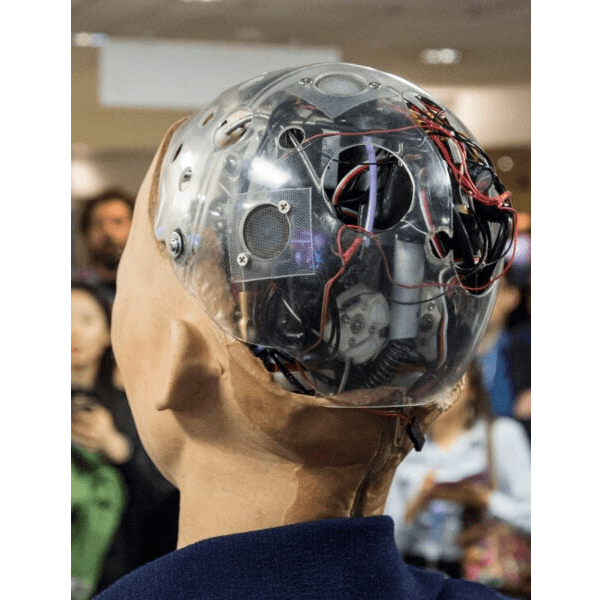

Gold (XAU/USD) every day chart

The sharp transfer larger in Treasury yields and the greenback yesterday resulted in a steep drop in gold. Of be aware, the autumn took out the January low in addition to the $2,000 mark. However at the least in the intervening time, consumers are capable of hold on because the 100-day transferring common (purple line) at $1,989.90 isn’t firmly damaged simply but.

As talked about earlier, the next leg higher in the dollar might be tougher to come by. And gold is a part of that consideration as effectively, amid its correlation with bond yields for probably the most half. As such, it would require 10-year Treasury yields breaking its personal 100-day transferring common of 4.342% to actually transfer the needle decrease in gold.

That stated, there are nonetheless some vital assist layers that consumers can depend on even when we do see a continued drop this week. The December lows round $1,973-75 would be the first earlier than the 200-day transferring common (blue line) at round $1,965.54. Thereafter, the November low of $1,949 will come into play.

Gold is stuttering to this point to start out the brand new 12 months. Nevertheless, I nonetheless retain a extra bullish conviction on the valuable metallic within the long-term. The structural view stays that gold is more likely to shine as soon as central financial institution price cuts begin being realised. It’s a guess on the disinflation narrative basically and I would argue that proper now, we’re simply in a pit cease.

However for buying and selling this week, the draw back won’t be accomplished simply but. There’s nonetheless US retail gross sales and PPI figures nonetheless to come back later within the week. These is perhaps catalysts for merchants to react additional following the CPI yesterday.