the greenback to maneuver effectively above $1.27.

Brent crude in London has dipped to be flat on the day at just under $80 a barrel.

12:07 PM GMT

Wall Avenue poised to fall forward of inflation figures

US inventory markets have dipped forward of the opening bell as buyers await a key inflation report.

The non-public consumption expenditure knowledge – the Fed’s most well-liked inflation gauge – might check an eight-week lengthy rally on Wall Avenue pushed by optimism that the Federal Reserve might decrease rates of interest subsequent 12 months.

Economists count on the value index to indicate a 2.8pc rise on an annual foundation in November, softening from a 3pc enhance the month earlier than.

Core costs, excluding risky gadgets like meals and power, are anticipated to have risen by 3.3pc final month, in contrast with 3.5pc development in October.

The S&P 500 and the Nasdaq completed over 1pc greater on Thursday after knowledge signaled third-quarter US financial development was not as sturdy as initially said, aiding hopes that the Fed might cut back borrowing prices subsequent 12 months.

All three indexes are poised for his or her eighth-straight week within the inexperienced, with the S&P 500 set for its longest weekly profitable streak since 2017, and the Nasdaq and the Dow since 2019.

In the meantime, Nike plunged 11.9pc earlier than the bell after the sports-wear maker trimmed its annual gross sales forecast blaming cautious shopper spending, a weaker on-line enterprise and extra promotions, and stated it plans to chop provides of key product strains to handle prices.

In premarket buying and selling, the Dow Jones Industrial Common was down 0.3pc, the S&P 500 was little modified and the Nasdaq 100 slipped by 0.1pc.

11:48 AM GMT

Wholesale gasoline holds stead amid Purple Sea turmoil

Gasoline costs are little modified regardless of the continuing assaults within the Purple Sea on vessels heading via the very important commerce route.

European benchmark contracts remained round €34 per megawatt hour, whereas the UK equal was static at about 85p per therm.

Costs had ticked greater after the assaults by Yemeni militants on transports via the Purple Sea.

Nonetheless, contracts have slumped by a few quarter over the past month as European provides maintain up. A gentle winter to this point has subdued demand.

11:26 AM GMT

Rail fares to extend by as much as 4.9pc subsequent 12 months

Regulated rail fares in England will enhance by as much as 4.9pc from March 3 subsequent 12 months, the Division for Transport has stated.

July’s RPI measure of inflation, which is historically used to find out annual fare rises, was 9pc. The earlier cap on will increase in regulated fares was 5.9pc.

Transport Secretary Mark Harper stated:

Having met our goal of halving inflation throughout the economic system, it is a important intervention by the Authorities to cap the rise in rail fares under final 12 months’s rise.

Modified working patterns after the pandemic imply that our railways are nonetheless dropping cash and require important subsidies, so this rise strikes a stability to maintain our railways working, whereas not overburdening passengers.

We stay dedicated to supporting the rail sector reform outdated working practices to assist put it on a sustainable monetary footing.

11:23 AM GMT

Unilever snaps up haircare model K18

Unilever has agreed to purchase fast-growing premium haircare model K18 because it continues to shake up its steady of manufacturers.

The deal, for an undisclosed sum, comes after Unilever bought off a few of its weaker performing manufacturers in latest months.

Earlier this week, the buyer big introduced it can promote a bunch of greater than 20 manufacturers together with Timotei shampoo and Impulse physique spray to non-public fairness agency Yellow Wooden Companions.

The corporate additionally bought off its Greenback Shave Membership enterprise in October.

K18 in the meantime is a quickly rising enterprise specialising in hair masks and different merchandise to deal with hair injury, with celeb followers together with Hailey Bieber and Selena Gomez.

The model, which was based in 2020 by Suveen Sahib and Britta Cox, has been buoyed by surging recognition via social media, recording round 20 billion TikTok views.

11:01 AM GMT

Financial institution of England price setter hints at shift on rates of interest

One of many Financial institution of England’s most hawkish policymakers has signalled he could also be able to shift his stance on rates of interest if inflation continues to chill.

Prof Jonathan Haskel, one in every of a minority of Financial Coverage Committee members who pushed for price hikes at latest conferences, tweeted that there was “news” within the newest inflation report, which confirmed the buyer costs index eased from 4.6pc to three.9pc in November.

The Imperial Faculty Enterprise College professor stated that the autumn in companies inflation, which strips out risky elements like air fares, appeared extra “broadly based” than in earlier months.

Nonetheless, he insisted that he wouldn’t shift his stance “based on one month data”.

Private view of the Nov CPI launch and commentary: 1/3

1. Information in newest knowledge? Sure.

2. Information in earlier months that was ignored? IMHO, no.Proof. Chart based mostly on ONS knowledge reveals service sector inflation with and with out “erratics” (flagged in Dec minutes para 32) pic.twitter.com/nehu8754Y3

— Jonathan Haskel (@haskelecon) December 21, 2023

2/3. My view.

a. Service inflation excluding erratics higher indication of underlying stress than headline.

b. Svc inflation has been falling.

c. However svc_excluding, thus far, hardly falling. Tight coverage judgement appropriate.

d. Newest obs broadly based mostly = information.— Jonathan Haskel (@haskelecon) December 21, 2023

3/3. Extra level: I wouldn’t wish to make coverage based mostly on one month knowledge.

(Finish)— Jonathan Haskel (@haskelecon) December 21, 2023

10:17 AM GMT

Pound edges greater after retail gross sales enhance

The pound has shifted greater after official figures confirmed higher than anticipated retail gross sales in November.

Sterling was up 0.1pc towards the greenback to tip again above $1.27 after a pointy fall in inflation earlier this week despatched its worth decrease amid elevated bets on the Financial institution of England chopping rates of interest.

Nonetheless, the pound was held again by official knowledge displaying Britain’s economic system is teetering on the sting of recession.

Sterling has risen 0.1pc towards the euro to 86p.

09:58 AM GMT

Oil costs push greater after Purple Sea assaults

Oil prolonged its largest weekly advance in two months as contemporary assaults within the Purple Sea prompted a whole lot of ships to go for safer however longer routes.

World benchmark Brent traded 1pc greater above $80 a barrel and is ready for a second straight weekly acquire after a string of seven declines. US-produced West Texas Intermediate rose 1.2pc above $74 a barrel.

Freight charges have soared as extra ships take in depth and expensive detours – principally across the southern coast of Africa – to keep away from the danger of crusing via the Suez Canal and Purple Sea.

Iran-backed Houthi rebels in Yemen have been concentrating on every little thing from oil tankers to container vessels.

In the meantime, Angola introduced on Thursday that it was leaving the Opec oil cartel, shrinking the group to 12 nations.

09:34 AM GMT

China gaming shares in £63bn rout after regulator crackdown

The world’s largest gaming firm led an $80bn (£63bn) sell-off in shares within the sector after Chinese language regulators introduced a variety of guidelines aimed toward curbing spending and rewards that encourage video video games.

Tencent shares plunged as a lot as 16pc at one level whereas these of its closest rival, NetEase, plunged as a lot as 25pc after the draft guidelines had been revealed.

On-line video games will now be banned from giving gamers rewards in the event that they log in daily, in the event that they spend on the sport for the primary time or in the event that they spend a number of instances on the sport consecutively. All are widespread incentive mechanisms in on-line video games.

The brand new guidelines, which is able to successfully set spending limits for on-line video games, sparked panic amongst buyers.

Steven Leung, govt director of institutional gross sales at dealer UOB Kay Hian in Hong Kong, stated:

It’s not essentially the regulation itself – it’s the coverage threat that’s too excessive.

Folks had thought this type of threat ought to have been over and had began to take a look at fundamentals once more. It hurts confidence rather a lot.

09:21 AM GMT

Lengthy queues after strikes hit Christmas getaway

Christmas getaway disruption is constant with lengthy queues for cross-Channel journeys, motorway closures and practice cancellations.

The Port of Dover in Kent stated it’s taking about 90 minutes to course of automobiles with pre-booked tickets.

It attributed the delay to a surge in demand for ferries after the Channel Tunnel rail hyperlink was closed on Thursday because of unscheduled industrial motion by French employees, which ruined the journey plans of tens of hundreds of individuals.

Eurostar, which operates passenger companies to and from London St Pancras, stated it can function two additional companies per day between London and Paris as much as and together with Christmas Eve to assist individuals whose trains had been cancelled on Thursday.

Car-carrying practice service Eurotunnel stated it’s working its typical timetable however is simply accepting prospects who’ve pre-booked.

The M20 motorway in Kent stays closed within the coastbound course between junctions 8 and 9 because of Operation Brock, which includes organising a queue for freight site visitors throughout disruption to cross-Channel companies.

Nationwide Highways stated that is inflicting 45-minute delays.

08:59 AM GMT

Contemporary Tube strikes introduced by RMT union

London Underground employees will stage a sequence of strikes within the new 12 months in a dispute over pay.

Members of the Rail, Maritime and Transport union (RMT) have voted overwhelmingly to take industrial motion over a 5pc pay supply.

Engineering and upkeep employees can be taking motion over January 5 and 6, with no rest-day working or additional time till January 12.

London Underground management centre and energy/management members can be taking motion over January 7 and eight, and fleet employees will stroll out on January 8.

Signallers and repair controller members will take motion on January 9 and 12 whereas all fleet, stations and trains grades will stroll out on January 10.

RMT basic secretary Mick Lynch stated Tube employees who assist convey “vast amounts of value” to the London economic system weren’t going to place up with senior managers and commissioners “raking it in”, whereas they got “modest below-inflation offers”.

08:55 AM GMT

Retailers hit by weak Nike outcomes

JD Sports activities shares slumped as a lot as 6.9pc in early buying and selling to the underside of the FTSE 100 after Nike revealed it’s searching for to make value financial savings of as a lot as $2bn (£1.6bn).

The US sports activities big revealed a weak gross sales outlook after the closing bell on Wall Avenue, sending its shares down 12pc in after-hours buying and selling, with revenues anticipated to be down within the third quarter of its monetary 12 months and up within the low single digits within the fourth quarter.

Nike is seen as a bellwether for the sports activities vogue trade, with its weak efficiency hitting shares of outlets world wide.

Mike Ashley’s Frasers Group, which owns Sports activities Direct, has fallen 0.9pc whereas Primark proprietor Related British Meals has dropped 0.8pc.

Victoria Scholar, head of funding at Interactive Investor stated:

Nike has struggled amid the weak shopper backdrop, heavy promotions and reductions, sluggish on-line gross sales and a slowdown in demand from the world’s second largest economic system China.

Sports activities retailers have been extra cautious when it comes to their inventory purchases too, weighing on Nike’s wholesale enterprise.

Whereas the US economic system has up to now confirmed to be extra resilient than anticipated, there are issues a few slowdown coming via in 2024 which might harm Nike.

08:38 AM GMT

UK markets edge down after knowledge revisions increase threat of recession

UK shares slipped in early buying and selling after a dour GDP studying left Britain teetering on the edge of recession.

The blue-chip FTSE 100 and the domestically-focused FTSE 250 each edged down 0.1pc.

Retailers had been among the many largest fallers, declining as a lot as 1.5pc regardless of knowledge displaying store gross sales rose by greater than anticipated in November, as some commentators questioned whether or not the influence of Black Friday is waning.

Life insurers had been amongst prime decliners, falling as a lot as 0.9pc.

The FTSE 100 is eyeing a fourth straight weekly acquire, whereas the FTSE 250 is ready to rise for a 3rd consecutive week.

World markets have rallied amid hopes that the US Federal Reserve will start chopping rates of interest early subsequent 12 months, whereas a shock drop in inflation this week boosted UK equities.

UK markets will shut early at 12.30pm as merchants head house for the Christmas holidays.

08:30 AM GMT

Revolut suffers loss as delayed accounts revealed

Revolut has swung to a lack of £25.4m regardless of greater rates of interest, because it faces a renewed battle over its makes an attempt to safe a UK banking licence.

Our senior know-how reporter Matthew Subject has the most recent:

The £24bn monetary know-how firm recorded the pre-tax loss in 2022, falling from a revenue of £39.8m a 12 months earlier, whereas it recorded a rise in revenues of 45pc – to £922.5m.

The numbers in its long-delayed accounts got here after Revolut was compelled to revamp its monetary IT programs after its auditors issued a warning over its final set of accounts.

The monetary know-how firm was closely scrutinised in March after its auditors, BDO, raised warnings over nearly £477m of revenues in its accounts.

For 2022, BDO stated the “matter has been resolved” and it was glad it had seen “sufficient appropriate audit evidence” to confirm Revolut’s 2022 numbers.

08:11 AM GMT

German home costs endure file 10pc fall

Residential property costs in Germany continued their fall, dropping 10.2pc within the third quarter from a 12 months earlier, an extra grim signal for the nation’s real-estate sector, official knowledge confirmed.

Germany’s statistics workplace stated the decline was the most important because it started preserving data within the 12 months 2000.

08:03 AM GMT

UK markets fall as Britain susceptible to recession

The FTSE 100 fell on the opening bell as revised official knowledge confirmed Britain might be falling right into a recession.

The UK’s blue chip index was down 0.5pc to 7,681.32 whereas the midcap FTSE 250 was down 0.1pc to 19,553.70.

Markets are open for a shorter interval at the moment forward of the Christmas holidays.

07:59 AM GMT

Sunak has did not develop the economic system, says Reeves

The Prime Minister has “failed to grow the economy”, shadow chancellor Rachel Reeves stated.

Responding to the most recent GDP figures, Labour MP Ms Reeves stated:

Rishi Sunak is a Prime Minister whose legacy is one in every of failure. He did not beat Liz Truss, he failed to chop ready lists, he did not cease the boats and now he has did not develop the economic system.

13 years of financial failure beneath the Conservatives have left working individuals worse off with greater payments, greater mortgages and better costs within the outlets.

It’s time for change. The Labour Celebration, led by Keir Starmer, has a long-term plan to develop the economic system and make working individuals higher off.

07:54 AM GMT

Britain could also be in ‘mildest of mild recessions’, say economists

The autumn in GDP within the third quarter signifies that Britain could already be within the “mildest of mild recessions”, in line with economists.

Ashley Webb, UK economist at Capital Economics, stated:

Whether or not or not there’s a small recession, the massive image is that we count on actual GDP development to stay subdued all through 2024.

The breakdown of Q3 GDP confirmed that the drag from greater rates of interest is beginning to hit households tougher.

The 0.5pc quarter on quarter fall in shopper spending (revised down from 0.4pc q/q beforehand) was the primary fall since This autumn 2022.

However the 0.4pc q/q rise in actual family disposable revenue helped the saving price rise from 9.5pc in Q2 to 10.1pc in Q3.

With the total results of upper rates of interest but to feed via to the economic system, we predict shopper spending will fall additional in This autumn 2023 and Q1 2024.

General, at the moment’s launch suggests the economic system was a bit weaker than we beforehand thought in Q3 and the mildest of delicate recession could have begun. Wanting forward, the most recent exercise surveys level to weak GDP development in This autumn too.

07:40 AM GMT

Sunak’s pledge to develop the economic system severely doubtful, warn analysts

After the UK’s financial efficiency was revised down for the second and third quarters, Quilter Cheviot’s head of fastened curiosity analysis Richard Carter, stated:

ONS knowledge this morning reveals UK GDP fell by a shock 0.1pc in Q3 in comparison with the earlier quarter, revised down from a primary estimate of no development, highlighting simply how a lot of a pressure there at the moment is on the UK economic system.

Q2 was additionally revised down and is now estimated to have proven no development in comparison with the 0.2pc enhance beforehand estimated, that means the UK has barely scraped by with no recession in 2023.

Progress is weakening and rates of interest are actually starting to chunk and whereas a recession has simply been prevented thus far, there isn’t any assure one can be prevented in 2024.

You simply have to take a look at October’s -0.3pc studying to see that development is trending additional within the flawed course.

Inflation has eased greater than anticipated and rate of interest predictions are suggesting extra easing than initially thought in 2024, however the injury could have already got been carried out. Definitely, Rishi Sunak’s pledge to develop the economic system is now severely doubtful.

That is going to ratchet the stress up on the Financial institution of England to chop rates of interest. The federal government will surely like this given 2024 is prone to be an election 12 months, however finally the Financial institution of England will follow the narrative of the job just isn’t but carried out on inflation and it’s too early to be speaking about price cuts.

07:32 AM GMT

Christmas will nonetheless come all the way down to the wire for retailers, specialists warn

Black Friday is now not giving the identical enhance to retailers, that means the most recent enhance in retail gross sales figures ought to be seen with warning, in line with Lisa Hooker of PwC. She stated:

At a headline degree, retail gross sales elevated in November in contrast with October’s disappointing efficiency, with gross sales volumes – excluding petrol – up 1.3pc on the earlier month, and so they had been additionally up 0.3pc vs the earlier 12 months.

Virtually the entire enhance was due the early begin to Black Friday which we recognized in our on-line promotions tracker, in addition to the extra seasonal wetter and colder climate in the beginning of the month, encouraging extra consumers to spend earlier within the month.

Nonetheless, a notice of warning decoding November’s outcomes as they didn’t embrace the entire Black Friday weekend.

The long term development means that Black Friday is now not giving the identical enhance to retailers as beforehand, with the non-seasonally adjusted gross sales peak falling yearly since 2019. This echoes the findings of our personal survey which confirmed 1 / 4 fewer shoppers excited about Black Friday total.

Certainly, non-food volumes remained 2.7pc under pre-pandemic ranges, regardless of the obvious enchancment final month.

Which means, regardless of the headline enchancment in gross sales final month, Christmas continues to be prone to come all the way down to the wire for retailers. Shoppers stated they might spend much less total, however can they be persuaded to spend greater than they deliberate within the closing weekend earlier than the massive day itself? And, if not, the chance of bumper Boxing Day gross sales to clear seasonal inventory will solely enhance.

Regardless, the Golden Quarter may have been a disappointment for a lot of retailers, and they are going to be hoping that the bettering macroeconomic backdrop of decrease inflation and growing actual wages will enhance their outlook within the new 12 months.

07:23 AM GMT

Black Friday boosts retailers in run-up to Christmas

Retail gross sales grew stronger than anticipated final month as consumers snapped up Black Friday bargains and purchased Christmas presents, in line with official figures.

The Workplace for Nationwide Statistics (ONS) revealed that retail gross sales volumes elevated by 1.3pc in November.

It was forward of the predictions of economists, who had forecast 0.4pc development for the month.

The ONS additionally revised its knowledge for October upwards, reporting that there was zero development in retail gross sales after earlier estimating a fall of 0.3pc.

07:20 AM GMT

Struggling small companies drive financial slowdown, says ONS

ONS director of financial statistics Darren Morgan stated:

The newest knowledge from each our common month-to-month enterprise survey and VAT returns present the economic system carried out barely much less effectively within the final two quarters than our preliminary estimates.

The broader image, although, stays one in every of an economic system that has been little modified over the past 12 months.

The newest VAT knowledge, which takes somewhat time to obtain and course of means we now estimate the economic system confirmed no development within the second quarter, with weaker performances from smaller companies, significantly these in each hospitality and IT than first proven.

We additionally now estimate the economic system contracted barely within the third quarter, once we beforehand reported no development, with later returns from our enterprise survey displaying movie manufacturing, engineering & design and telecommunications all performing somewhat worse than we initially thought.

07:09 AM GMT

Financial outlook is way extra optimistic, insists Hunt

After the downward revisions for the economic system, Chancellor Jeremy Hunt stated:

The medium-term outlook for the UK economic system is way extra optimistic than these numbers counsel.

We’ve seen inflation fall once more this week, and the OBR expects the measures within the Autumn Assertion, together with the most important enterprise tax minimize in fashionable British historical past and tax cuts for 29 million working individuals, will ship the most important enhance to potential development on file.

07:08 AM GMT

Britain susceptible to recession as development revised down

The UK is teetering on the sting of a recession, official figures present, after preliminary estimates on the efficiency of the economic system had been revised down.

Gross home product (GDP) fell by 0.1pc within the three months to September, in line with the Workplace for Nationwide Statistics.

Preliminary estimates had indicated the economic system flatlined within the third quarter, and the next estimates that the economic system shrank by 0.3pc in October means the fourth quarter might additionally present a contraction.

Two consecutive quarters of financial contraction are the definition of a technical recession.

Britain’s economic system can be estimated to have proven no development within the second quarter of the 12 months, revised down from a beforehand estimated enhance of 0.2pc.

The information will enhance stress on the Financial institution of England to chop rates of interest early subsequent 12 months to keep away from a deeper financial downturn.

Separate figures confirmed this week that inflation fell to three.9pc in November as households battled with 15-year excessive rates of interest of 5.25pc.

GDP is estimated to have fallen by 0.1% in Quarter 3 (July to Sept) 2023, revised down from the earlier estimate of no development.

In the meantime GDP is now estimated to have proven no development in Q2, revised down from the earlier estimate of +0.2% development.

➡️ https://t.co/KjTIdncntf pic.twitter.com/xb7H0dRZKD

— Workplace for Nationwide Statistics (ONS) (@ONS) December 22, 2023

07:01 AM GMT

Good morning

Thanks for becoming a member of me. Britain is susceptible to a recession after revisions to official knowledge confirmed the economic system shrank within the third quarter.

The Workplace for Nationwide Statistics stated GDP slumped by 0.1pc within the three months to September.

Two consecutive quarters of contractions are outlined as a technical recession. The UK started the fourth quarter with a 0.3pc contraction in October.

5 issues to start out your day

1) Hunt hints at spring tax cuts if Britain’s debt bill falls | Economists count on the Chancellor to have over £10bn of fiscal wiggle room

2) The war on landlords has backfired – and Britons are paying the price | Nation’s animosity in direction of the ‘bogeymen of modern times’ has reached a breaking level

3) Paramount heiress prepares to bow out as Hollywood streaming wars turn ugly | Billionaire tycoon alleged to be exploring promoting 77pc stake of controlling shares

4) China blocks exports of rare earth technology after MPs warn Beijing is ‘weaponising’ supplies | Transfer follows Western efforts to limit the nation’s entry to microchip know-how

5) Patrick Minford: The Laffer Curve is about to blow up the SNP | Determination to introduce 48pc prime tax price is simply going to usher in modest quantities

What occurred in a single day

Shares had been principally greater in Asia after a number of robust revenue reviews helped Wall Avenue claw again most of its sharp loss from day earlier than.

Japan’s core inflation price fell to 2.5pc in November from 2.9pc a month earlier as power prices eased. The decline would possibly counter expectations that the central financial institution will tighten its lax financial coverage in coming months.

Financial institution of Japan officers have indicated they wish to guarantee inflation is sustained close to the 2pc goal degree and that wages are additionally rising earlier than adjusting the central financial institution’s longstanding minus 0.1pc benchmark rate of interest.

Tokyo shares trimmed early positive aspects and closed solely marginally greater as markets abroad transfer into the vacation season.

The benchmark Nikkei 225 index edged up 0.1pc, or 28.58 factors, to finish at 33,169.05, whereas the broader Topix index added 0.5pc, or 10.45 factors, to 2,336.43.

The Kospi in Seoul added 0.4pc to 2,609.54. Hong Kong’s Cling Seng index gave up 0.4pc to 16,548.98 and the Shanghai Composite index was up 0.5pc at 2,933.25. In Sydney, the S&P/ASX 200 picked up 0.1pc to 7,510.90.

Bangkok’s SET slipped 0.3pc and the Sensex in Mumbai was up 0.3pc.

Wall Avenue shares resumed their upward climb on Thursday. The Dow Jones Industrial Common of 30 main American corporations closed up 0.9pc at 37,404.35 factors, whereas the broader S&P 500 index was up 1pc at 4,746.75. In the meantime, the Nasdaq Composite index, which is skewed in direction of know-how shares, was up 1.3pc at 14,963.87.

The yield on benchmark 10-year US Treasury bonds was up 1.5 foundation factors to three.892pc, from 3.877pc late on Wednesday.