Pedestrians stroll by way of the festively adorned Burlington Arcade luxurious procuring arcade in London, UK, on Monday, Dec. 4, 2023. Inflation in UK retailers has fallen to a 17-month low as retailers struggle to draw customers forward of the essential vacation interval. Photographer: Jason Alden/Bloomberg by way of Getty Photographs

Bloomberg | Bloomberg | Getty Photographs

“Girl math” makes a well timed return this vacation season, throwing the highlight on new seasonal spending habits that customers are adopting this 12 months.

Customers on TikTok say for those who’re shopping for items months earlier than Christmas, it is going to be “free” by December. Should you splurged throughout Cyber Week, you’re technically saving extra for Christmas day.

Welcome to woman math — however with a vacation twist.

Woman math is a viral TikTok development on private finance. It reveals methods girls customers rationalize their spending habits — typically involving psychological gymnastics to justify one’s purchases in a approach that maximizes happiness.

This vacation season, the return of woman math could also be an indication that customers are beginning to really feel a pressure on their wallets, however simply cannot cease procuring.

Kicking off 2023 vacation procuring

Whereas inflation has stabilized, costs stay excessive and shoppers are nonetheless spending.

Over half of vacation customers say they really feel financially burdened this vacation season, in keeping with a study by Bankrate.

Nevertheless, at the same time as shoppers stay cautious, “shoppers do feel like they want to celebrate the holiday season right,” Bryan Gildenberg, managing director at Retail Cities, advised CNBC’s “Squawk Box Asia” in late November.

Analysts say customers could also be working as much as the gifting season with woman math to rationalize their purchases amid rising prices.

“An extended holiday season may be an example of girl math, as shoppers may view discounts as ‘saving money.’ For example, having a 40% discount on a $100 item is saving $40 to them,” Melissa Lee, a monetary guide from Nice Jap, advised CNBC.

Woman math has turn into a way for customers to create a “mental label for their money,” and justify their spending habits, she added.

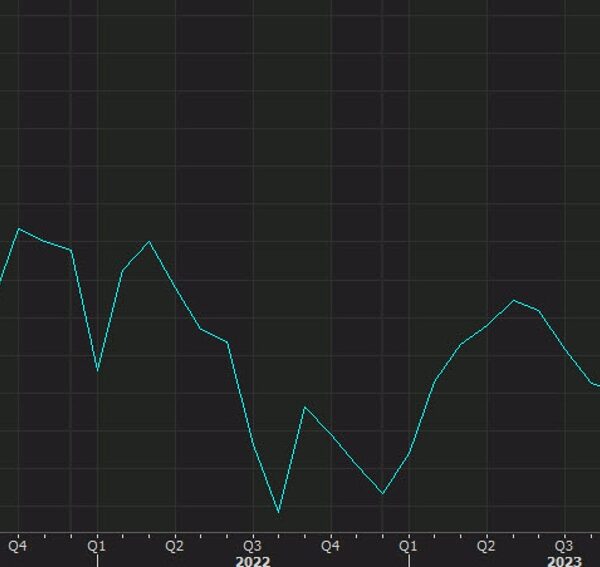

In actual fact, holiday shopping began sooner than it did in 2022, and it is anticipated to finish late this 12 months, in keeping with McKinsey & Firm.

An “increasingly long” 2023 U.S. vacation season began earlier than Halloween — 50% of vacation procuring started in October or earlier, adopted by 40% in November, a McKinsey report stated. Customers additionally expressed that they’d fairly make purchases over a few months than suddenly, and began searching earlier in anticipation of worth will increase, their analysis confirmed.

This pushed pre-holiday on-line spending to an all-time excessive of $76.8 billion in October — some $4.3 billion greater than a 12 months in the past, a report by Adobe Analytics confirmed.

Vacation spending can be anticipated to surge in November and December, reaching as much as $966.6 billion in 2023, in keeping with a forecast by the Nationwide Retail Federation. November’s core retail gross sales — excluding eating places, vehicles and gasoline — had been up 0.73% month-on-month and 4.17% year-on-year, the CNBC/NRF Retail Monitor showed.

Nevertheless, most shoppers really feel there’s nonetheless plenty of procuring to be finished.

A survey by Morgan Stanley confirmed that 61% of shoppers will proceed to buy between Dec. 1 and Christmas day, in anticipation that offers might be higher than these on Black Friday and Cyber Monday in late November.

Who spends extra?

After a summer season of spending, customers do not look like backing down this winter.

Ladies gave the financial system a lift with their “record-breaking” attendance at films and dwell concert events in summer season — a development that can seemingly final by way of the winter, a report by PwC predicted. They’re anticipated to spend 11% extra this 12 months in comparison with 2022, and usually tend to spend on items in comparison with their male counterparts, the report confirmed.

Nevertheless, an uptick in spending by girls will not be a mirrored image of frivolous spending. Quite, it reveals girls’s strategic method to discerning one of the best worth for his or her cash.

Following the “rules” of woman math, girls appear to be much less involved concerning the sticker worth, however care extra concerning the worth, free returns, transport and comfort of their purchases, the report by PwC confirmed.

Moreover, younger dad and mom had been highlighted as a distinguished shopper demographic this vacation.

“Young adults are in their prime consumption years, and especially when they have young kids, they’re a big holiday shopping cohort,” Ted Rossman, senior business analyst at Bankrate, advised CNBC.

Rossman famous that households with younger youngsters usually tend to partake in reductions this vacation season — a report by Bankrate confirmed that 49% of fogeys with youngsters underneath 18 years outdated participated in October gross sales, in comparison with 28% of vacation customers with out children.

Then again, spending the vacations with your loved ones may also value you extra.

A study by Rocket Money — a private finance app — discovered that these staying with household this vacation season are anticipated to spend 53% extra.

Over half of these celebrating the vacations with household view their overspending in 2022 as a “moderate to serious problem,” the research confirmed.

Various cost strategies

Bank cards stay the go-to financing methodology for customers this vacation season. A survey by Forbes Advisor confirmed that 52.3% of Individuals plan to make use of bank cards and borrow to pay for present purchases.

Moreover, 42% of respondents indicated they plan to extend their balances by at the least $501, together with 11% who’re anticipated to cost greater than $1,000 on their bank cards this vacation, the survey discovered.

A choice for extra versatile cost strategies can be on the rise.

Particularly, “buy now, pay later” installment plans have gained reputation amongst shoppers.

This 12 months, BNPL hit an all-time excessive on Cyber Monday at $940 million in on-line purchases — up by 42.5% year-over-year, a report by Adobe Analytics revealed. The report confirmed the variety of objects per order additionally rose 11% year-over-year, as shoppers are utilizing BNPL for more and more larger carts.

Versatile cost strategies like BNPL have been more and more well-liked with customers who “won’t feel the immediate pinch of spending the money at the moment” and debt could be paced out over a number of months, Lee added.

From Nov. 1-27, BNPL amassed $8.3 billion, doubtlessly making November the most important month on file for the cost methodology, the report by Adobe Analytics stated.

— CNBC’s Michael Bloom contributed to this report.