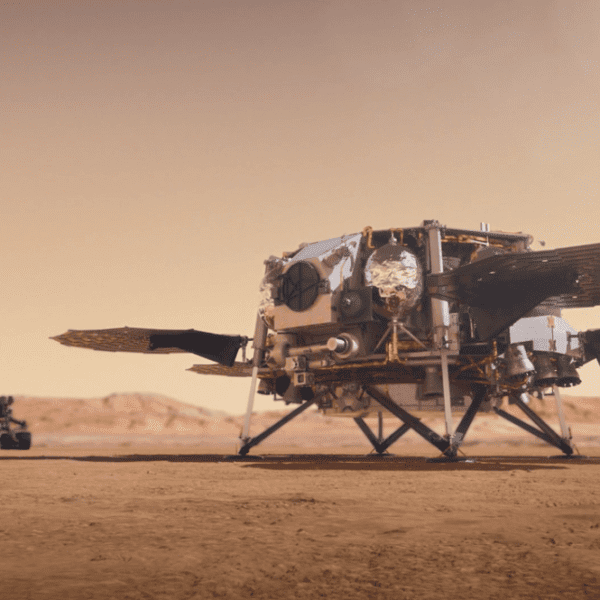

The latest geopolitical tensions was an excellent purpose for shares to come back off the boil. And now that the fears are abating, it’s also offering an excellent purpose for gold to additionally let loose a number of the steam. Gold made some makes an attempt to prime $2,400 earlier this month however did not see a day by day shut above the important thing degree. And now, value is beginning to really feel exhausted because it falls again to $2,300 on the day.

Gold (XAU/USD) day by day chart

It has been fairly the run for gold during the last two months, having gained by greater than 20% at one level. One can simply make an argument of value operating up too excessive, too quick. And with that, comes the correction/retracement section. That may be the place we’re at now.

The near-term chart already took a flip in buying and selling yesterday here. And the additional drop at the moment now calls into query the larger image from a technical perspective. The day by day chart highlights that we would see this newest fall prolong additional, with little help on the way in which down.

The Fib retracement define exhibits that we may see a push in the direction of $2,260 subsequent not less than earlier than some semblance of help. That coming from the 38.2 Fib retracement degree. The following key cease after that may be a push in the direction of $2,200.

However as talked about yesterday, there’s nonetheless a really sturdy argument for gold to run even increased within the months forward. As such, this newest retreat is one other dip shopping for alternative. Keep vigilant on modifications in market sentiment and in addition lean on the technicals. That is the very best wager when going about trades like this one.