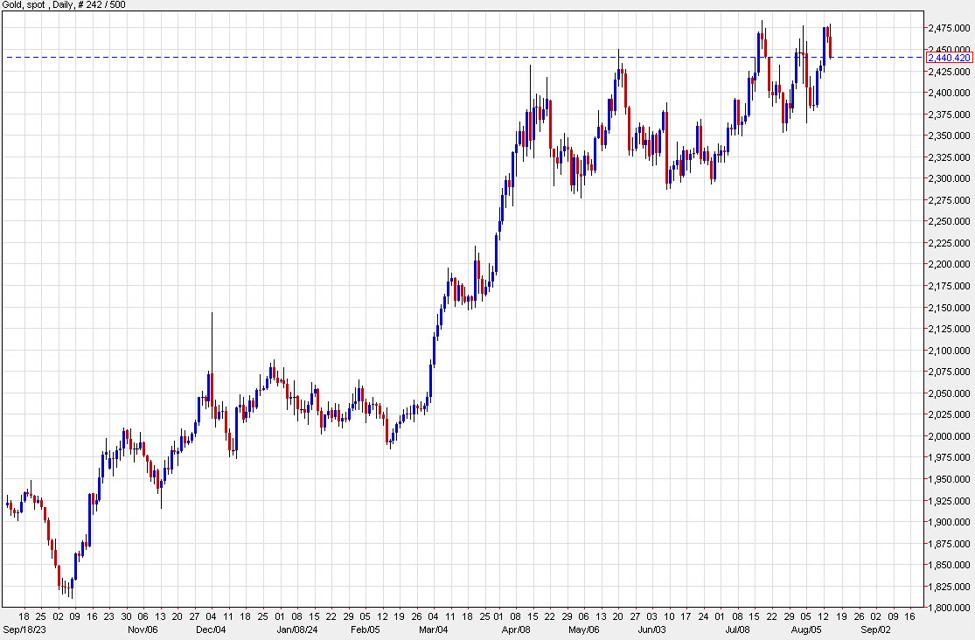

Gold daily

Gold is down 1% today after a third failure near $2475.

It’s still higher on the week after it shot up on Monday but it couldn’t get through the July highs and has since retreated. A big part of that is the market walking back its Fed rate cut expectations.

What’s hard to square is that Treasury yields are also falling and terminal Fed pricing hasn’t moved that much. I think the Middle East story is some of the froth in gold and the lack of action there (though still likely coming).

I think gold needs a clear catalyst to leg higher from here and I’m not sure a dovish Fed is it. Seasonally, there are tailwinds in November but that’s a long wait.

China clearly wants to add to reserves but now appears to be price sensitive. That will put a floor under gold but it could be as low as $2000 so it’s not a catalyst right now. Chine retail buying continues to be a strong force but could also be sensitive to technicals.

Overall, I think this is more of a ‘buy the breakout’ or a ‘buy a deeper dip’ trade than something to chase here.