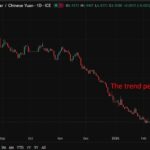

Yesterday gold had its worst day going back August 2020. The price fell -5.318%. The momentum downside continued today.. From the high to the low price today, the price has moved down around -8.5%.

Gold is currently down $50 (-1.23%) at $4,073.46, but the key takeaway is the intraday price action. Earlier today, the price successfully tested and bounced sharply off the $4,000 natural psychological support (hitting a low of $4,004.40). This dip was immediately bought, suggesting strong demand at that key level.

Technical Outlook (4-Hour Chart):

The rebound has pushed Gold back above a critical short-term marker: the rising 100-bar moving average at $4,060.04. Maintaining a hold above this MA is essential to confirm a potential low and sustain the short-term bullish bias.

The Challenges Ahead (Hourly Chart):

While the buyers are showing strength, significant overhead resistance remains. The price is currently trading below both its 100-hour and 200-hour moving averages.

-

The immediate target for buyers is the 200-hour moving average at $4,179.36.

-

Buyers must reclaim this $4,179 level to fully neutralize the bearish pressure and gain meaningful long-term confidence.

A more negative technical view would happen if the price move back below the 4000 is the level hundred bar moving average on the 4 hour chart at $4060 and then below the $4000 level. The next key target area would be around the $3900 level where the 38.2% retracement of the move up from the May low is found. The rising 200 bar moving average on the 4 hour chart is moving toward that level as well (currently at $3877.