borzaya/iStock through Getty Photographs

To Our Shoppers and Buddies:

For the fourth quarter and 12 months ended December 31, 2023, the Giverny Capital Asset Administration mannequin portfolio, which is a Poppe household account 1, carried out as follows 2:

|

GCAM Efficiency |

Quarter ending |

Yr-to- date ending |

One-year ending |

Three years ending |

*Annualized Since Inception |

|

12/31/2023 |

12/31/2023 |

12/31/2023 |

12/31/2023 |

12/31/2023 |

|

|

Portfolio Internet Return |

16.26% |

29.07% |

29.07% |

8.94% |

18.68% |

|

11.69% |

26.29% |

26.29% |

10.00% |

19.66% |

|

|

Extra Return -Internet |

4.57% |

2.78% |

2.78% |

-1.06% |

-0.98% |

|

* Inception Date 04/01/2020 |

The inventory market is peculiar in its potential to ship a passable consequence over time in a way that feels unsatisfying. It is maybe like a restaurant with superb meals and terrible service. Or a slot machine in reverse: you largely win and over time your wealth will increase. However now and again you undergo a debilitating loss that causes actual monetary ache. On prime of this, the losses generate headlines and the positive aspects are sometimes obtained skeptically.

The important thing to long-term success is fortitude. Warren Buffett says temperament issues greater than intelligence in investing. Buyers who withstood the ache of 2022 have been rewarded as shares clawed again steep losses in 2023. Buyers who stop once they have been behind can have a tricky time ever getting their capital again.

If we take a look at the three-year interval from 2021 via 2023, the S&P 500 Index’ annualized return was a really passable 10%. Ours was 9%. Each are properly above inflation and approximate the historic norm for the Index. Had we earned a gradual 8% to 12% return every year to attain this consequence, traders possible would really feel like a pleasantly overfed patriarch on the vacation dinner desk. Complacent, even perhaps drowsy.

Mr. Market doesn’t do drowsy. Right here is how he delivered a ten% return over three years: +28.7% for 2021; -18.1% for 2022; and +26.3% for 2023. The whipsaw journey to an general acquire of 33%, or 10% yearly, was the other of snug. Our three-year internet return is even spikier: we have been +29.5% in 2021, then down 22.6% final 12 months, earlier than rising 29.1% for 2023. That led to our three-year internet acquire of 29.5%, or a whisker beneath 9% yearly.

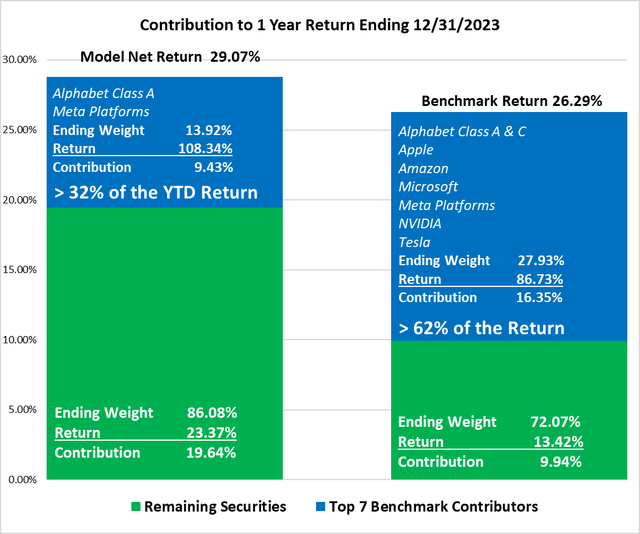

Not solely has the market return been wobbly within the excessive, it has been pushed by seven large tech shares, the so-called Magnificent Seven, of which we personal solely two: Alphabet (GOOG,GOOGL) and META. Because the market delivered 10% compounded over three years, these seven shares (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) compounded at a price of 16.2% on common. As these seven made up 28% of the Index on the finish of 2023, it is clear they drove a superb little bit of the general market return.

One motive why I’m assured in our future is that our return outpaced the Index for 2023, and approached it for the three-year interval, regardless of our gentle publicity to the tech giants. It isn’t a degree of pleasure for me to not personal Apple (AAPL) or Microsoft (MSFT), two of the very best companies on the planet. However it’s a level of pleasure for me that we’re fairly good inventory pickers: we loved large returns this 12 months from an eclectic basket of shares, together with Arista Networks (ANET, +94%); Constellation Software program (OTCPK:CNSWF, +63%), Ground & Décor (FND, +60%) and Put in Constructing Merchandise (IBP, +114%). That is along with our two Magnificent Seven members, Meta Merchandise (+194%) and Alphabet (+58%).

In a 12 months the place 72% of S&P 500 shares underperformed the market common, our year-end portfolio had 48% (or 12) beneath the market return and 52% (or 13) above it. Our dispersion is what one would anticipate: half the constituents beneath the general return and half above. The S&P return, however, hints on the narrowness of the Index. Comparatively few constituents drove the return.

Various our long-term holdings generated returns above 20% for the 12 months, together with Progressive Corp. (PGR,+23%), Analog Units (ADI,+21%), JP Morgan (JPM,+27%), Ashtead Group (OTCPK:ASHTF, +26%), 5 Under (FIVE,+21%) and CarMax (KMX, +26%).

The market returned 26% for the 12 months, so one would possibly shrug at a listing of shares that kind of carried out because the market did. However 493 S&P shares exterior the Magnificent Seven returned 13% for the 12 months.

Extra essential than our broader base of efficiency, our corporations’ earnings trajectories look good. Most fourth quarter earnings will not be reported but, however 9 months of the 12 months are within the books.

In keeping with the consensus of Wall Avenue analyst estimates as compiled by FactSet Analysis, the Index elements grew their earnings per share by 1% this 12 months. One needn’t be a math savant to know {that a} 26.3% return for shares pushed by 1% earnings development means the Index loved a hefty 600 enlargement of the PE a number of. I believe it’s honest to say traders have been very anxious final 12 months in regards to the prospects for a recession in 2023 and knocked inventory costs down in anticipation of 1. When earnings and the economic system held up, inventory costs rose.

Our portfolio elements grew earnings effectively above the Index. Utilizing FactSet consensus estimates with very minor changes by us, primarily for insurers with massive funding portfolios whose gyrations we exclude from earnings per share calculations, the GCAM mannequin portfolio ought to develop 2023 earnings per share by 7%, barring a significant 4th quarter shock.

So, now we have a broader base of efficiency than the Index, higher earnings per share development and a lesser reliance on the tech giants. All good. That can assist you visualize this, we’ll reprise a chart we printed in our final quarterly letter, breaking out the portion of our return pushed by our Massive Tech holdings Alphabet and Meta vs. the portion generated by our different holdings, after which displaying the identical for the Index.

We had a powerful fourth quarter, however sadly I really feel compelled to say that particular person quarters do not imply a lot. If the market is characterised by bursts of volatility, I shouldn’t boast when the volatility goes our manner. Additionally, within the fourth quarter the massive know-how shares lagged relative to the remainder of the market. Just lately, we have underperformed when the Magnificent 7 outpaced the market. We simply outperformed throughout a stretch when they didn’t. However to repeat myself, I’m blissful about our robust annual efficiency and earnings development.

It felt to me like we have been lively this 12 months, primarily as a result of I made some troublesome choices (for me) about exiting two positions. But once I reviewed our general transactions for the 12 months, we solely turned over about 13% of the portfolio. We intention to behave as long-term enterprise homeowners, partnering with nice administration groups to create wealth for our purchasers and ourselves. The portfolio is just not a museum and there might be turnover (and taxes to pay) now and again, however I’m from the Charlie Munger faculty of funding thought: attempt to make a couple of well-considered choices in your life and in any other case spend your time pondering (or, as Charlie would’ve put it, sitting in your butt) reasonably than to making an attempt to show that you simply’re smarter than the market by buying and selling on daily basis.

An essential facet of our low-turnover philosophy is that in a 12 months the place our mannequin portfolio appreciated by 29%, the mannequin realized a small short-term capital loss (largely First Republic Financial institution gross sales) and a long-term capital acquire amounting to 1.7% of year-end belongings. For a consumer invested the identical because the mannequin, a $100,000 portfolio at the start of 2023 would have loved $29,000 of appreciation whereas realizing roughly a $1,000 short-term capital loss and a $2,200 long-term acquire. The tax tail ought to by no means wag the financial canine, however long-term enterprise homeowners ought to anticipate tax effectivity as a aspect advantage of affected person possession. [This also presumes the client account behaved the same as the model. Client accounts can differ based on cash flows into and out of the account, timing of account opening – hence the basis price of portfolio positions – and other factors].

Non-taxable purchasers might not care how actively we commerce, nevertheless it ought to resonate that making fewer choices with extra info normally works higher than making extra choices with much less info.

As we assessment transactions for the 12 months, let’s cowl the dangerous information first. We exited First Republic Financial institution (OTCPK:FRCB) at a considerable loss within the first quarter. This price us roughly 2.5% of consumer capital, a significant motive why our outperformance for the 12 months was not higher. I lined this error in our first quarter letter and will not rehash it aside from to say I used to be listening in Might when Warren Buffett spoke on the Berkshire assembly about First Republic’s mismanagement of its stability sheet. I knew this on the time, in fact, however felt the enterprise had such robust buyer loyalty that it might survive its funding in long-dated bonds yielding very low curiosity. Mr. Buffett’s level, maybe oversimplified by me, gave the impression to be that when the capital allocation is poor it does not actually matter how robust the enterprise is. In the long run, poor capital allocation is the act of administration frittering away wealth.

It is a bit like two neighbors, each younger and with glorious incomes. If one diligently saves a superb portion of their revenue, greenback price averages often into the inventory market, pays just a little further on the mortgage each month and avoids bank card debt, whereas the opposite dabbles in unique investments, is on a first-name foundation with an area bookie and maxes out bank cards on the holidays, now we have a fairly good concept which family might be richer at age 65, regardless of who earns extra money over their careers.

It is the identical for corporations. Earnings energy issues, however no more than capital allocation. I thought of this for some time and bought SS&C within the third quarter. This can be a wonderful enterprise with a historical past of creating sensible acquisitions. However not too long ago the choice to make use of floating price debt to finance acquisitions when rates of interest have been at historic lows has been a expensive mistake. SS&C is rising modestly, however its earnings are stagnant as a result of incremental money stream have to be devoted to larger curiosity costs.

Within the fourth quarter, we bought Markel (MKL), the Richmond-based insurer. For some years now, Markel has tried to imitate Berkshire Hathaway (BRK.A, BRK.B) by utilizing revenue generated in its core insurance coverage enterprise to purchase entire corporations. Whereas this has been a compelling mannequin for Berkshire, Markel has not been capable of persuade high-quality corporations to promote for enticing costs to the identical diploma as Berkshire.

In the meantime, in its insurance coverage operations, Markel has an elevated expense construction – it spends about 33 cents of each greenback collected in premiums by itself overhead. Its leanest competitor spends 21 cents of each premium greenback on overhead. Markel’s price construction stems from an unwieldy know-how stack that may be very costly to improve. I’ve nice respect for Markel, however the mixture of middling investments and a difficult expense construction triggered me to imagine I might discover higher worth elsewhere.

We additionally exited Ciena (CIEN) through the summer season. This was a small place that we mentioned in our second quarter letter.

Promoting SS&C (SSNC) and Markel, which have been every about 4% of the portfolio, was not simple for me. Each companies commerce for affordable costs and have good aggressive positions. They’ve robust CEOs who’ve been within the job for a few years. CEO Invoice Stone based SS&C and is a billionaire due to his personal choices. Tom Gayner at Markel is a well-regarded inventory market investor and a much-admired chief.

However with the purchases that adopted, I really feel assured we strengthened the portfolio.

We purchased Fiserv (FI) and Ferguson (FERG) within the third quarter. We lined these purchases intimately in our third quarter letter. Fiserv has carried out about the identical as SS&C and Ciena since buy and Ferguson has achieved higher, up about 25% at year-end.

After the sale of Markel within the fall, we used the proceeds to purchase a 2% place in Align Know-how in November and a 2% place in Kinsale Capital in early December.

With Align (ALGN), our foundation is slightly below $190 and it completed the 12 months at $274, for a really productive seven weeks of possession.

I’ve been following Align off-and-on for greater than a decade with out making a significant sum of money for purchasers for doing so. Till now. Align is the inventor of Invisalign clear aligners, which permit orthodontists and dentists to straighten enamel with out utilizing wires and brackets. Thousands and thousands of adults worldwide have opted to straighten their enamel with clear aligners. More and more, orthodontists can obtain the identical outcomes for teenagers utilizing aligners as with braces.

That is essential as a result of the marketplace for adults who’d like a greater smile is large-but-discretionary. A 40- 12 months outdated who has lived with crooked enamel for years can defer a $6,000 process indefinitely. Alternatively, many mother and father really feel chargeable for their youngsters’s orthodontia and, in consequence, some 15 million children all over the world get braces every year, together with roughly 3.5 million within the US.

Within the US, Align has a roughly 15% share of the teenager orthodontia market, however our work suggests leading- edge orthodontists are placing 40%-50% of their teen sufferers into aligners, with this market share transferring solely in a single course. Importantly, teenagers usually ask for Invisalign by identify.

Mr. Market alternates between exuberance on the prospect of Align changing the worldwide marketplace for wires and brackets and anxiousness on the prospect of recent entrants copying the know-how and commoditizing the value level. In any case, there are not any recognizable model names for wires and brackets. Consequently, prior to now three years the inventory has traded as excessive as $700 and as little as $170.

As talked about, I have been paying consideration for a while and don’t imagine a powerful second participant is rising. Some huge cash has been misplaced, actually, making an attempt to compete with Align by introducing lower cost factors. Align has misplaced some patent protections lately, spurring a flood of capital into the market and a modest lack of market share. However Align nonetheless holds a whole bunch of US patents and spends extra on aligner Analysis & Growth than all of its rivals mixed. It has model recognition with sufferers who ask for Invisalign by identify and credibility with dentists and orthodontists whose skilled reputations depend on reaching good outcomes. I believe we purchased a market chief at a reduction to its intrinsic worth.

Kinsale (KNSL) was a December buy, so actually we have owned it for a couple of weeks, however it’s up properly from our $330 foundation. Kinsale is an insurance coverage firm that writes insurance policies within the so-called Extra & Surplus market, or E&S. The E&S market takes on dangers that the regulated market, or commonplace market, will not underwrite. Loads of small enterprise coverages find yourself in E&S, and due to the growing dangers for cyber safety, hacking and different types of fraud, small companies discover themselves needing extra protection.

In the meantime, property homeowners in Florida, the Gulf Coast or California who can not get hold of any protection for hurricane or wildfire threat are also ending up within the E&S market. There, they may pay twice as a lot premium for half as a lot protection as they’d beforehand. As a result of regulators will not enable admitted corporations to successfully quadruple their charges, these insurers in some circumstances are withdrawing from property markets. The consequence: insurance policies stream into E&S.

Kinsale was based in 2009 by Mike Kehoe, an business veteran who stays on the helm. Mike constructed Kinsale on a state-of-the-art know-how platform that enables the corporate to offer quotes to most callers inside a few hours. Many rivals want a number of days to scour their databases and assemble the data required to supply a quote. Kinsale’s expense ratio is about 21%, far beneath bigger rivals like Markel. Insurance coverage is a commodity product; almost each enterprise coverage is put out to brokers for bid. In the long run, the insurer with the bottom price of operation goes to win.

We paid a excessive worth for Kinsale relative to its present earnings, however I imagine the corporate can develop at a mid-to-high teenagers price for a very long time. Presently, it has a 1.5% market share in E&S.

We did a little bit of portfolio sculpting through the 12 months, with combined outcomes. We trimmed Arista Networks a number of instances through the 12 months because it soared. These trims, a really small one in March at roughly $163 and a bigger one in August at $183, do not look sensible with Arista ending the 12 months at $235 (and up extra in January). Arista rose 94% this 12 months. The excellent news is, Arista completed the 12 months as our second largest holding, at 7.9% of the portfolio.

If you’re questioning how I might promote some Arista at $163 however then maintain most of it at $235, the reply is that Arista’s excellent aggressive place in Synthetic Intelligence grew to become clearer to me because the 12 months progressed. I felt in March that Arista would earn $8 per share in a couple of years. I see at the moment that it would earn $8 in 2025.

It is doable there may be AI-related froth within the Arista inventory worth, but additionally possible that Arista will proceed to develop quickly because the computing facilities that course of AI queries require huge quantities of knowledge bandwidth. I imagine Arista’s routers and switches are the very best instruments for routing so-called hyperscale site visitors. Additionally, its working software program permits laptop giants to handle the kudzu-like development of their information facilities, decreasing their complete price of operation.

We trimmed our Heico Class A (HEI.A) shares from 5% to 4% within the fourth quarter, one other doubtful determination contemplating we bought shares for about $132 they usually completed the 12 months a couple of weeks later at $142. Heico, which sells personal label aftermarket components to the aviation business, is a good family-run enterprise with an unlimited development runway, no pun supposed. Like Kinsale, it has a tiny market share in its business and a implausible cost-position. It perpetually trades for an unlimited worth. We felt like 5% publicity to a PE a number of of roughly 35x was just a little an excessive amount of.

The gross sales of each Arista and Heico mirrored my need to handle PE a number of threat. I continue learning the exhausting manner, nonetheless, that trimming your winners usually does not add worth. If the valuation is past justification, promote the place. If the valuation is excessive however the enterprise continues to dominate its area of interest, develop steadily and add worth for patrons, perhaps simply take a stroll across the block till the urge to promote goes away.

If our two primary trims weren’t well-timed, the excellent news is that that our additions to current positions largely added worth. We purchased extra shares of M&T Financial institution (MTB) in April at $115. It completed the 12 months at $137. I do not love the banking enterprise, however M&T is so intelligently managed by CEO Rene Jones and his group that I felt like $115, about seven instances 2023 earnings, was too low cost to cross up.

We added to our holding in Charles Schwab (SCHW) a number of instances through the 12 months within the mid-$50s. Schwab completed the 12 months above $68 earlier than declining a bit in January. At year-end, Schwab was our sixth-largest place at 5.7% regardless of an general worth drop of 18% for the 12 months and a steep earnings decline. I imagine on this enterprise and its earnings energy over the following few years. Nevertheless, Schwab qualifies as a poor supervisor of its personal stability sheet. If I listened to Warren Buffett on this, I’d promote the inventory.

Have I ever talked about that one in all my favourite aphorisms is “consistency is the hobgoblin of little minds?” Like First Republic Financial institution, Schwab purchased an enormous quantity of extraordinarily low-yielding authorities bonds through the pandemic. As charges rose, the bonds misplaced resale worth whereas additionally producing anemic revenue. If the bonds have been marked down far sufficient, Schwab won’t have sufficient capital to help its enterprise.

In contrast to First Republic Financial institution, nonetheless, Schwab continued gathering billions of {dollars} of brokerage belongings all 12 months, shoring up its capital place. The stream of recent cash into Schwab meant it had loads of capital available, even after marking down the worth of longer-dated bonds. Schwab’s acquisition and integration of TD Ameritrade has been rocky – we use Schwab as our major custodian and generally really feel the ache. However Schwab retains an amazing degree of belief with retail traders and stays an incredible worth accomplice to funding advisors like me. I believe the enterprise has earnings energy effectively past latest outcomes and can energy via its mishap(s).

Maybe our greatest addition to an current place this 12 months was Put in Constructing Merchandise. When the inventory fell to $112 within the fourth quarter, we purchased shares. The inventory virtually instantly went on a tear, ending the 12 months at $182 and vaulting into our prime 10 holdings. If I did this extra usually, I’d grow to be unbearable.

We equally added to our place in Ashtead Group, shopping for in September at $66 after which in November at $59 (translated from British kilos). Ashtead completed the 12 months at $70 however subsequently issued weak steerage for 2024 and the inventory is again to the low-$60s. Ashtead rents gear to clients within the development, upkeep, leisure and occasions industries largely via its Sunbelt Leases chain within the US. As with IBP, I imagine it has a superior price and repair place in its business and am excited to have a bigger stake on this enterprise.

Two of our additions earlier within the 12 months weren’t useful: we added to Eurofins Scientific (OTCPK:ERFSF) in March at $71 (translated from euros). It completed the 12 months at $64. Eurofins is a number one scientific testing firm that has struggled with decrease demand for testing in Europe and elevated worth regulation in its residence market of France. And we added to First Republic on the way in which down, which felt like catching a boulder with a baseball mitt. This will really feel to the reader like a whole lot of exercise, nevertheless it amounted to 13% portfolio turnover.

I need to end up with a deep dive into my macroeconomic outlook for 2024 and past. Simply kidding. Nobody is aware of what the longer term will convey, least of all me. There are one million issues to fret about: abroad wars; the mounting federal debt and lack of seriousness about addressing it; more and more fragile US establishments; and so on. There’ll all the time be issues to fret about. The inventory market doesn’t exist freed from macroeconomic or political considerations, however it’s near not possible to foretell how these considerations will play out. As a result of a century of knowledge exhibits that shares are the very best performing asset class over time, albeit extraordinarily unstable, our bias needs to be to remain invested. That is the place temperament is available in. We handle threat by partnering with excellent administration groups and powerful enterprise fashions, and by not overpaying for our shares. The underlying assumption is just not that all the things might be wonderful. The idea is that it doesn’t matter what occurs, the very best determination makers working on the strongest companies will navigate storms higher than others.

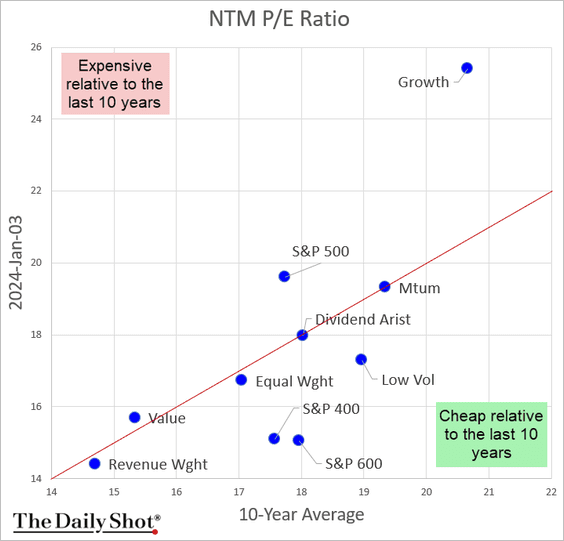

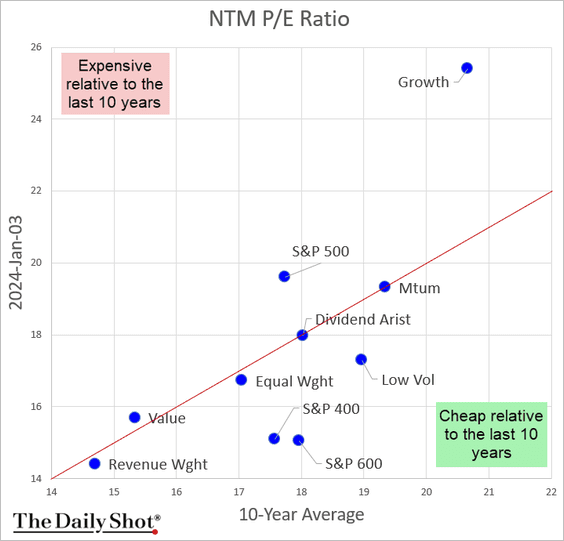

I’d additionally notice that even after an enormous return in 2023, the market exterior of the Magnificent Seven is just not particularly costly. Here’s a chart from The Day by day Shot that caught my eye in early January.

The message right here is easy. The S&P 500 is pricey relative to its common valuation over the previous 10 years, buying and selling at a ahead a number of of about 19.5 instances earnings (the Y-axis) versus a 10-year common PE of lower than 18 instances earnings (the X-axis). Nevertheless, the equal weight S&P 500 is barely beneath its 10- 12 months common valuation and the S&P MidCap 400 is priced effectively beneath its 10-year common. The S&P 600 (SP600), which is a small cap index, can be attractively priced, not less than in comparison with the previous decade.

The S&P 400 (SP400) contains corporations ranging in market capitalization dimension from $2 billion to $18 billion. It appreciated 9% final 12 months. Now we have 25% of our portfolio in corporations of this dimension whereas the flagship S&P 500 Index has solely about 5% publicity to midcaps.

We outperformed the Index in 2023 and are near the efficiency over three years with a portfolio that’s fairly completely different from the Index. Over the previous century, small and mid-cap shares have outperformed mega-cap shares for the straightforward motive that’s exhausting to develop earnings quickly from a large dimension. Immediately, a number of of the very best performing (and costliest) shares within the US have market caps above $1 trillion and modest earnings development. My funding determination is that we’ll be higher off over time on the lookout for youthful corporations which have years of earnings development forward of them, and ideally with founders or owner-operators on the helm.

In our quest so as to add worth for you, I’m fortunate to work alongside my companions at Giverny Capital Inc. They’ve confirmed to be fantastic colleagues and mates over our almost 4 years collectively. I’m grateful to our head of operations Al Munro, whose diligence and a focus to element serves all of us effectively. In October, John Bleday joined us as an analyst. He is already making an incredible contribution in analysis.

Most significantly, GCAM is fortunate to have a steadily rising roster of purchasers. Once I began this enterprise, a cash supervisor buddy suggested me to be considerate about development. “If you like your clients, you’ll like your life,” he mentioned. “And if you don’t like your clients, you’re going to hate your life.” Properly, I like my life. I’m in enterprise with long-term traders who imagine within the energy of a concentrated portfolio. Thanks for entrusting me to speculate in your behalf.

With each good want,

David M. Poppe

|

Giverny Capital Asset Administration |

Prime 10 holdings |

|

December 31, 2023 |

|

|

Alphabet A&C |

8.3% |

|

Arista Networks |

7.9% |

|

Constellation Software program |

7.3% |

|

Progressive Corp. |

6.9% |

|

Charles Schwab |

5.7% |

|

Meta Platforms |

5.6% |

|

5 Under |

4.5% |

|

CarMax |

4.5% |

|

Put in Constructing Merchandise |

4.2% |

|

Berkshire Hathaway |

4.0% |

|

Whole |

58.9% |

|

2023 Prime Contributors |

Avg Weight |

Whole Return |

Contribution To Return |

|

Arista Networks, Inc. |

7.24 |

94.08 |

5.70 |

|

Meta Platforms Inc. Class A |

4.78 |

194.13 |

5.31 |

|

Alphabet Inc. Class A |

8.21 |

58.32 |

4.44 |

|

Constellation Software program |

6.84 |

62.40 |

4.01 |

|

Put in Constructing Merchandise |

2.99 |

117.53 |

2.83 |

|

30.06 |

89.14 |

22.28 |

|

|

2023 Backside Contributors |

Avg Weight |

Whole Return |

Contribution To Return |

|

First Republic Financial institution |

0.49 |

-89.99 |

-3.23 |

|

Charles Schwab Corp |

5.02 |

-15.96 |

-1.51 |

|

Eurofins Scientific SE |

2.53 |

-7.77 |

-0.36 |

|

Ciena Company |

0.87 |

-14.34 |

-0.28 |

|

M&T Financial institution Company |

2.34 |

-1.67 |

-0.02 |

|

11.25 |

-23.40 |

-5.40 |

|

|

Footnotes 1 The household account doesn’t pay a administration payment. The returns introduced herein assume the deduction of an annual administration payment of 1% to point out what a consumer account’s efficiency would have been if it had been invested the identical because the household account through the interval. Previous efficiency is just not essentially indicative of future outcomes. 2 The S&P 500 Index returns embrace the reinvestment of dividends and different earnings. The Index is an unmanaged, capitalization-weighted Index of widespread shares of 500 main US firms. The Index doesn’t incur bills and isn’t out there for funding. |

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.