I hated this commerce when it was being reposted daily and now we have all seen why.

Correlation doesn’t equal causation.

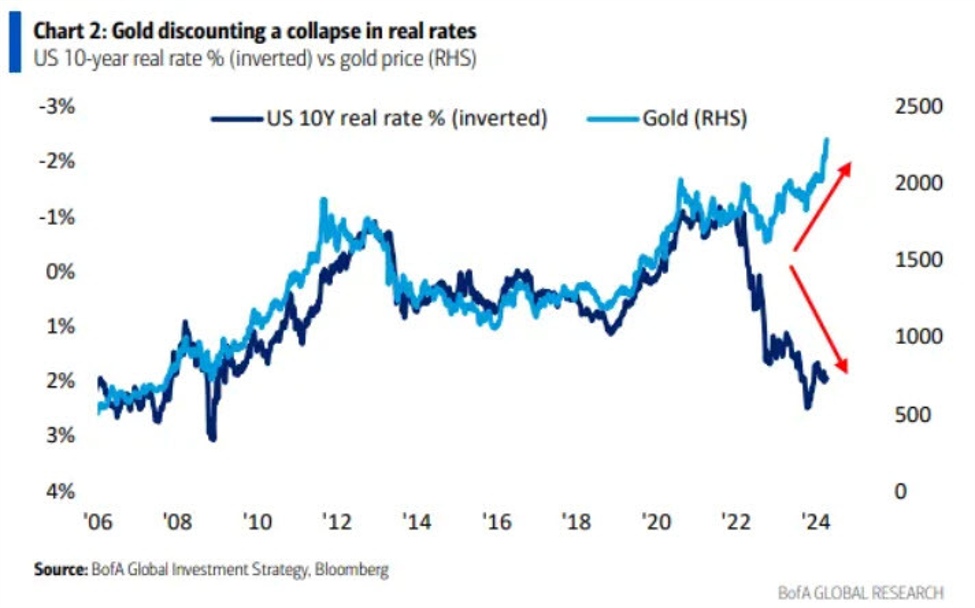

Gold is a chameleon. Sure, at instances it competes with bonds and yield is an element nevertheless it’s additionally a forex. What occurred when these diverged?

Russia invaded Ukraine and the west confiscated Russia’s international sovereign bonds.

It is also the time when the Fed misplaced management of inflation after lengthy declaring it was transitory.

Now Russia, China and different unfriendly nations with the US have undoubtedly discovered there lesson. The bid for gold is definitely coming from Asia and most probably China because it sells bonds and buys gold. However not simply official sources, gold is extremely prized in China and lots of different nations with capital controls and a historical past of presidency instability. There’s additionally one thing of a rush to gold ETFs in China; how that develops in mild of at present’s strong yuan fix shall be one thing to look at.

The 2-day 20 foundation level rise in Treasuries together with a scorching CPI studying brought about a $30 dip in gold nevertheless it’s now been full erased. That is one other check handed.

Gold 10 minutes

I nonetheless do not see a substantial amount of retail enthusiasm for gold, although the latest rise in silver suggests it is beginning. The bodily market can also be comparatively small in comparison with the huge sums of cash flowing by way of markets now.

Over the previous 5 years, gold has now outperformed the S&P 500 excluding dividends