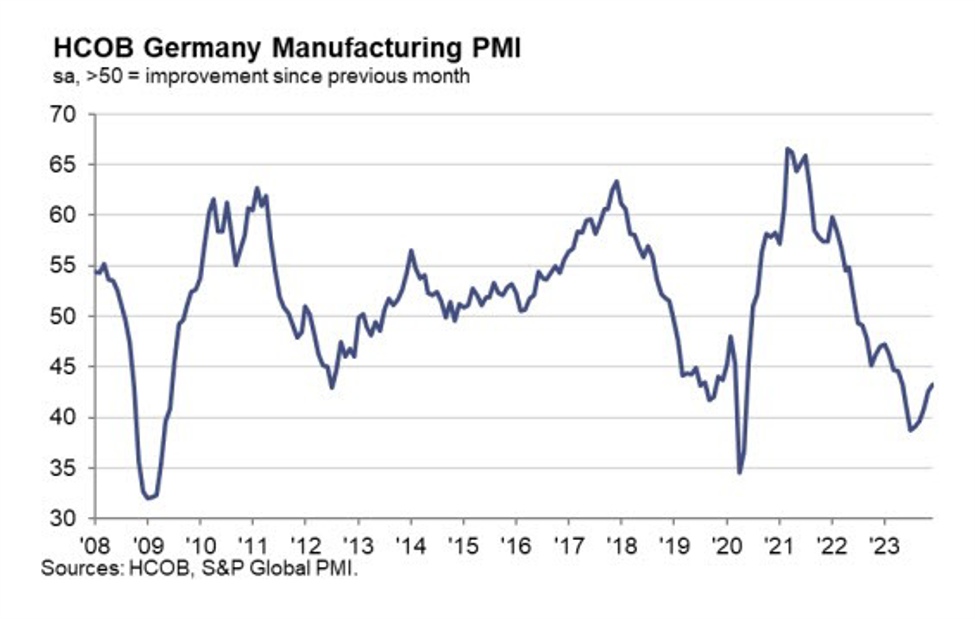

Even with a powerful contraction in manufacturing circumstances, that is nonetheless a 8-month excessive studying for Germany – which speaks extra to how unhealthy issues received sooner or later final yr. However at the very least now, new orders are seen declining at its slowest price since April and worth pressures are additionally softening additional. Nonetheless, there may be nonetheless a lot uncertainty that’s persisting on the outlook. HCOB notes that:

“The state of affairs in Germany’s manufacturing business will be likened to a hiker who has involuntarily descended right into a valley.

Progress is clear within the seek for an exit, but uncertainty lingers concerning the proximity of discovering the suitable path. Thus, whereas it

is encouraging that the PMI index has elevated for 5 months in a row, it continues to sign a relatively quick decline of

demand for manufactured items.

“Over the previous few months, producers have develop into extra aggressive in lowering employment, particularly within the

section of intermediate items. This adjustment is probably going a response to a development the place the backlog of orders for a major

variety of firms has decreased to a stage the place sustaining all staff on the payroll is now not viable.

Due to this fact, the pathway to a reversal in employment developments hinges on a extra favorable order state of affairs.

“Within the realm of sectors, there’s a silver lining within the funding items section. The decline in new orders has notably

eased, with the corresponding index approaching the pivotal 50 threshold. Employment discount on this sector has nearly

come to a standstill, and the dip in output is comparatively minor. This contrasts with the intermediate items sector, the place output,

new orders and employment are all experiencing a swifter decline.

“Producers have been constantly reducing their costs for seven consecutive months. One might assume that this

improvement places stress on income. Nonetheless, that is most likely not the case, as a result of there was a major

reduction on the price aspect. To be extra exact, enter costs started their descent eleven months in the past and have skilled a

way more substantial drop than output costs. Moreover, in December, firms decreased output costs solely minimally.

Total, regardless that output has taken a extreme hit, it seems that income have managed to climate the storm.”